A Beginner’s Guide to Working Capital.

What is working capital? Why do you need it? Let’s take a detailed look at working capital for small businesses.

Ever been in a position where you don’t have money to pay creditors or employees? Started a large project, only to find that you don’t have to money to see it through?

These situations highlight the need for a working capital.

Loosely defined, working capital supports your day-to-day running costs and once off projects that can make or break your businesses. Without it, the survival of your business is under threat, and bankruptcy a constant looming possibility.

But don’t worry, in this post, we’ll highlight everything you need to know about working capital:

- What is working capital?

- How to calculate working capital?

- Importance of working capital.

- What is the working capital cycle?

- Features of working capital

- How to use working capital?

- Tips to manage it effectively.

So, without further ado, let’s get started!

What Is Working Capital?

Working capital is the money used to fund the day-to-day operations of a business. It’s used to pay short-term debts and cover other operational expenses.

How to calculate working capital?

Working capital is calculated as-

Current assets (things you own that can be converted into cash) — Current liabilities (costs you will incur in the next 12 months).

Here are some examples of items that fall under the category of current assets:

Here are some examples of items that fall under the category of current assets:

- Stocks or Bonds

- Cash in hand

- Cash in bank

- Short-term investments etc.

And here are some examples of items falling under the category of current liabilities:

- Creditors

- Outstanding Expenses

- Short-term debt etc.

Importance of Working Capital

Working capital keeps the business operations moving. It is needed to purchase raw materials, to pay the workers and staff and also to pay the recurring expenses like electricity and power bills, rent, etc.

Working capital keeps the business operations moving. It is needed to purchase raw materials, to pay the workers and staff and also to pay the recurring expenses like electricity and power bills, rent, etc.

Having positive working capital can be a good sign of the short-term financial health for a company because it has enough liquid assets remaining to pay off short-term bills and to internally finance the growth of their business.

Negative working capital means assets aren’t being used effectively, and a company may a liquidity crisis. Even if a company has lots invested in fixed assets, it will face financial challenges if liabilities come due too soon.

And what happens when you run out of money to meet your day-to-day business needs? Bankruptcy!

A company that pays its creditors well on time has a positive reputation in the credit market. Such a goodwill helps a company to get raw materials on credit. It can also get loans and advances from the banks.

Hence, working capital increases a company’s creditworthiness.

What is the working capital cycle (WCC)?

Working capital cycle (WCC) is the time taken by any organization to convert its net current assets and current liabilities into cash. In layman’s terms, the working capital cycle is the duration between buying goods to manufacturing products and generating cash flow according to the selling of products.

Ideally, the WCC should be short since the shorter the working capital cycle, the faster the organization gets the cash stuck in working capital. If the WCC gets longer, the entire capital gets stuck in the operating cycle and the organization fails to earn significant returns. WCC helps you in monitoring the ability and the efficiency of the organization to manage its short-term liquidity position.

Three main steps of the working capital cycle are:

- Paying for the inventory/assets you plan to sell

- Sell out the inventory or provide services to a client

- Receive back payment from the goods sold

i.e.,

Working Capital Cycle = Inventory Days + Receivable Days – Payable Days

Features of Working Capital – A Quick Overview

The primary goal of maintaining working capital is to ensure a streamlined operation of the organization. A decent flow of working capital allows the organizations to get operational flexibility and balance both liquidity and profitability.

Certain features of working capital that you must know includes:

- Short Term needs & Circular movement

- Permanency and Fluctuation

- Less Risky

Short Term needs and Circular Movement

Working capital is often used to acquire capital assets which are converted into cash in a short span. The entire duration of working capital depends on the length of the production process. The conversion of working capital to cash to working capital is a recurrent process and goes on continuously.

Permanency and Fluctuation

Working capital is an important necessity as it continues the production activity of the organization. So, till the time the production continues for the enterprise, they’ll require a decent flow of working capital. Another important aspect of working capital is that it fluctuates a lot and varies directly according to the level of production.

Less Risky

Working capital is less risky as it’s dependent on product prices whose variations are less severe in general. Any form of technological change doesn’t impact it directly as it gets converted into cash again and again.

How to use working capital?

Working capital is important for day-to-day operations, for funding your organizations’ growth and assisting and preparing you well in advance for any difficult times that lie ahead.

If you’re a part of the retail industry, you need working capital to kickstart the cash flow, manage your inventory, marketing, and sales.

You must have sufficient working capital to purchase additional inventory in advance before the peak season begins, upgrade your store (if needed), and still have enough balance to give your employees the paycheck each month irrespective if it’s a peak season or not.

Decent working capital gives you the flexibility to market your products/services during tough times and continue with the cash flow without creating gaps in the net revenue for your organization. To better understand what amount of working capital you need for your organization, you must figure out the items which are increasing or decreasing the working capital.

At times, the businesses rely on credit lines available via banks to safeguard the organization from diluting and cease their operations due to a lack of capital. In such circumstances, the management keeps a close watch on the working capital.

3 Simple Hacks to manage Working Capital effectively

Speed Up Your Collection Process

By not having to wait weeks, and in some cases — months — to getting paid quicker and, you’ll reduce your working capital cycle (WCC). WCC is the amount of time it takes to convert current assets and liabilities into cash.

A longer working capital cycle means your cash is tied up in liabilities and assets longer, without earning any return.

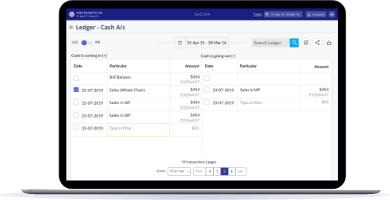

One important way you can ensure you get paid quicker is by jumping to a cloud-based accounting platform. A good cloud accounting software will help you create and send industry standard professional looking invoices so that your customers do not take your business value for granted

Here are some other strategies to ensure your invoices get paid on time and reduce your working capital cycle:

- Show courtesy in invoices.

- Specify exact payment days to avoid confusion.

- Make it easy for clients to pay by accepting payment from multiple sources like credit cards, online, and payment gateway.

- Use accounting software such as Giddh to automate invoicing. The software even lets you automate invoice you send on a recurring basis.

Eliminate Unnecessary Expenses

Apply transparency and clarity when it comes to how much you spend. This begins with examining your budget and breaking it down to its components. Make sure you’re not overspending in any area of your business. Set rules to restrict any unnecessary spending.

Apply transparency and clarity when it comes to how much you spend. This begins with examining your budget and breaking it down to its components. Make sure you’re not overspending in any area of your business. Set rules to restrict any unnecessary spending.

In business, even the smallest, most inconsequential expenses add up. And every little bit takes away from your working capital. To keep an eye on your working capital levels, be sure to carefully control your expenses.

Setting clearly communicated rules for your employees is crucial to keeping expenses like travel or entertainment minimum. Plus, as the business owner, you should be sure to be watchful of company-wide expenses and cut back on costs wherever you can.

Use Up-to-date Financial Information

The way to make sure that working capital is managed is to use key performance indicators (KPIs).

The way to make sure that working capital is managed is to use key performance indicators (KPIs).

Keep financial statements and reports that are constantly updated automatically will enable your company to have a clear picture of the financial position at all times and will provide you with avenues for improvement.

Many businesses are cornered into bankruptcy or take on debt when they run out of working capital because they are uanable to get a real-time overview of their financial health.

Your business can avoid this by integrating a cloud accounting software to your business which will constantly provide you all your financial information in real time, along with providing you with the working capital ratio(current ratio).

The Bottomline

Working capital is crucial for your day-to-day. Without it, you cannot pay expenses, salaries, and other short-term debts. Without it, you run the risk of having to shut up shop and… you don’t want that!

How you go about managing and growing it depends on your business requirements. You may need to speed up collection procedures, seek a loan, or incorporate technology with business to get a firm grip over working capital.

Whatever it may be, if you take the right step, it will help your business thrive and stay financially agile.

This brings us to the end of our working capital for dummies guide. Got anything else you’d like to add on working capital? Comment below and let’s get the discussion started.