Tips for Choosing the Best Business Accounting Software for Your Needs

TL;DR: With a multitude of business accounting software options available, choosing the right tool can be overwhelming. Businesses need software that not only tracks expenses but also simplifies operations and ensures compliance with regional tax laws, such as GST in India. Whether you are a small business or a large enterprise, selecting software that aligns with your goals is crucial. Key factors include ease of use, scalability, cost, and security. In this blog, we'll explore the essential features of accounting software, factors to consider for GST compliance, and help you find the best accounting software for small businesses in India.

According to a recent statista survey, the global accounting software market is expected to reach $28.9 billion by 2026, growing at a CAGR of 8.3%. This growth reflects the increasing need for businesses to streamline financial operations and ensure seamless compliance with local tax regulations, such as GST in India.

Is your business leveraging business accounting software to its full potential? If not, you might be missing out on significant time-saving benefits and improved financial accuracy. In today’s digital-first world, business owners can no longer afford to rely on outdated methods like spreadsheets or manual bookkeeping.

Finding the right accounting software is not just a matter of handling finances; it’s about setting your business up for long-term success.

This guide will walk you through everything you need to know about selecting the best accounting software, including GST-ready options, particularly for small businesses in India.

Why Your Business Needs Accounting Software

Many small businesses in India often struggle to manage their finances due to outdated systems. But, using the right accounting software can ease these burdens significantly. Here’s how:

-

Improved Accuracy: Automated features such as invoicing and tax calculations reduce human error.

-

Compliance: The right software can help businesses stay compliant with GST laws and avoid penalties.

-

Time Savings: Quick access to financial data and automated reports saves business owners valuable time.

Key Features to Look for in Business Accounting Software

When evaluating the best business accounting software for your company, you need to consider more than just basic functionality. Several features can significantly improve your financial management:

-

GST Compliance: Since GST is mandatory for businesses in India, having accounting software with GST features is non-negotiable. It should automatically calculate GST on transactions, generate GST-compliant invoices, and prepare GST returns for easy filing.

-

User-Friendly Interface: The software should be easy for you and your team to use. It should come with a simple, intuitive interface, even for non-accounting professionals. Look for online small business accounting software that offers cloud-based solutions for ease of access and flexibility.

-

Invoicing and Billing: Efficient invoicing is crucial for any business. Your software should allow you to create, send, and track invoices effortlessly. Additionally, it should include payment tracking, reminders, and late fee calculation.

-

Bank Reconciliation: The software should allow you to link your bank accounts directly to it for automatic bank reconciliation. This ensures that your transactions match the data your bank provides.

-

Reporting and Analytics: Customizable reports can provide valuable insights into your business’s financial health. Look for software that allows you to generate profit and loss statements, balance sheets, cash flow reports, and tax reports with a few clicks.

-

Scalability: As your business grows, you may need more complex features. The best business accounting software in India for GST should offer scalability options, including additional users, advanced features, and integration with other business tools, such as payroll or CRM.

-

Cloud-Based Solutions: Cloud-based accounting software offers several benefits, including remote access, data security, and easy collaboration with accountants or team members from anywhere.

Best Business Accounting Software for Small Businesses in India

If you're looking for accounting software with GST for small businesses in India, here are some top options tailored to Indian businesses.

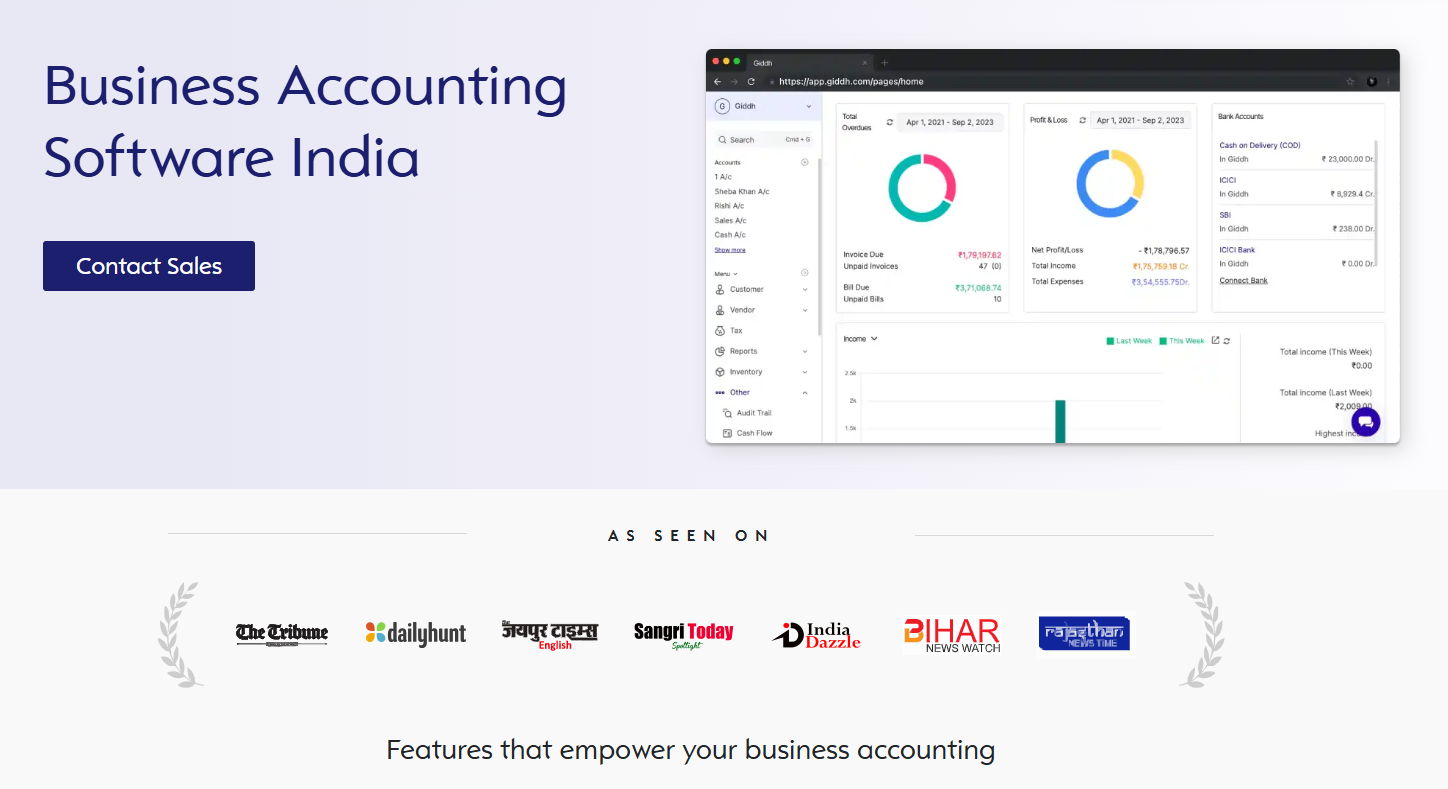

1. Giddh

Giddh is a cloud-based business accounting software designed specifically for Indian businesses. It offers a wide range of features, including GST filing, invoicing, and banking integration. Giddh is known for its simplicity and affordability, making it ideal for small businesses that need easy-to-use accounting software.

Features:

-

GST Filing: Automates GST returns and ensures compliance with Indian tax laws.

-

Invoicing: Create professional invoices with GST details.

-

Bank Integration: Sync your bank transactions for easy reconciliation.

-

Cloud Access: Access your financial data anytime, anywhere.

-

Real-time Reporting: Generate detailed financial reports in real time.

Pros:

-

Affordable for small businesses.

-

User-friendly interface that is easy to navigate.

-

Fully GST-compliant.

-

Cloud-based, allowing access from anywhere.

Cons:

-

Limited advanced features compared to global competitors.

-

May not be suitable for larger businesses with complex needs.

2. TallyPrime

TallyPrime is one of the most popular business accounting software solutions in India. It’s widely recognized for its GST-ready features and comprehensive accounting tools, including payroll management and inventory tracking. It’s ideal for businesses looking for an all-in-one solution.

Features:

-

GST Ready: Automatically calculates GST on transactions and helps in filing GST returns.

-

Inventory Management: Track stock, purchases, and sales in real-time.

-

Payroll: Manage employee payroll, including taxes and deductions.

-

Multi-currency support: Useful for businesses dealing with international transactions.

Pros:

-

Well-established and trusted brand in India.

-

Comprehensive accounting features.

-

Affordable for small businesses.

Cons:

-

Steeper learning curve for beginners.

-

It may be overkill for very small businesses that don't require advanced features.

Zoho Books

Zoho Books is a cloud-based accounting solution perfect for small businesses in India. It integrates seamlessly with GST, providing an intuitive, automated system for invoicing, expense tracking, and generating reports.

Features:

-

GST Integration: Supports GST invoicing and filing.

-

Expense Tracking: Track and categorize your business expenses.

-

Invoicing: Create and send invoices easily with GST-compliant templates.

-

Cloud-based: Access data from any device with an internet connection.

Pros:

-

Highly user-friendly and easy to navigate.

-

Integrates well with other Zoho applications, such as CRM and payroll.

-

Cloud-based, enabling remote access.

Cons:

-

Limited features on the free plan.

-

Not suitable for larger businesses that need more customization or advanced reporting.

QuickBooks India

QuickBooks is a globally recognized accounting software that has an Indian version tailored to local needs. It provides GST invoicing, expense tracking, and tax calculation, making it a popular choice for businesses in India.

Features:

-

GST Invoicing: Generate GST-compliant invoices.

-

Expense Tracking: Easily track business expenses.

-

Tax Calculation: Automates tax calculations for GST and other taxes.

-

Bank Integration: Link your bank accounts for seamless reconciliation.

Pros:

-

Easy to use and intuitive interface.

-

Scalable for businesses of all sizes.

-

Integrates well with banking and other software.

Cons:

-

Pricing may be higher than some other options, especially for small businesses.

-

It can become expensive as you scale up.

How to Choose the Right Accounting Software for Your Business

When selecting business accounting software for your small business, consider both your immediate needs and future growth. Here’s a quick guide to help you make an informed decision:

-

Identify Your Business Needs: Does your business require advanced features like payroll management, multi-currency support, or inventory tracking? Be clear about the features you need right now and those you might need as your business grows.

-

Consider the Pricing: Small businesses should look for affordable options that don’t compromise on essential features. Many software providers offer tiered pricing or free trials, so you can test the software before committing.

-

Look for Integrations: Choose software that integrates well with other tools you use. For instance, if you already use a CRM or e-commerce platform, ensure the accounting software integrates seamlessly with it.

-

Read Reviews and Get Recommendations: Research customer reviews and get recommendations from peers or industry experts to ensure the software has a good reputation for customer support and reliability.

Conclusion

Choosing the right business accounting software India can have a profound impact on your company’s financial management, accuracy, and growth. For small businesses in India, it's crucial to ensure the software you select is GST-compliant, easy to use, and scalable. Take your time, evaluate your needs, and choose software that not only meets your current requirements but also grows with your business. Whether it’s cloud-based accounting software or a more robust solution like Tally or QuickBooks, the right choice will save you time, reduce errors, and help your business stay compliant.

FAQ

Q1: What is the best accounting software for small businesses in India?

Answer: The best accounting software for small businesses in India includes TallyPrime, Zoho Books, QuickBooks India, and Giddh. These options are affordable, user-friendly, and offer GST compliance features.

Q2: Does online accounting software help with GST filing?

Answer: Yes, most online small business accounting software, like Zoho Books, QuickBooks, and Giddh, offer automatic GST calculation and filing, making compliance easier.

Q3: Can I use accounting software for multiple users?

Answer: Many business accounting software options allow multiple users with varying access levels, which is especially useful if you have a team managing your finances.

Q4: What is the cost of accounting software for small businesses in India?

Answer: The cost of the best accounting software for small business India ranges from ₹1,000 to ₹10,000 per year, depending on the features, number of users, and subscription plan.