How to Master the Two Crucial Profit Margins for Small Business Success

Did you know that small businesses fail due to poor financial management and cash flow issues? One of the most critical yet often overlooked aspects of financial management is understanding your business’s profit margins.

Tracking and improving profit margins isn’t just a good practice; it’s essential for surviving and thriving in today’s competitive landscape.

Whether you're a startup or an established small business, profit margins reveal the true financial health of your business and highlight areas for improvement.

In this post, we’ll dive deep into the two most crucial profit margins for small business success: gross profit margin and operating profit margin, and provide you with actionable strategies to calculate and improve them.

You’ll also discover accounting tools, such as profit margin calculators, that can help you streamline this process and drive profitability.

What Are Profit Margins?

Profit margins are key financial metrics that measure your business's profitability. They provide insight into how much of your company's sales revenue your company retains after accounting for costs. Understanding profit margins is crucial because they indicate how efficiently your business is operating and help you make data-driven decisions to boost growth.

Types of Profit Margins:

- Gross Profit Margin: Gross profit margin measures the profitability of your core business activities, excluding indirect costs. It tells you how much money is left over after you’ve paid for the production or acquisition of the goods you sell.

- Operating Profit Margin: Operating profit margin considers not only the cost of goods sold (COGS) but also the business’s operating expenses, such as salaries, rent, and utilities. This margin provides a clearer view of overall business efficiency.

Why Profit Margins Matter

Understanding your profit margins is vital because it directly impacts your business’s sustainability. These margins help small business owners assess whether they are pricing products correctly, managing costs efficiently, and achieving profitability. A healthy profit margin also enables reinvestment, supporting continued growth and innovation.

The Two Kinds of Profit Margins Every Small Business Needs to Know

For small businesses, it’s imperative that your business must be profitable especially if you are bootstrapped. You need the money for serving your customers, paying your employees and rewarding yourself. Your profit margins are like the measurement of your profitability.

There are two kinds of profit margins that a small business owner must focus on-

1. Operating profit margin

2. Gross profit margin

Operating Profit Margin

The operating profit margin is simply a calculation of how much of every rupee in sales ends up as operating profit (before tax) for your small business. For example, if you had Rs 10 lakh in sales and ended up with a pre-tax profit of Rs 2,50,000, your operating profit margin would be 25 per cent. Remember that your operating profit margin is a great way to measure how profitable your business is on an overall basis.

As per this example, if you are able to go from a 25 per cent to a 30 per cent operating margin by say better expenses management, you would earn more profit from that same Rs10 lakh of gross revenue. To be precise, that 5 per cent increase in operating profit margin would lead to a 20 per cent increase in profit.

We don’t want you to worry too much about this math per se but just to give you a feel of the concept of operating profit margin.

Operating profit margin measures the efficiency of your business in generating profit from its operations, excluding taxes and interest. It focuses on the relationship between your operating income and your revenue. The higher the operating profit margin, the better your business is at controlling costs while generating sales.

Formula for Operating Profit Margin:

Operating Profit Margin = Operating Income ÷ Revenue × 100

Example: If your revenue is Rs 1,000,000 and your operating income is Rs 200,000, your operating profit margin would be 20%. A higher operating profit margin suggests that your business is effectively managing its operational costs.

Gross Profit Margin

The second important type of margin to understand is your gross profit margin. Believe it or not but in Indian businesses, this one is the most misunderstood and least leveraged number for your business.

The gross profit margin is the measure of how much money you have left over from every sale after you take out your cost of production or for acquiring the product or the service that you just sold. Here’s how you calculate it –

Gross Sales (i.e., total sales before any expenses) Minus COGS (the “cost of goods sold” for the sales you made). Gross profit margin is both vital and powerful for the success of your business.

That’s because this margin informs you how much money you have left after you pay the cost to produce and fulfill on a sale to spend on sales, marketing, fixed overhead etc and still have enough left to make a reasonable profit for your time, effort, and risk.

This number also tells you clearly about the overall efficiency of your business.

When you know your gross profit margin, you can get valuable insights about your pricing. It lets you understand which customers, products, or projects are the best margin business to pursue and which you should consider phasing out (or even immediately cutting), and it even helps you spot inefficiencies in your production cycle.

You can easily get such insights through an online accounting software such as Giddh. It has in-built categories and you can add groups and categories as per your industry. If you have any queries about how you can optimize profit margins through accounting software, let us know.

Gross profit margin, on the other hand, is concerned with how well your business is performing in its core operations—how much money you make from each sale after accounting for the cost of producing goods or services.

Formula for Gross Profit Margin:

Gross Profit Margin = (Revenue – COGS) ÷ Revenue × 100

Example: If your revenue is Rs 1,000,000 and your cost of goods sold (COGS) is Rs 600,000, your gross profit margin would be 40%. This tells you that you have 40% of your sales revenue left to cover operating expenses and profit.

Both margins are essential for understanding your business's financial position. Improving these margins will help you increase profitability without needing to increase sales volume.

How to Use Profit Margins to Optimize Your Business

Understanding your gross profit margin and operating profit margin is only half the battle. The key to business success lies in optimizing these margins. Below are a few strategies to help you boost both margins and drive profitability:

Improving Gross Profit Margin

- Renegotiate supplier contracts to Secure better pricing for raw materials and products.

- Reduce raw material costs: Look for ways to minimize waste and improve production efficiency.

- Streamline production processes: Identify bottlenecks or inefficiencies in your production line and optimize them.

Improving Operating Profit Margin

- Cut overhead costs: Evaluate your fixed expenses, such as rent, utilities, and salaries. Look for areas where you can reduce costs without sacrificing quality or service.

- Improve operational efficiency by automating or delegating repetitive tasks. Implement lean business practices to maximize output with minimal input.

- Use automation tools: Invest in business management software that can streamline financial reporting, cost tracking, and decision-making.

Using a Profit Margins Calculator

One of the easiest ways to track and improve your margins is by using a profit margins calculator. Tools like Giddh allow small business owners to calculate gross and operating profit margins in real time. These calculators make it easier to track margin changes and provide actionable insights into areas for improvement.

With tools like these, you can quickly identify trends, make informed pricing decisions, and optimize your costs.

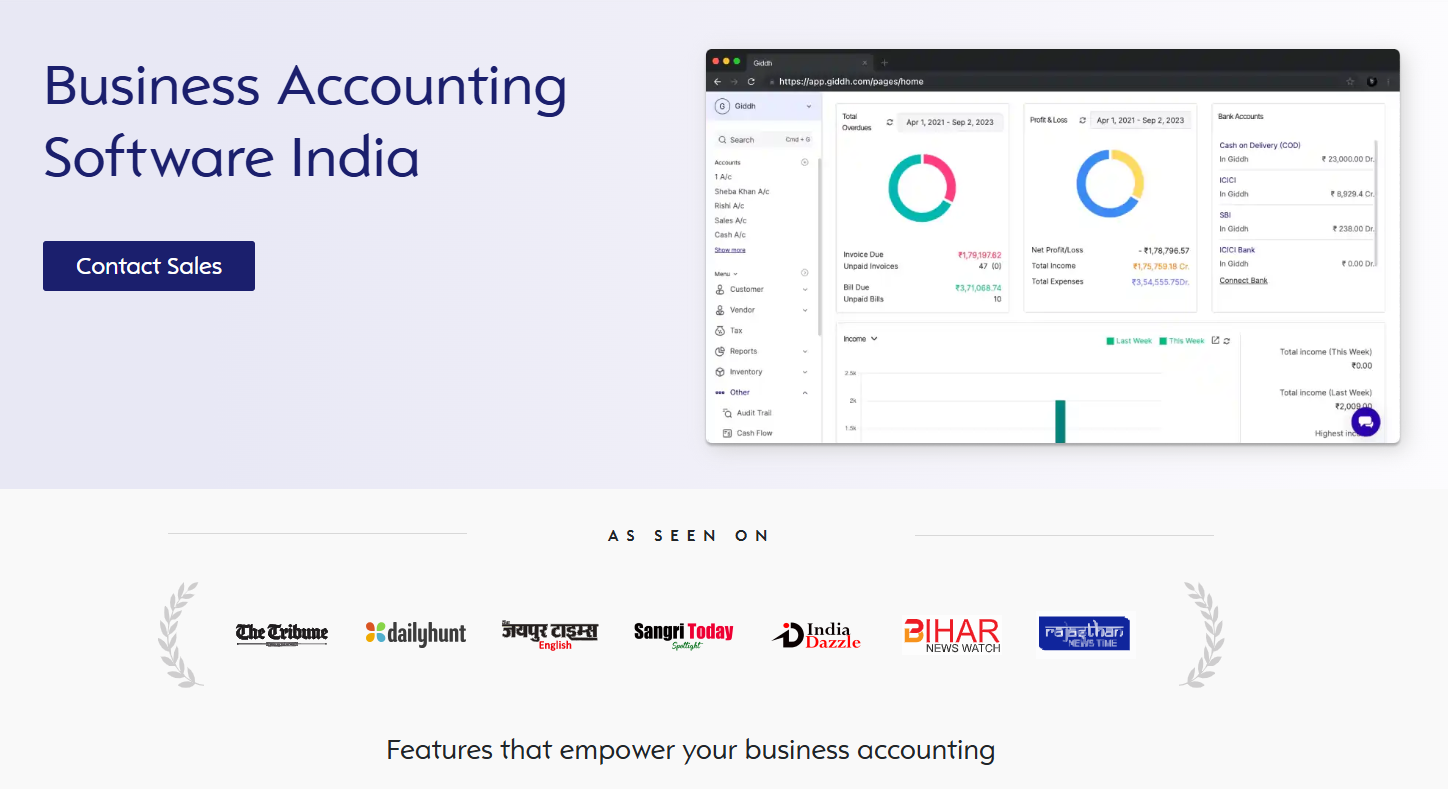

Giddh: Streamlining Profit Margin Tracking for Small Businesses

Managing your profit margins efficiently is essential to maintaining a healthy business. Giddh, a leading online accounting software, provides small businesses with powerful tools to track and optimize their profit margins.

By simplifying financial management and offering detailed insights, Giddh helps business owners stay on top of their financial health and improve their overall profitability.

Features of Giddh

-

Real-time Profit Margin Calculation: Giddh’s intuitive dashboard enables you to calculate gross and operating profit margins in real-time, ensuring you always have up-to-date information on your business’s financial performance.

-

Customizable Reports: With Giddh, you can generate customized reports tailored to your business needs, allowing you to focus on the financial metrics that matter most, such as profit margins by product, service, or customer.

-

Cash Flow Management: Giddh offers robust cash flow tracking, which is directly tied to your profit margins. With easy-to-read charts and tables, you can see where your money is coming from and where it's going.

-

Expense Tracking and Budgeting: Giddh helps you track and manage both fixed and variable costs, which directly influence your operating profit margin. You can create budgets and forecasts to ensure that your business remains on track.

-

User-Friendly Interface: Giddh is designed with small business owners in mind, offering an easy-to-use interface that simplifies accounting tasks, making it perfect for entrepreneurs who may not have an accounting background.

-

Ledger-Based Accounting: Track every transaction in a highly organized ledger, ensuring accuracy and seamless integration of all your business’s financial data.

-

Multi-Currency Support: Conduct business across borders with the ability to manage transactions in multiple currencies, making Giddh ideal for global or multi-region operations.

-

Unlimited User Access: Grant access to as many users as needed without any restrictions, ensuring collaborative financial management across teams or departments.

-

Manage Over 100 Companies: Giddh supports the management of financials for over 100 companies, ideal for businesses with multiple entities or those managing several brands or subsidiaries.

Why Giddh Is Perfect for Profit Margin Optimization

Giddh’s tools and features make it easier to stay on top of your profit margins by offering detailed, real-time insights into your revenue, expenses, and profit. The ability to track and analyze gross and operating profit margins simplifies financial decision-making and helps identify areas where you can reduce costs or improve efficiency.

With Giddh, you don’t have to rely on complex spreadsheets or manual calculations to understand your profit margins. Whether you need to improve your gross profit margin by reducing direct costs or optimize your operating profit margin by cutting overhead, Giddh gives you the tools to succeed.

Conclusion

Mastering your gross profit margin and operating profit margin is a fundamental aspect of running a successful small business. These profit margins not only reflect your business’s financial health but also provide insights into areas where you can improve efficiency, control costs, and increase profitability.

By regularly tracking and optimizing these margins, you can make informed decisions that drive business growth, reduce operational waste, and increase your profitability.

Start your free trial and get profit margin calculators and other features to get a clear picture of your business’s financial health and take steps to optimize your profit margins today.

FAQs

How gross profit margin is calculated?

Answer: Gross Profit Margin = (Revenue − COGS) ÷ Revenue × 100. It helps businesses measure their efficiency in producing goods or services.

What is the difference between gross profit margin and operating profit margin?

Answer: Gross profit margin focuses on direct production costs, while operating profit margin accounts for all operating expenses.

How can I improve my gross profit margin?

Answer: Improving gross profit margin can be achieved by renegotiating supplier contracts, reducing raw material costs, and streamlining production.

Should I use a profit margin calculator?

Answer: Yes, using a profit margin calculator can help you track and optimize margins efficiently, ensuring better decision-making.