Why Giddh Is a Powerful Zoho Books Alternative in India

Accounting software plays a crucial role in simplifying the financial operations of small and medium-sized businesses (SMBs). However, choosing the right solution can be a daunting task. In India, many SMBs struggle with finding software that balances affordability, user-friendliness, and local compliance. A recent report suggests that over 70% of businesses in India still rely on traditional bookkeeping methods or inefficient solutions, primarily due to the complexity and high costs of global accounting software solutions like Zoho Books.

While Zoho Books is popular, it's not always the perfect fit for Indian businesses. Its steep pricing and complex features often overwhelm smaller companies. Furthermore, its localization for Indian tax laws—especially GST—leaves much to be desired.

This is where Giddh, a powerful Zoho Books alternative in India, steps in. With its affordability, ease of use, and seamless GST compliance, Giddh is quickly becoming a favorite among Indian SMBs. Let’s dive into why Giddh might be the solution your business needs.

Why Businesses in India Are Looking for Zoho Books Alternatives

Indian SMBs face unique challenges that many global accounting software platforms, including Zoho Books, struggle to address effectively. Here are some of the primary reasons why businesses in India are seeking Zoho Books alternatives:

1. High Pricing and Overwhelming Features

While Zoho Books offers a wide range of features, its pricing can be prohibitive for small businesses. SMBs with limited resources often find Zoho’s feature set more than what they need, resulting in underutilized tools and unnecessary expenses.

2. Limited Localization for Indian GST Compliance

Zoho Books, although widely used, doesn't always stay ahead of India’s frequent tax law changes. This lack of seamless GST integration means businesses must often do manual updates, leading to costly errors.

3. Complex Interface and Usability

Many businesses find Zoho Books’ interface overwhelming. It is designed for a wide range of use cases, and the complexity can be daunting for SMBs that don’t need a full suite of advanced features. For finance professionals and business owners who want quick access to key accounting functions, simplicity is paramount.

4. Support Challenges for Indian Users

While Zoho Books offers support, it’s often more geared toward global users, making it harder for Indian businesses to get timely, localized assistance. Support teams that are not fully aligned with Indian accounting and tax regulations can lead to delays and frustration.

For businesses seeking a more tailored approach, Giddh stands out as a compelling Zoho Books competitor, addressing these challenges with a simpler, more cost-effective, and locally compliant solution.

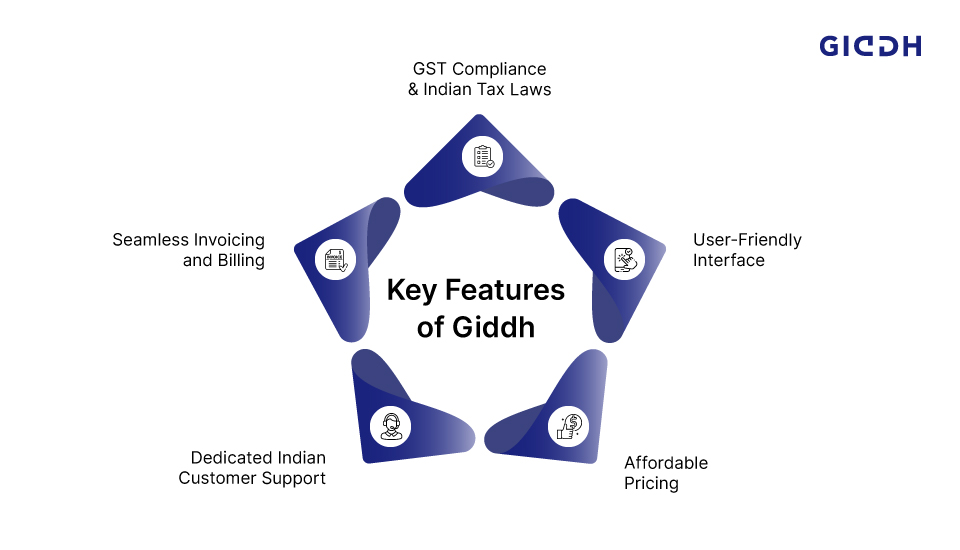

Features of Giddh That Make It the Best Zoho Books Alternative in India

When comparing Giddh with Zoho Books, it’s essential to focus on the key differentiators that make Giddh an excellent choice for Indian SMBs:

GST Compliance & Indian Tax Laws

India’s GST regulations are complex and ever-changing. Giddh stays updated with the latest tax laws to ensure your business remains fully compliant. With features like automatic GST calculation and e-filing, Giddh makes tax filing straightforward, reducing the risk of costly errors.

-

Automatic GST calculation: Ensures accuracy and saves time on manual calculations.

-

E-filing: Direct integration with GST portals for quick and accurate filing.

-

GST reports: Automatically generated to simplify tax filing and compliance.

-

Real-time updates: Always in sync with the latest tax law changes.

User-Friendly Interface

Giddh’s intuitive design is perfect for SMB owners and financial managers who need a hassle-free accounting experience. Unlike Zoho Books, which can overwhelm users with complex features, Giddh offers simplicity without sacrificing functionality. It’s ideal for businesses that need core accounting features without the learning curve.

-

Simple navigation: A clean and organized interface that’s easy to understand.

-

Quick access to key features: Tasks like invoicing, billing, and reports are just a click away.

-

Customizable dashboard: Tailor the software layout to suit your needs.

-

Minimal learning curve: Designed for non-accountants and small business owners.

Affordable Pricing

One of the main benefits of Giddh is its cost-effective pricing model, which is designed specifically for Indian businesses. Unlike Zoho Books, which charges significantly higher fees, Giddh offers an affordable plan that covers all essential features, making it more accessible for small businesses.

-

Competitive pricing: Giddh offers budget-friendly pricing plans without compromising on features.

-

Transparent billing: No hidden fees, with pricing plans that are easy to understand.

-

Flexible plans: Tailored for businesses of all sizes, from startups to established enterprises.

-

Free trial: Test the platform with no commitment before deciding to purchase.

Dedicated Indian Customer Support

Giddh offers robust, India-centric customer support, ensuring that users get timely help with issues related to Indian tax laws and local regulations. Zoho Books may struggle to provide personalized service tailored to the specific needs of Indian businesses, but Giddh bridges this gap.

-

24/7 support: Available through chat, email, and phone.

-

Indian-specific expertise: Support team well-versed in Indian accounting and GST requirements.

-

Fast response times: Dedicated support to resolve issues quickly and efficiently.

-

Localized assistance: Help with everything from tax compliance to software setup and usage.

Seamless Invoicing and Billing

As a Zoho invoice alternative, Giddh makes it easy to generate professional invoices and track payments. With its automated billing system, businesses can save time and reduce manual errors, allowing them to focus on growth.

-

Automated invoice generation: Create and send invoices automatically with just a few clicks.

-

Customizable templates: Tailor invoices to match your branding.

-

Payment tracking: Keep track of payments and outstanding invoices effortlessly.

-

Recurring billing: Set up and manage recurring invoices for subscription-based services.

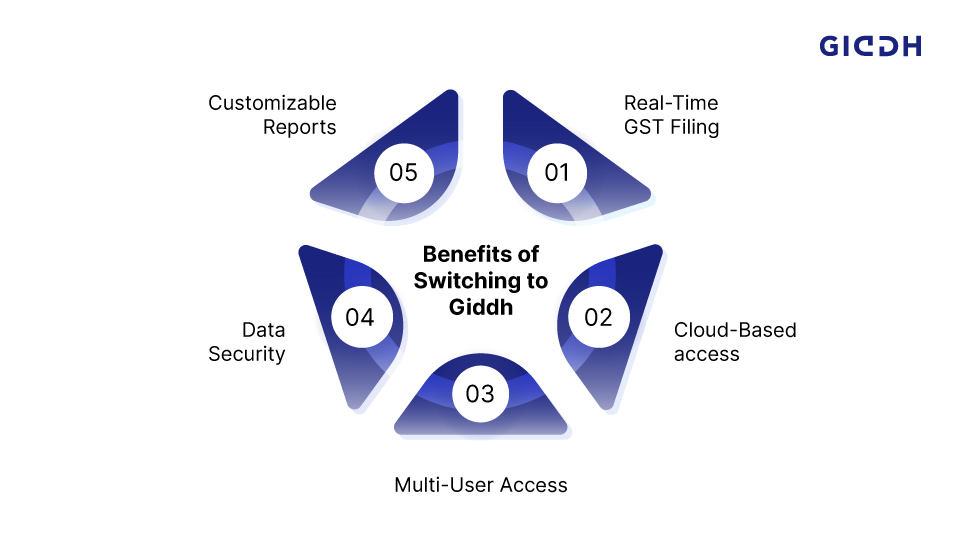

Key Benefits of Switching to Giddh for Your Accounting Needs

Real-Time GST Filing

With Giddh, you never have to worry about the latest tax updates. Real-time GST filing allows you to avoid errors, maintain accurate records, and ensure compliance at all times. This feature is a game-changer for Indian businesses struggling to keep up with frequent tax changes.

Cloud-Based Access

Being a online accounting solution, Giddh allows business owners and accountants to access financial data from anywhere, at any time. This means you can monitor your accounts on the go, helping you make informed decisions swiftly and accurately.

Multi-User Access

Whether you have a small team or a growing business, Giddh makes collaboration seamless. Multiple users can access the software simultaneously, ensuring smooth communication between business owners, accountants, and finance professionals.

Data Security

Security is a top priority for Giddh, which uses industry-standard encryption to ensure your financial data remains safe. With cloud-based storage, your data is automatically backed up, reducing the risk of losing important financial records.

Customizable Reports

Giddh’s customizable reporting feature enables businesses to generate detailed financial reports tailored to their specific needs. From profit and loss statements to balance sheets, Giddh’s reporting tools help you stay on top of your finances.

Customer Testimonials: Success Stories of Giddh Users

Many businesses in India have already switched from Zoho Books to Giddh, and feedback has been overwhelmingly positive. Users have reported:

-

Cost Savings: Small businesses have found Giddh significantly more affordable than Zoho Books.

-

Simplified Accounting: Users have praised Giddh’s user-friendly interface, which makes it easier for business owners without accounting backgrounds to manage their finances.

-

Better GST Compliance: Businesses that struggled with Zoho Books’ GST features have benefited from Giddh’s seamless integration with Indian tax laws.

Giddh vs. Zoho Books: A Comparison

Parameter | Giddh | Zoho Books |

|---|---|---|

Ideal For | Indian SMBs, startups, accountants | SMBs and growing businesses |

Pricing Approach | Cost-effective, India-centric | Higher pricing across plans |

GST Compliance | Built specifically for Indian GST | GST-enabled with configuration |

GST Calculation | Automatic and real-time | Automatic |

GST Returns & Filing | Simplified GST filing workflow | GST returns supported |

Ease of Use | Simple, minimal learning curve | Feature-rich, steeper learning curve |

Interface Design | SMB-friendly, clutter-free | Advanced, accounting-heavy |

Localization for India | Purpose-built for Indian regulations | Localized for India |

Customer Support | Dedicated Indian GST support | Centralized / global support |

Invoicing & Billing | GST-ready, automated invoicing | Advanced invoicing features |

Multi-User Access | Included across plans | User limits based on plan |

Cloud-Based Access | Yes | Yes |

Reporting & Insights | Customizable financial reports | Advanced reports |

Scalability | Ideal for growing Indian businesses | Suitable for scaling companies |

Free Trial | Available | Available |

Overall Suitability for Indian SMBs | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐ |

Why Giddh is the Future of Accounting Software in India

Giddh continues to innovate based on user feedback. As India’s business landscape evolves, Giddh is committed to updating its features and ensuring that Indian businesses stay compliant with tax laws. Giddh’s scalability ensures that it remains a trusted solution as businesses grow.

Conclusion:

For SMBs in India, finding an accounting solution that is affordable, user-friendly, and compliant with local tax laws is crucial. Giddh offers all this and more, positioning itself as a powerful alternative to Zoho Books. With real-time GST filing, a simple interface, and robust support, Giddh can streamline your accounting processes and help your business thrive.

Start your free trial of Giddh today and experience seamless accounting for your business!

FAQ

1. Why should I choose Giddh over Zoho Books for my Indian business?

Giddh is specifically designed for Indian businesses, offering simple, affordable, and GST-compliant features that Zoho Books may not fully cater to. Its easy-to-use interface and dedicated Indian support make it an ideal choice for SMBs.

2. Is Giddh suitable for small businesses in India?

Yes, Giddh is perfect for small businesses due to its affordable pricing, user-friendly design, and robust GST compliance.

3. How does Giddh handle GST compliance for Indian businesses?

Giddh automatically calculates GST and facilitates e-filing, ensuring that your business stays compliant with Indian tax laws without manual updates.

4. Can Giddh handle multi-user access?

Yes, Giddh allows multiple users to access the software simultaneously, making it easy for teams to collaborate and streamline accounting tasks.

5. How secure is my data with Giddh?

Giddh uses industry-standard encryption and cloud-based storage to ensure that your financial data remains safe and secure at all times.