5 Reasons Why Small Businesses Prefer Bookkeeping Software

Are you spending more time managing spreadsheets and receipts than focusing on your business? Many small business owners face the frustration of manual bookkeeping, relying on error-prone methods that consume hours of their time each week. The result? Mistakes, missed deadlines, and unnecessary stress are common during tax season.

Cloud-based bookkeeping software for small businesses offers a practical solution. Automating routine tasks, such as invoicing, expense tracking, and financial reporting, eliminates the time-consuming burden of manual entry. With features designed for accuracy and ease of use, such software ensures your records are always up to date and compliant with tax regulations.

Switching to the best bookkeeping software for small businesses not only saves time but also empowers business owners to make more informed decisions, leading to growth and stability.

Whether you’re looking to streamline your financial management or stay tax-compliant, cloud bookkeeping for small businesses is the key to efficiency and peace of mind.

The Challenges of Manual Bookkeeping for Small Business Owners

Managing finances manually might seem manageable at first, but it quickly turns into a time sink with high risk. For small business owners already stretched thin, manual bookkeeping can slow growth and create unnecessary stress.

The Time-Consuming Nature

Manual entry of every invoice, receipt, and expense consumes a significant amount of time each week.

-

Valuable time is spent on repetitive tasks instead of growth activities.

-

Even minor errors can lead to hours of backtracking.

Error-Prone Process

Spreadsheets and handwritten ledgers are highly vulnerable to mistakes.

-

A single wrong digit can throw off your entire balance sheet.

-

Manual processes increase the risk of missed payments or duplicate entries.

Tax Compliance

Staying compliant with changing tax laws can be challenging without automation.

-

Manual calculations can lead to incorrect GST filings.

-

Missed deadlines often result in penalties or audits.

Pain Points That Add Up

Inaccurate reports. Endless paperwork. Stress during tax season.

-

No real-time insights into cash flow or profitability.

-

Decisions based on guesswork, not data.

Using bookkeeping software for small business helps eliminate these risks—saving time and bringing clarity to your finances.

What Is Cloud Bookkeeping and How Does It Work?

Cloud bookkeeping is an online accounting solution that allows small business owners to manage their finances from any device with internet access. Unlike traditional software, which requires installation and updates, cloud bookkeeping software for small businesses works through a secure, centralized platform that automatically stores data online.

-

No need for manual backups or software upgrades.

-

Accessible from anywhere, at any time.

How It Works

Cloud-based systems automatically sync financial data in real-time, ensuring all your records are up-to-date without manual intervention.

-

Transactions are instantly recorded, saving time on data entry.

-

Reports, such as profit and loss, balance sheets, and cash flow, are generated automatically.

By choosing cloud bookkeeping, small businesses can unlock several key advantages:

-

Accuracy: Automated calculations minimize errors and streamline processes.

-

Efficiency: Saves time by eliminating repetitive tasks and reducing manual work.

-

Cost-effectiveness: Cloud solutions are often more affordable than traditional software, as they eliminate the need for costly hardware or installations.

Using bookkeeping software for small business offers a more innovative, more efficient approach to managing finances.

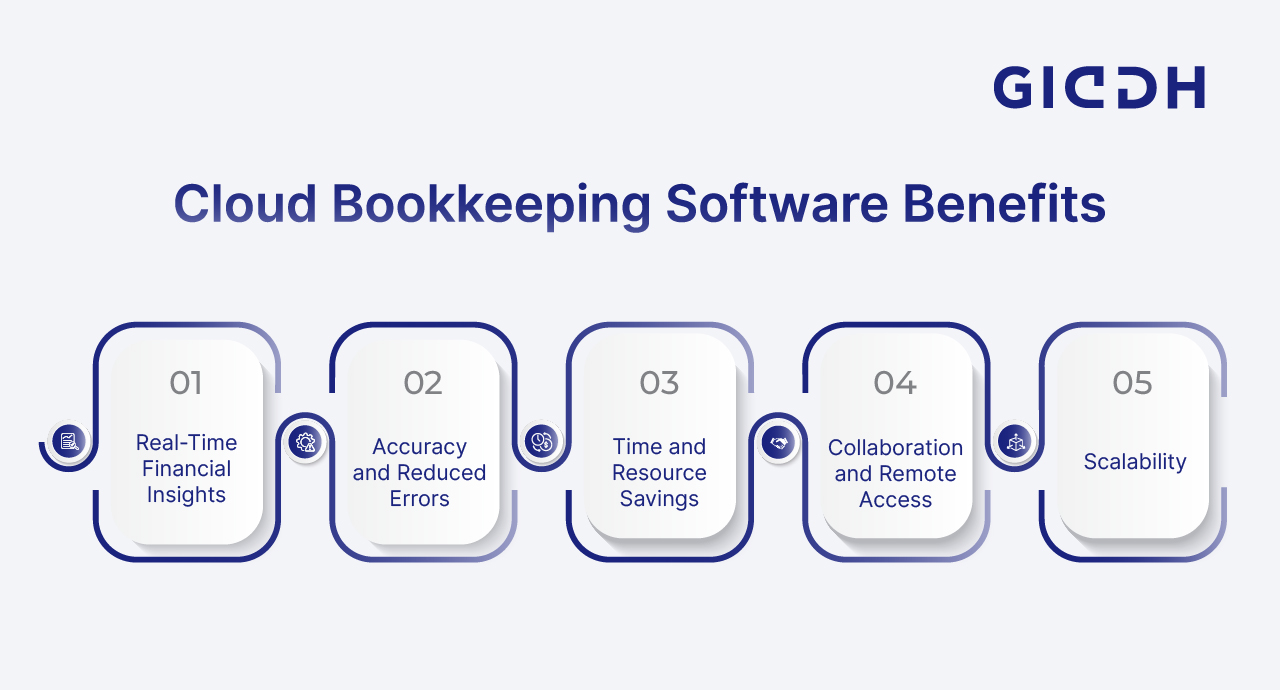

Key Benefits Of Using Bookkeeping Software For Small Business Owners

As small businesses grow, their financial management needs also increase. Cloud bookkeeping offers a modern solution to meet these challenges with ease, providing business owners with real-time insights, accuracy, and time savings. Below are some of the key benefits of using bookkeeping software for small business owners.

1. Real-Time Financial Insights

Cloud bookkeeping software provides instant access to your business’s financial health, allowing for more intelligent decision-making.

-

You can monitor cash flow, track expenses, and view profits in real-time.

-

Budgeting and forecasting are simplified, helping you plan for the future with greater confidence.

-

Instant data access enables you to identify trends, make informed adjustments, and ensure your financial strategy is aligned with your business goals.

2. Improved Accuracy and Reduced Errors

Manual bookkeeping is prone to errors, which can lead to costly mistakes. Cloud-based bookkeeping software automates calculations, reducing human error.

-

Transaction reconciliations are streamlined, and reports are automatically generated, ensuring your numbers are accurate.

-

With fewer mistakes, your tax filings become more accurate, helping you stay compliant with regulations.

-

This reduces the risk of costly audits and penalties, providing peace of mind for business owners.

3. Time and Resource Savings

By automating repetitive tasks like invoicing, payroll, and expenses, cloud bookkeeping frees up valuable time for business owners.

-

This allows you to focus more on growth strategies and less on administrative tasks.

-

Cloud bookkeeping saves hours every week by eliminating manual entries and organizing records efficiently.

-

This efficiency can enhance overall productivity, allowing you to allocate more time to growing your business.

4. Easy Collaboration and Remote Access

One of the key benefits of cloud bookkeeping is the ability for multiple users (like accountants or partners) to access and collaborate on your financial data, regardless of their location.

-

Cloud systems allow real-time updates and easy sharing of financial reports.

-

Whether you’re in the office or on the go, your financial data is always at your fingertips, helping your team stay aligned.

-

This flexibility supports remote working, making it easy to collaborate across time zones or geographic locations.

5. Scalability

Cloud bookkeeping software is designed to grow with your business. As your transactions increase or your needs become more complex, the software adapts to provide the necessary support.

-

You can easily add new users, customize features, and expand your accounting capabilities.

-

Whether you're adding new revenue streams, managing multiple locations, or handling increased inventory, cloud bookkeeping can handle it.

-

This scalability ensures that your bookkeeping solution continues to meet your needs as your business evolves.

By integrating bookkeeping software for small businesses, owners gain a powerful tool that improves efficiency, reduces errors, and supports informed decision-making. That's how bookkeeping software can simplify financial management for small businesses, making it an essential resource for any growing business.

Selecting the Best Bookkeeping Software for Small Businesses in India

When it comes to managing your business finances, choosing the right bookkeeping software for small business is essential for smooth operations and growth. Here's what to look for in a reliable bookkeeping solution:

Ease of Use

The software should be user-friendly, even for those without accounting expertise.

-

A simple, intuitive interface reduces training time.

-

It allows for quick navigation and efficient data entry.

Customization Options

Every business is unique, so the software must adapt to your needs.

-

Customizable reports and dashboards provide insights tailored to your business.

-

Ability to adjust features as your business grows.

Tax-Compliant Features

Ensure the software helps you stay compliant with local tax regulations, especially GST in India.

-

Automates GST filings, reducing manual errors.

-

Keeps you up-to-date with changing tax laws.

Customer Support

Responsive and helpful customer support is crucial for resolving any issues that arise.

-

Access to knowledgeable support staff.

-

Multiple support channels are available, including chat, email, and phone.

Integrations with Other Business Tools

Seamless integration with tools such as invoicing, payroll, and inventory management streamlines operations, enhancing efficiency.

- Connect with payment gateways, CRM systems, and banks for automated data sync.

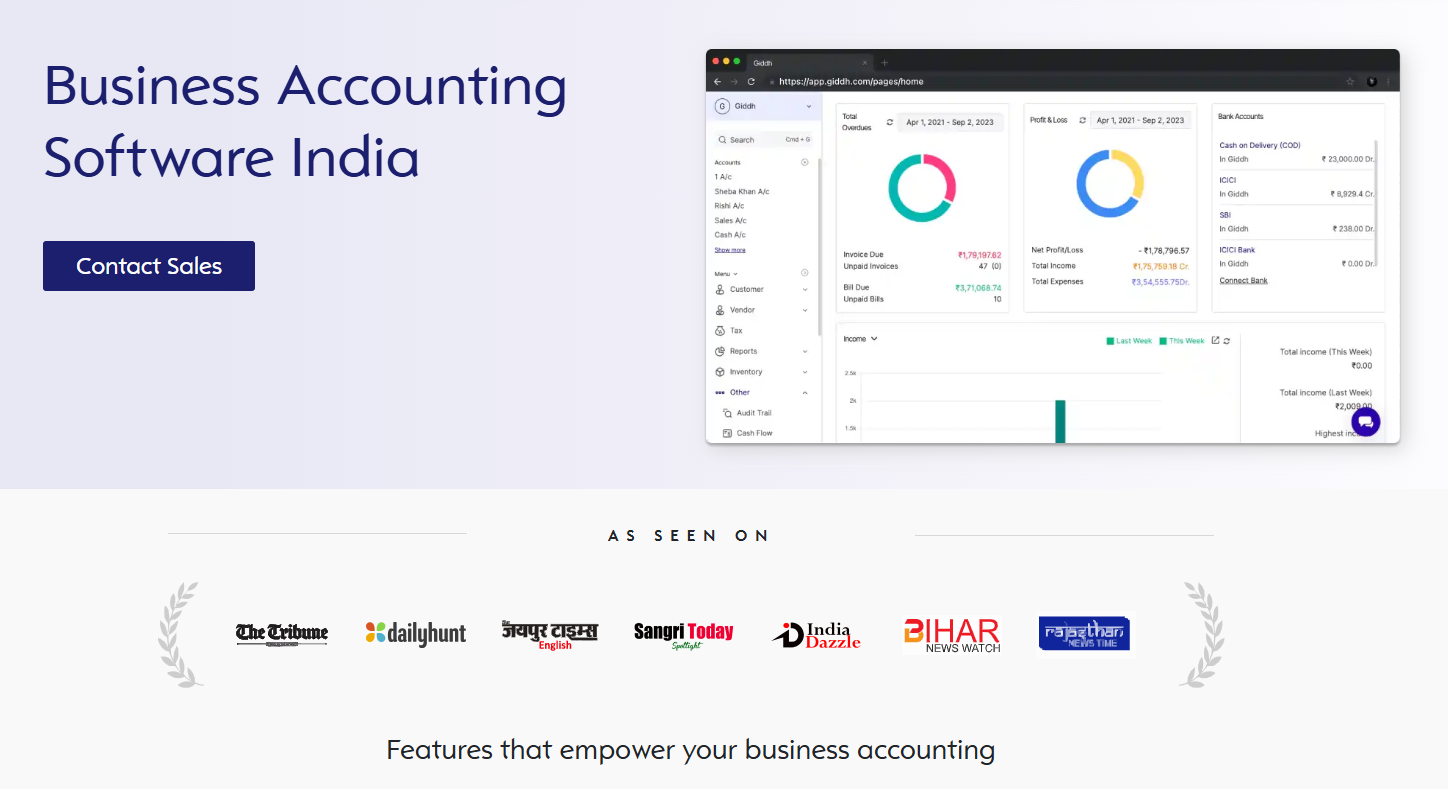

Giddh: The Perfect Cloud-Based Bookkeeping Software for Small Businesses in India

Giddh is a cloud-based bookkeeping software explicitly designed to cater to the unique needs of small business owners in India. It provides an intuitive, easy-to-use platform that simplifies financial management, offering a range of features that help businesses stay organized, compliant, and efficient.

Key Features of Giddh:

1. Automated GST Compliance

Navigating GST regulations can be overwhelming for small business bookkeeping software, but Giddh makes it easy. The software automatically updates GST rates, ensuring your filings are accurate and submitted on time.

-

Automated GST returns and e-filing: No more manual calculations, reducing errors and saving valuable time.

-

GST Reports: Obtain precise reports for GST returns that can be filed with ease and accuracy.

2. Smart Mobile Accounting App

Giddh offers a mobile accounting app, allowing you to manage your business finances from anywhere. Whether you’re at a client meeting or working remotely, you have full access to your accounts.

-

Track transactions in real time.

-

Manage invoices, expenses, and reports on the go, giving you complete control wherever you are.

3. Smart Inventory Management

For businesses that manage products or stock, inventory tracking is crucial. Giddh’s Smart Inventory Management feature streamlines this process, making it easier to track stock levels and manage orders.

-

Real-time tracking of inventory items.

-

Automatic stock updates when sales are made, helping prevent overstocking or stockouts.

4. Accurate Financial Reports

Giddh automatically generates detailed financial reports, giving you a clear view of your business's performance. These reports help you make informed decisions based on real-time data.

-

Profit and Loss Statements, Balance Sheets, Cash Flow Statements, and more—automatically created for you.

-

Easily assess business performance and plan for future growth.

5. Simplified Client Interactions and Billing

Giddh streamlines invoicing, billing, and client communication, making it easier to maintain professional relationships.

-

Create customized invoices with ease, and send them directly to clients via email.

-

Track payments and manage overdue invoices to improve cash flow management.

6. Ledger-Based Accounting

Giddh offers a comprehensive, ledger-based accounting system that enables you to track all your financial transactions in one place.

-

Maintain accurate ledgers for every account, be it assets, liabilities, or expenses.

-

Quick access to past transactions for auditing and reporting purposes.

Why Choose Giddh for Your Business?

With Giddh, managing finances becomes a simplified process that saves time and reduces errors. The platform is fully GST compliance, ensuring timely and accurate filings without the stress. Its cloud-based design makes it easy to access your business's financial data from anywhere at any time, allowing for seamless tracking and reporting.

Moreover, Giddh grows with your business. Whether you're just starting or scaling up, the software adapts to your needs and continues to support you with its scalable features.

Conclusion

Switching to cloud bookkeeping offers small business owners significant advantages. By moving away from manual methods, you can save time, reduce errors, and make more informed decisions that drive growth. Bookkeeping software for small businesses streamlines processes like invoicing, financial reporting, and tax compliance, ensuring accuracy and efficiency across the board.

The time saved on administrative tasks allows you to focus on what matters most: growing your business. Automated features eliminate the risk of human error, and real-time insights give you a clearer picture of your financial health, helping you plan for the future.

Now is the perfect time to make the change. Don’t let outdated methods hold you back. Discover how Giddh helps you manage your finances more efficiently, save time, and stay compliant.

Sign up for a free trial today and experience the benefits of cloud bookkeeping for your business.

FAQs

1. What is the best bookkeeping software for small businesses in India?

The best bookkeeping software for small businesses in India is one that offers ease of use, automated GST compliance, and real-time financial insights. Giddh is a top choice, offering these features alongside mobile accessibility, intelligent inventory management, and accurate financial reporting to help small businesses thrive.

2. Is cloud bookkeeping safe?

Yes, cloud bookkeeping is safe. Leading cloud accounting platforms, such as Giddh, utilize robust encryption and secure servers to safeguard your financial data. Automatic backups ensure your records are safe from hardware failures or cyber threats.

3. How much does bookkeeping software cost for small businesses?

The cost of bookkeeping software for small businesses varies depending on the features and the company's size. Entry-level solutions can start as low as ₹500-₹1,500 per month, while more advanced software with additional features may cost ₹2,000 or more per month. Giddh offers affordable plans designed to suit small businesses in India.

4. Can bookkeeping software help with GST filing in India?

Yes, bookkeeping software for small businesses in India can automate GST filing. Platforms like Giddh ensure that your GST returns are accurate and timely by automatically calculating taxes and generating GST-compliant reports.