GST Invoice: What Businesses Must Know in 2025

GST invoicing is no longer optional; it's foundational. With compliance rules tightening in 2025, every business issuing taxable supplies must follow the updated GST billing rules to avoid penalties, input credit loss, or audit triggers.

In this blog, we break down the types of GST invoices, when to issue them (for both goods and services), and how tools like Giddh GST invoice software can help you stay compliant and profitable.

What is a GST Invoice?

A GST invoice is a tax-compliant document issued by a registered seller to the buyer. It includes all necessary details, such as GSTIN, HSN codes, taxable value, applicable tax rates (CGST/SGST/IGST), and the total invoice value.

Think of it as the cornerstone of your GST compliance—the point from which filings, credits, and refunds all stem. If this is mismanaged, the snowball effect can trigger cascading issues, from return rejections to blocked ITC and vendor disputes.

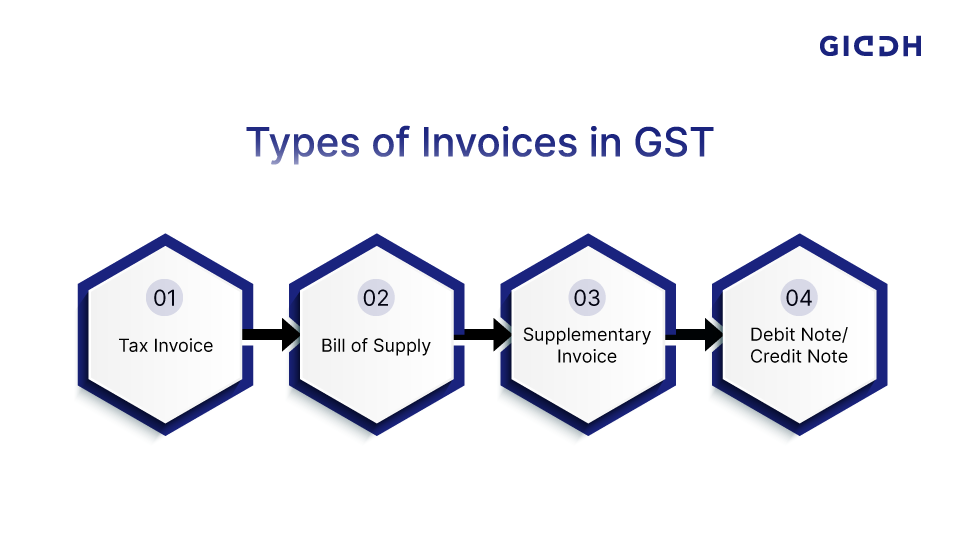

Types of Invoices in GST You Must Know (2025 Edition)

Every business must issue specific types of invoices depending on the nature of the supply. Here’s a breakdown:

✅ 1. Tax Invoice

-

When Used: For all taxable supplies of goods or services

-

Includes: Tax breakdown, buyer/seller details, GSTIN, HSN/SAC, quantity, rate, etc.

✅ 2. Bill of Supply

-

When Used: For exempted goods/services or composite scheme suppliers

-

Note: Does not include tax details.

✅ 3. Supplementary Invoice

- When Used: To rectify undercharged tax or price revisions post-supply.

✅ 4. Debit Note / Credit Note

- When Used: To adjust previously issued invoices (increase/decrease in value).

Pro Tip: You must report all these in GSTR-1 filings accurately to avoid mismatches in your buyer’s input credit claims.

When to Issue a GST Invoice (Goods vs. Services)

To comply with GST rules, it’s not enough to just issue the invoice. You must do so at the right time. Here's a simplified view:

Supply Type | For Goods | For Services |

|---|---|---|

One-Time Supply | Before or at the time of removal/delivery | Preferably before supply; if after, follow Rule 47 |

Continuous Supply | Before each successive payment | If payment due date is fixed: issue on/before date |

Reverse Charge | Recipient issues invoice on goods receipt | Issue before completion or to the extent of service received |

Approval-Based | When approval converts to sale | Not applicable |

Benefits of GST Invoice Compliance

Staying compliant with GST billing rules has direct advantages:

-

Faster Input Tax Credit (ITC): Well-timed and formatted invoices ensure credit is available without delays

-

Accurate Return Filing: Prevent mismatches in GSTR-1 and GSTR-3B

-

Avoid Penalties: Late or incorrect invoicing invites scrutiny and fines

-

Vendor Trust: Clean invoicing builds trust with enterprise buyers and partners

Automate GST Invoicing with Giddh

Managing compliance manually increases your risk of errors, late filings, and even loss of credit.

That’s where Giddh GST invoice software steps in.

💡 Why Giddh for GST Invoicing?

-

Auto-generate tax-compliant invoices in real-time

-

Built-in reverse charge, bill of supply, and credit note handling

-

Seamless GSTR-1 and e-Invoice integration

-

100% secure, cloud-based platform with real-time sync to your books

-

Customizable templates, multi-currency support, and API integrations

Whether you're a small business or managing enterprise-level invoices, Giddh ensures you're always on time, on track, and 100% compliant.

Final Thoughts

In 2025, GST invoice compliance isn't just about avoiding penalties; it’s about enabling faster credit cycles, building financial credibility, and improving cash flow.

Don’t let manual errors snowball into compliance nightmares. Automate your invoicing and GST returns with Giddh’s smart accounting software.

Ready to upgrade your GST invoicing process? Visit giddh.com and start your free trial today.