Quick Book Alternatives & Competitors In 2025

Did you know that over 6.2 million businesses worldwide rely on QuickBooks for their accounting needs? (Source: Intuit Investor Relations) While the software dominates the market, many small businesses, freelancers, and accountants are beginning to question if it still meets their evolving financial needs.

With rising subscription costs, complex setups, and limited scalability for specific industries, the demand for Quick Book alternatives is stronger than ever in 2025. Business owners are actively seeking accounting tools that are affordable, user-friendly, and designed with flexibility in mind.

So the question is—if QuickBooks no longer feels like the right fit for your business, what other options can provide the features you need without stretching your budget or overwhelming your workflow? This blog examines the top QuickBooks competitors in 2025, enabling you to compare features, pricing, and usability, and make an informed decision for your financial management needs.

Why are Businesses Actively Looking for Quick Book Alternatives in 2025?

QuickBooks has earned its reputation as one of the most widely used business accounting software. Yet, several challenges are pushing businesses to explore alternatives:

-

Rising Subscription Fees – QuickBooks has increased pricing over the past few years, which affects cost-sensitive SMEs and freelancers.

-

Complex Interface – Smaller businesses with limited accounting knowledge often find the software overwhelming.

-

Industry-Specific Gaps – QuickBooks doesn’t always cater to niche industries or custom workflows.

-

Integration Limitations – Businesses that rely on multiple tools for payroll, CRM, or inventory often struggle with seamless connectivity.

-

Customer Support Concerns – Long wait times and inconsistent support have frustrated many users.

For SMEs and growing startups, these challenges create a need for affordable accounting tools, cloud-based software, and online bookkeeping platforms that simplify finance management.

What Key Features Should You Look for in a Quick Book Alternative?

When comparing QuickBooks competitors in 2025, businesses should focus on more than just pricing. Look for solutions that combine ease of use with scalability. Here’s what matters most:

-

Ease of Setup and Use – A clean interface that allows non-accountants to manage finances easily.

-

Scalable Pricing Models – Flexible plans that grow as your business expands.

-

Essential Accounting Features – Invoicing, expense tracking, bank reconciliation, and tax calculation.

-

Cloud Access & Mobile Support – Anytime, anywhere access for remote teams.

-

Automation – Smart features like automated reconciliation and recurring invoicing.

-

Integration Capabilities – Smooth connections with payment gateways, payroll, and CRMs.

-

Strong Customer Support – Reliable help through chat, phone, or email.

Choosing a Quick Book replacement software becomes easier when these features align with your specific business requirements.

Top QuickBooks Competitors in 2025 (Comparative List)

Here’s a detailed comparison of the top contenders:

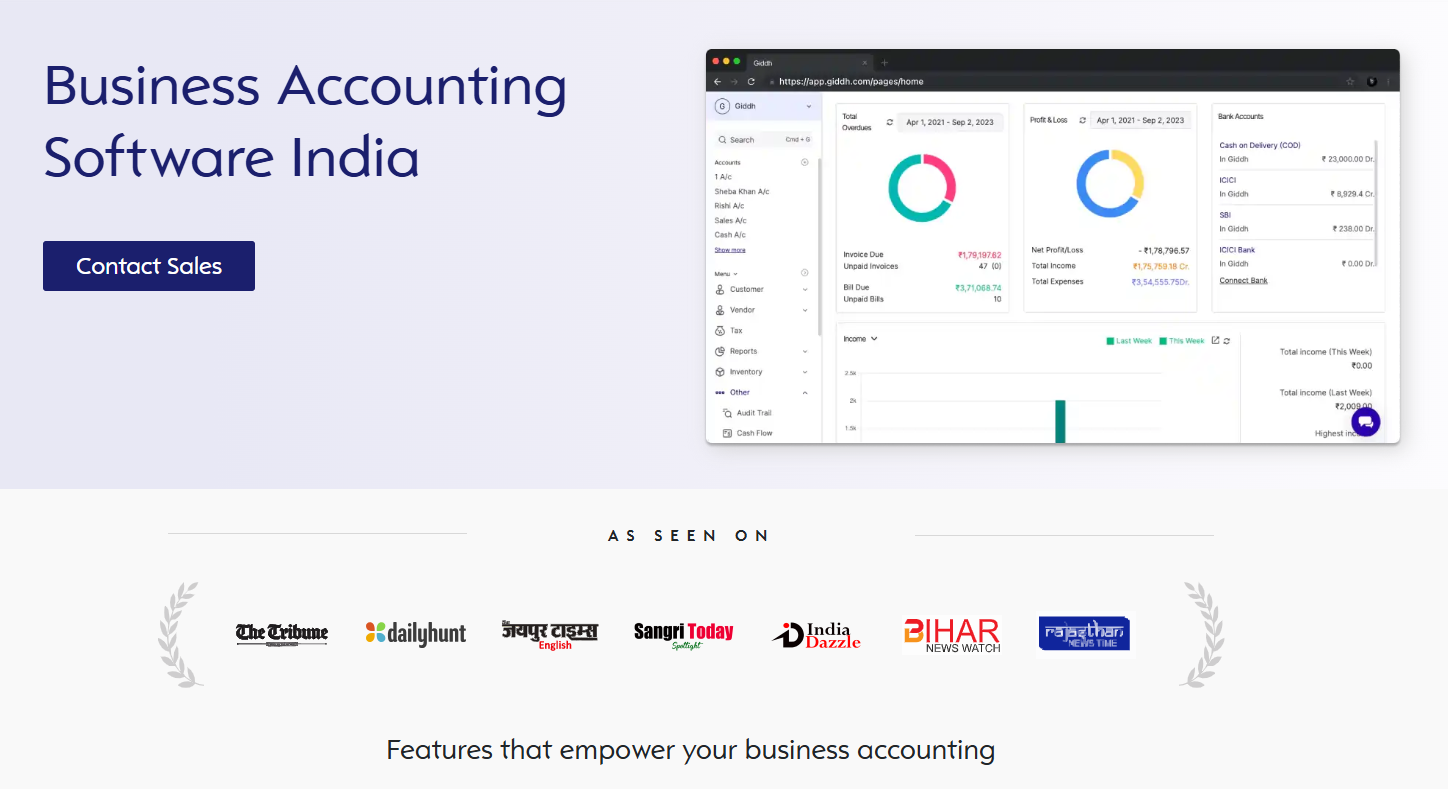

Giddh

Giddh is a cloud-first accounting & bookkeeping platform designed with Indian SMEs, startups, and accountants in mind, while also prioritizing global accounting usability. It supports ledger-based entries, inventory, multi-currency, and more without forcing users into overly complex modules.

With transparent tiered pricing (including a free or entry-level version) and modular add-ons, Giddh positions itself as a scalable, no-surprise alternative to QuickBooks.

Key Features

-

Ledger-based Journal Entries – Allows direct posting to ledgers for absolute accounting rigor.

-

Invoicing & Billing – Create and send invoices and track due dates and payment status.

-

Inventory & Variants – Manage products, variants, barcode scanning, and branch/warehouse transfers.

-

Bank Reconciliation – One-click match of bank transactions to your accounting entries.

-

Multi-Currency & Conversion – Invoice and accept payments across 100+ currencies with live rates.

-

Security / Access Control – Unlimited user access with role controls, date-range filters, and IP restrictions.

-

Audit Trail & Logs – Full traceability of changes for compliance and tracking.

-

Integrations – Shopify sync, imports/exports (Excel, Tally), APIs, bank connectors.

Pros

-

Transparent pricing with a robust free or entry plan and no hidden add-on surprises.

-

Strong local compliance support (e.g, GST, reverse charge) built in.

-

Deep control over access (IP, role, time) ensures data security.

-

Real inventory and branch-level features—rare in accounting tools aimed at SMEs.

-

Scalability—supports multiple companies, cross-currency, APIs for custom growth.

Cons (Areas to Watch / Improve)

-

Ecosystem (third-party apps) is less mature compared to global giants like Xero.

-

In very complex multinational tax regimes (beyond the Indian / GST realm), you may need custom workarounds.

-

Some users report that, in rare cases, advanced automation features may require manual adjustments.

Best For

-

Indian SMEs and startups seeking the best accounting solution with local compliance.

-

Businesses that expect to scale (multiple branches, multi-company).

-

Teams that value security controls (role/IP restrictions) and auditability.

-

Those looking to migrate off QuickBooks but maintain depth without paying for unused features.

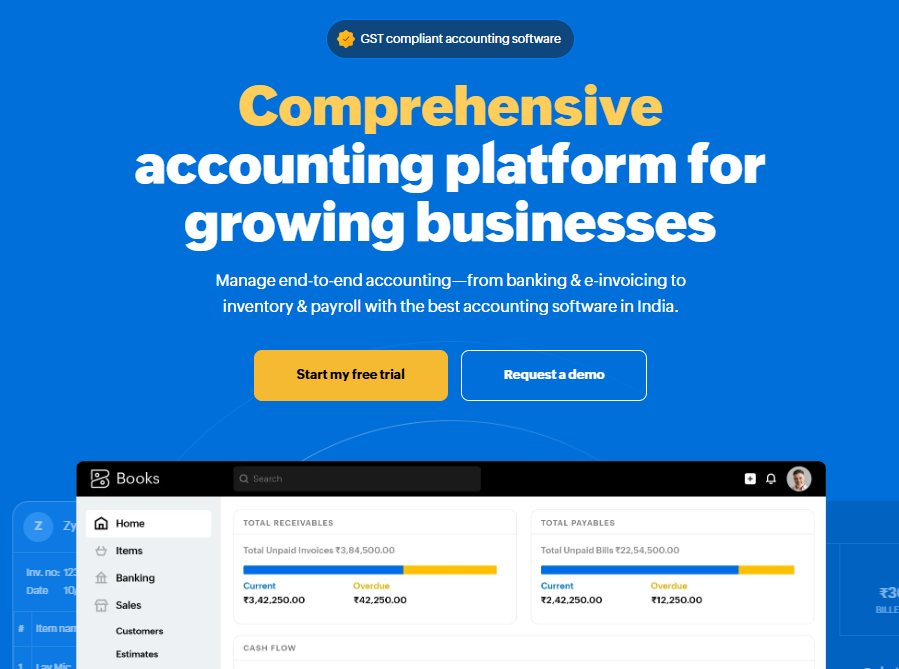

Zoho Books

Zoho Books is part of the broader Zoho ecosystem (CRM, Inventory, Projects, etc.). As a cloud accounting tool, it’s well-suited for small to medium businesses that already use or plan to use Zoho’s suite.

Features

-

Full invoice & expense tracking

-

Automated workflows & approval flows

-

Bank feed integrations & reconciliation

-

Inventory tracking, multi-currency support

-

Client portal, vendor billing

-

Integration with Zoho CRM, Projects, Inventory, Analytics

Pros

-

Seamless synergy with the Zoho suite.

-

Strong automation and workflow customization.

-

Affordable pricing, especially for businesses already in Zoho’s stack.

-

Good mobile & web interface.

Cons

-

The payroll module often needs third-party add-ons.

-

Feature depth can overwhelm newbies.

-

Ecosystem outside Zoho is less connected than e.g. Xero’s app marketplace.

Best For

-

Businesses already using Zoho apps or planning to.

-

Fast-growing SMEs need more automation and structured workflows.

-

Teams that want an integrated CRM + accounting.

Xero

Xero is a mature, globally recognized cloud accounting platform targeting small and mid-sized enterprises. It emphasizes collaboration, breadth of the app ecosystem, and real-time reporting.

Features

-

Unlimited users with role permissions

-

Bank feeds & auto-match

-

Bill payments, tracking, and purchase orders

-

Multi-currency, foreign exchange handling

-

App integrations (1,000+ apps)

-

Advanced reporting & forecasting tools

Pros

-

Large ecosystem of connected apps and add-ons.

-

Scalability with strong collaboration tools.

-

Good reputation and global reach.

Cons

-

Costs can add up via add-ons.

-

Some features (payroll, advanced modules) require external modules in certain countries.

-

Learning curve for non-accountants.

Best For

-

Businesses with an international footprint.

-

Firms that anticipate needing many integrations or custom workflows.

-

Teams that already rely on a variety of third-party tools.

FreshBooks

FreshBooks is designed primarily for freelancers, consultants, and small service-based businesses. It focuses on invoicing, time tracking, and streamlined billing.

Features

-

Time tracking & billable hours

-

Simple invoicing, recurring invoices

-

Expense capture and categorization

-

Basic reporting

-

Integration with payment processors, other tools

-

Mobile app support

Pros

-

Very easy to use for non-accountants.

-

Ideal for invoice-heavy, service-oriented businesses.

-

Good support and mobile tools.

Cons

-

Not as strong in inventory or complex accounting.

-

Reporting depth is limited.

-

Scaling beyond fundamentals may require upgrades or other tools.

Best For

-

Freelancers, consultants, small agencies.

-

Businesses with minimal inventory or fixed-asset needs.

-

Teams prioritize simplicity over full accounting depth.

Wave Accounting

Wave is one of the few truly free accounting tools available (especially in the U.S./Canada), offering core bookkeeping and invoicing features without monthly fees.

Features

-

Basic invoicing & expenses

-

Receipt scanning

-

Bank connections/transactions import

-

Income/expense reports

-

Optional paid features for payments and payroll

Pros

-

No monthly cost for basic accounting & invoicing.

-

Good for very small businesses or solo operators.

-

Simplicity and ease of setup.

Cons

-

Limited scale; some features locked behind paid add-ons.

-

Customer support is limited.

Best For

-

Very small businesses, sole proprietors, micro-enterprises on a budget.

-

Users who need only basic bookkeeping and invoicing with minimal overhead.

-

Those willing to accept limitations in depth.

Sage Business Cloud Accounting

Sage Business Cloud (formerly Sage One) is a well-established name in accounting, particularly among medium-sized businesses and those operating in regulated environments. It combines cloud features with traditional accounting foundations.

Features

-

Financial accounting (journals, ledgers)

-

Invoicing, expenses, bills

-

Multi-period accounting and budgets

-

Reporting and analytics

-

Integration with payroll, third-party modules

Pros

-

Strong reputation for compliance and robustness.

-

Good support for regulatory and audit features.

-

Used widely by businesses transitioning from legacy accounting.

Cons

-

The interface may feel outdated or less intuitive for users with smaller screens.

-

Advanced modules often come with higher costs or require additional add-ons.

-

Less flexibility compared to modern cloud-native tools.

Best For

-

Businesses in regulated industries need audit and compliance.

-

Firms migrating from on-premise or legacy accounting systems.

-

Companies that demand stability and support over bells and whistles.

Comparison Table: QuickBooks vs. Alternatives

| Software | Pricing | Best For | Strengths | Limitations |

|---|---|---|---|---|

| QuickBooks | High | SMEs, accountants | Robust features, industry reputation | Costly, complex |

| Giddh | Low | SMEs, startups | Affordable, collaborative, reporting | Smaller ecosystem |

| Zoho Books | Medium | SMEs with Zoho apps | Automation, integrations | Learning curve |

| Xero | High | Growing enterprises | Scalability, integrations | Add-ons increase cost |

| FreshBooks | Medium | Freelancers, consultants | Invoicing, time-tracking | Limited reporting |

| Wave | Free | Freelancers, startups | Free invoicing & accounting | Limited advanced tools |

| Sage | Medium | Medium businesses | Compliance, strong reporting | Less intuitive |

How to Choose the Right QuickBooks Replacement Software

Finding the right QuickBooks alternative starts with aligning your software choice to your business model and long-term goals. A freelancer may need simple invoicing, while a fast-scaling SME requires inventory, multi-branch support, and detailed reporting. The right decision saves time, reduces costs, and ensures financial clarity.

Steps to Identify the Best Fit

-

Define business needs

-

Freelancers: invoicing, expense tracking, payment integrations.

-

SMEs: multi-user access, GST compliance, and inventory management.

-

Startups: scalability, API integrations, role-based controls.

-

-

Match features with requirements

-

Compare features like bank reconciliation, reporting, and automation.

-

Look for extras such as audit trails, security controls, or multi-currency if relevant.

-

-

Evaluate support and training.

-

Check if the vendor offers responsive customer service.

-

Onboarding guides, tutorials, and community support accelerate the adoption process.

-

-

Consider cost vs. scalability.

-

Weigh monthly costs against features provided.

-

Ensure the platform grows with your business, rather than forcing a migration later.

-

Conclusion

QuickBooks remains a dominant player in accounting, but its rising costs and complexity have led many to seek better-suited tools. From cloud-based accounting software like Xero to free options like Wave, businesses in 2025 have a wide range of alternatives.

If you’re seeking affordability, collaboration, and transparent financial reporting, Giddh stands out as a powerful choice. With features tailored for SMEs and startups, it simplifies accounting without sacrificing depth.

The decision ultimately depends on your business type, but exploring these Quick Book alternatives ensures you won’t be limited by cost or complexity. Take the time to test a few options, compare their usability, and select the one that best empowers your financial journey.