The Hidden ROI of Cloud-Based Accounting Software for Growing Companies

TL;DR — Cloud-based accounting software provides growing businesses with a competitive edge by enhancing financial accuracy, saving time, and reducing operational costs. For companies in India and beyond, leveraging cloud solutions can simplify compliance, streamline multi-entity management, and support scalable growth. In this blog, we delve into the hidden ROI of cloud-based accounting, discuss its benefits, and share insights on how businesses can find the best solution tailored to their unique needs. |

As businesses strive to scale, traditional accounting systems often become a bottleneck. In fact, a recent report by Markets and Markets predicts that the global cloud accounting market will grow from $5.7 billion in 2020 to over $11.8 billion by 2025.

But what does this mean for growing businesses? It highlights the undeniable shift towards cloud-based accounting solutions. Companies worldwide, including those in India, are increasingly adopting cloud-based accounting tools to replace outdated methods. Why? The need for efficiency, real-time insights, and cost-effective scalability is now more critical than ever.

Are you ready to enhance your financial management with a more innovative and scalable solution? Let’s dive deeper into the benefits of cloud based accounting software and how it can provide a hidden ROI for your business.

The Hidden ROI of Cloud-Based Accounting Software:

Growing companies are facing increasing complexity in their financial operations. As businesses scale, they often find themselves burdened by outdated systems that fail to keep up with their evolving needs.

Traditional accounting software or manual accounting methods can lead to errors, inefficiencies, and a lack of real-time visibility into financial health. Enter cloud-based accounting software, an advanced solution that promises to streamline accounting processes, enhance scalability, and provide valuable insights to drive business growth.

How Cloud-Based Accounting Software Helps Growing Businesses

Cloud based accounting software offers a comprehensive suite of tools that automate financial tasks, ensuring greater accuracy, faster processing, and simplified collaboration. The key benefits include:

-

Real-Time Financial Data: Cloud-based solutions provide businesses with instant access to real-time financial information, enabling faster decision-making and more accurate financial forecasting.

-

Automated Processes: Manual accounting tasks such as invoicing, reconciliation, and financial reporting are automated, saving businesses time and reducing human error.

-

Scalability: Cloud solutions can easily scale with your business, adapting to new locations, entities, or even expanded financial complexity as you grow.

-

Improved Collaboration: Teams can access the same data remotely, enabling seamless collaboration and reducing silos in financial operations.

The Financial ROI of Cloud-Based Accounting Software

While the benefits of cloud-based accounting are evident, what about the return on investment (ROI)? It’s often the hidden advantages that truly make cloud solutions a game-changer for growing businesses. Here are the key areas where cloud-based accounting software provides a tangible ROI:

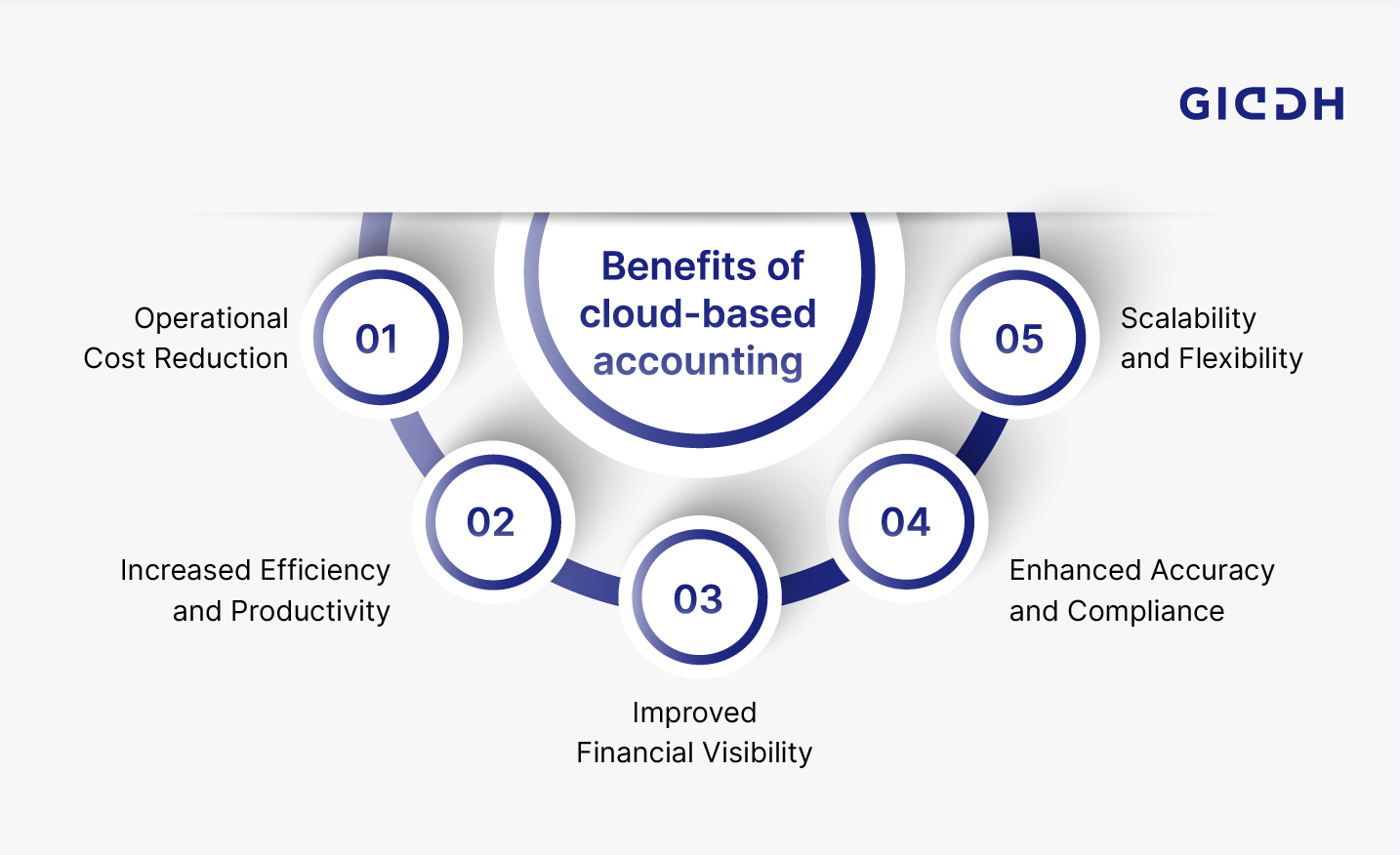

1. Operational Cost Reduction

Cloud-based accounting software reduces operational costs by eliminating the need for expensive IT infrastructure, such as servers and dedicated hardware. With software-as-a-service (SaaS) platforms, businesses pay only for what they use, making it a cost-effective choice for growing companies.

2. Increased Efficiency and Productivity

The automation of routine tasks reduces the need for manual intervention, leading to significant time savings. According to QuickBooks, businesses can save up to 40% of their time on accounting tasks with the help of cloud accounting software. This time savings translates to increased productivity, enabling staff to focus on value-added activities, such as strategic planning.

3. Improved Financial Visibility

With cloud accounting, businesses gain a clearer, real-time view of their financial performance. This improved visibility enables business owners to make informed decisions based on accurate, up-to-date data, reducing the risk of financial mismanagement.

4. Enhanced Accuracy and Compliance

Cloud-based systems reduce the risk of human error by automating calculations and generating reports with greater accuracy. In markets like India, where tax regulations are complex and constantly evolving, these platforms enable businesses to stay compliant with GST and other rules, thereby minimizing the risk of costly penalties.

5. Scalability and Flexibility

As businesses expand, their financial operations become more complex. Cloud-based accounting software can easily scale to accommodate growing needs, whether it's adding more users, managing additional entities, or expanding into new regions. This scalability makes it an ideal solution for businesses with long-term growth goals.

Choosing the Best Cloud-Based Accounting Software

When evaluating cloud-based accounting software, businesses must consider several key factors to ensure they select the most suitable solution. Here’s what to look for:

1. Ease of Use

The software should be intuitive, user-friendly, and require minimal training to get started. A steep learning curve can slow down adoption, so look for solutions with a simple interface and easy navigation.

2. Integration Capabilities

Your cloud accounting solution should integrate seamlessly with other business tools, such as CRM, payroll, and inventory management systems. Integration helps ensure a smooth flow of data between departments and reduces the risk of data entry errors.

3. Security and Compliance

Data security is a top concern for businesses handling sensitive financial information. Ensure the software utilizes encryption and incorporates robust security features to protect against potential breaches. Additionally, check whether the software is compliant with local tax regulations, such as GST filing in India.

4. Customer Support and Training

Look for software providers that offer excellent customer support, comprehensive training materials, and valuable resources to help your team maximize the platform's potential.

5. Pricing

Cloud-based accounting software should offer transparent pricing that aligns with your budget and financial needs. Many platforms provide tiered pricing models based on the size of your business or the features you require.

Top Cloud-Based Accounting Software Options in India

As businesses in India continue to grow, adopting cloud-based accounting software has become a strategic choice for streamlining financial management. These tools provide real-time data, enhanced accuracy, and scalability, making them an ideal fit for businesses seeking efficiency and growth.

Below are the top 5 cloud-based accounting software options available in India, including an in-depth look at Giddh, one of the leading solutions for businesses in the region.

Giddh:

Giddh is a cloud-based accounting software designed specifically for Indian businesses, offering a wide range of features to simplify financial management. It is ideal for small to medium-sized businesses that need scalable solutions for managing finances across multiple entities or locations.

Features:

-

GST Compliance: Automatically generates GST-compliant invoices and facilitates easy filing of GST returns.

-

Multi-Entity Support: Manage multiple companies and branches from a single account, with separate accounting and reporting for each entity.

-

Real-Time Financial Insights: Access your financial data and reports in real-time, enabling better decision-making and enhanced financial visibility.

-

Bank Reconciliation: Simplified bank reconciliation to ensure all transactions are aligned with bank statements.

-

User-Friendly Interface: The platform is designed to be intuitive and straightforward, requiring minimal accounting knowledge to get started.

Benefits of Use:

-

Time Savings: Automated processes, such as invoicing, GST filing, and reconciliation, save businesses hours of manual work each month.

-

Scalability: Whether you’re managing a single entity or multiple branches, Giddh grows with your business.

-

Better Decision-Making: Real-time reporting and financial visibility enable decision-makers to stay informed about their financial health and performance.

-

Compliance Assurance: Stay updated with the latest tax regulations in India, ensuring smooth compliance with GST and other financial requirements.

-

Cost-Effective: Unlike traditional accounting software, Giddh offers flexible pricing with no hidden costs, making it a budget-friendly choice for growing businesses.

Tally Prime

Tally Prime is one of India’s most popular accounting software solutions, known for its ease of use and comprehensive features. It helps businesses manage their finances, inventory, sales, and GST compliance from a centralized platform.

Features:

-

GST Integration: Automated GST invoicing and return filing.

-

Inventory Management: Track stock levels, sales, and purchases to ensure optimal inventory management.

-

Multi-Currency Support: Tally Prime allows businesses to manage financial accounting in multiple currencies.

-

Customizable Reports: Generate a variety of reports tailored to your business needs.

-

Security: Tally Prime ensures your data is protected with multiple layers of security and user permissions.

Benefits of Use:

-

Comprehensive Financial Management: Handle all aspects of your financial operations in one place.

-

GST Compliance Made Easy: Simplified GST return filing and invoicing ensure that businesses remain compliant with tax regulations.

-

Intuitive Interface: Easy to use, even for non-accountants, reducing the learning curve for new users.

-

Real-Time Reporting: Track your business’s financial health with real-time updates on sales, expenses, and profits.

Zoho Books

Zoho Books is a cloud-based accounting software designed for small to medium-sized businesses. It offers an extensive range of features, including online invoicing, expense tracking, and tax management. Zoho Books also integrates seamlessly with other Zoho apps, making it an excellent choice for businesses already using Zoho’s ecosystem.

Features:

-

GST-Ready: The software is GST-compliant and automatically generates GST returns.

-

Invoice Management: Create professional invoices and automatically send them to clients.

-

Expense Tracking: Track business expenses, categorize them, and generate detailed expense reports.

-

Bank Reconciliation: Automatically reconcile bank transactions with your financial records.

-

Project Accounting: Track expenses and time on projects, helping businesses manage profitability.

Benefits of Use:

-

GST Compliance: Zoho Books streamlines GST reporting, enabling businesses to stay compliant with ease.

-

Seamless Integrations: Integrates with other Zoho products (such as Zoho CRM and Zoho Inventory), making it an excellent choice for businesses already in the Zoho ecosystem.

-

User-Friendly Interface: The software features an intuitive and easy-to-use interface, making it accessible to users with minimal accounting experience.

-

Real-Time Collaboration: Collaborate with your team in real-time, reducing delays and increasing efficiency.

QuickBooks Online

QuickBooks Online is a globally recognized cloud-based accounting software that offers an array of features suitable for businesses of all sizes. It is especially popular among small to medium-sized businesses due to its ease of use and scalability.

Features:

-

Multi-User Access: Allows multiple users to access the software simultaneously, making it ideal for team collaboration.

-

Automated Invoicing: Automatically generate and send invoices to clients based on predefined templates.

-

Payroll Management: Integrated payroll tools help manage employee salaries and taxes.

-

GST Compliance: QuickBooks Online supports GST-compliant invoicing and reporting.

-

Mobile Access: Access your financial data on the go via the QuickBooks mobile app.

Benefits of Use:

-

Efficiency and Accuracy: Automates key accounting processes, reducing the chances of error and improving productivity.

-

Ease of Use: QuickBooks Online is renowned for its user-friendly interface and straightforward setup process, making it ideal for non-accountants.

-

Global Reach: Whether you’re working in multiple countries or managing multi-currency transactions, QuickBooks makes it easy to handle.

-

Mobile Access: Stay on top of your finances wherever you are with QuickBooks’ mobile app.

Xero

Xero is a cloud-based accounting software that provides powerful tools for managing finances and streamlining accounting workflows. It is beneficial for businesses with complex accounting needs and those requiring scalability.

Features:

-

Real-Time Collaboration: Enables multiple users to collaborate on the same financial data in real-time.

-

Bank Reconciliation: Automatically imports bank transactions, speeding up and simplifying reconciliation.

-

Project Tracking: Track financial data for specific projects to monitor profitability.

-

Mobile App: Xero’s mobile app offers on-the-go access to all financial data and reports.

-

Multi-Currency Support: Handle transactions in multiple currencies, making it perfect for businesses with global clients or vendors.

Benefits of Use:

-

Ease of Collaboration: Multiple users can access and work on the software simultaneously, improving teamwork and efficiency.

-

Scalability: Xero scales with your business, offering features suitable for both small companies and larger enterprises.

-

Comprehensive Financial Management: Xero offers a suite of tools for managing everything from invoicing and payroll to expense tracking and reporting.

-

Cloud-Based Accessibility: Being cloud-based means you can access your financial data anytime, anywhere.

Why Cloud Accounting Software is Essential for Financial Growth in India

Cloud-based accounting software is particularly crucial for businesses in India due to the complex regulatory environment and the increasing adoption of digital business models. With cloud accounting, businesses can:

-

Ensure compliance with India’s tax laws, including GST and TDS.

-

Easily track and manage multi-currency transactions.

-

Streamline invoicing and financial reporting across multiple entities or branches.

Cloud accounting also enables businesses to scale without worrying about IT infrastructure or software limitations. As companies expand, their financial needs become more complex—cloud-based solutions can handle that growth seamlessly.

Conclusion:

Cloud based accounting software offers undeniable benefits for growing companies. From reducing operational costs to enhancing scalability and ensuring compliance with local tax laws, the ROI of cloud accounting lies in the efficiencies it delivers.

By adopting cloud-based solutions, businesses can achieve greater financial visibility, streamline processes, and make more informed decisions. As the cloud accounting market continues to grow, choosing the right software will be crucial for companies looking to stay ahead of the curve.

If you're ready to simplify your accounting processes and unlock hidden ROI, consider starting with a free demo of Giddh, a leading cloud-based accounting solution.

FAQ

1. What is cloud-based accounting software?

Cloud-based accounting software is a digital solution that enables businesses to manage their financial data and processes online. It provides real-time access to financial information, automates tasks like invoicing and reporting, and enhances collaboration across teams.

2. How does cloud-based accounting software benefit growing businesses?

It reduces operational costs, improves financial accuracy, increases productivity through automation, and offers scalability to support business growth. It also provides real-time insights, enabling faster and more informed decision-making.

3. What are the best cloud-based accounting software options in India?

Some of the best options in India include Tally Prime, Zoho Books, QuickBooks Online, and Giddh. Each offers unique features like GST compliance, multi-currency support, and seamless integration with other business tools.

4. Can cloud-based accounting software improve my business’s compliance with tax regulations?

Yes, cloud-based accounting software often includes built-in features that ensure compliance with local tax laws, such as GST in India. These features enable businesses to stay current with evolving regulations and minimize the risk of penalties.

5. How can I get started with cloud-based accounting software?

To get started, evaluate your business needs, select a software solution that meets your requirements, and begin with a free demo or trial. Most providers also offer training resources and support to help your team transition smoothly.