Top Features of Cloud-Based Bookkeeping Software to Boost Operations

Businesses are increasingly turning away from manual bookkeeping and outdated spreadsheets that slow down operations and introduce costly errors. For small and mid-sized businesses, where every decision directly impacts cash flow and growth, financial accuracy and accessibility are non-negotiable.

Cloud-based bookkeeping solutions are stepping in to fill this gap by offering automation, collaboration, and real-time reporting. But what features should you prioritize to ensure you are choosing the right platform for your business?

This blog explores the key features of cloud-based bookkeeping software and explains how they can enhance daily operations, minimize errors, and facilitate more informed business decisions and 6growth.

Why Do Businesses Need Cloud-Based Bookkeeping Solutions Today?

Manual bookkeeping wastes countless hours, creates room for human error, and makes it difficult to maintain transparency. Businesses that rely on offline systems often face:

-

Limited visibility into financial health

-

Delays in payments and reconciliations

-

Inaccurate records affecting compliance and reporting

-

Difficulty in collaboration across teams or locations

Cloud-based bookkeeping solutions resolve these challenges by:

-

Providing anytime, anywhere access to financial data

-

Automating repetitive tasks like reconciliations and invoicing

-

Enabling secure collaboration among teams and accountants

-

Offering real-time insights for strategic decisions

For small and mid-sized businesses, transitioning to a cloud system is not just a technological upgrade but a necessity for efficient scaling.

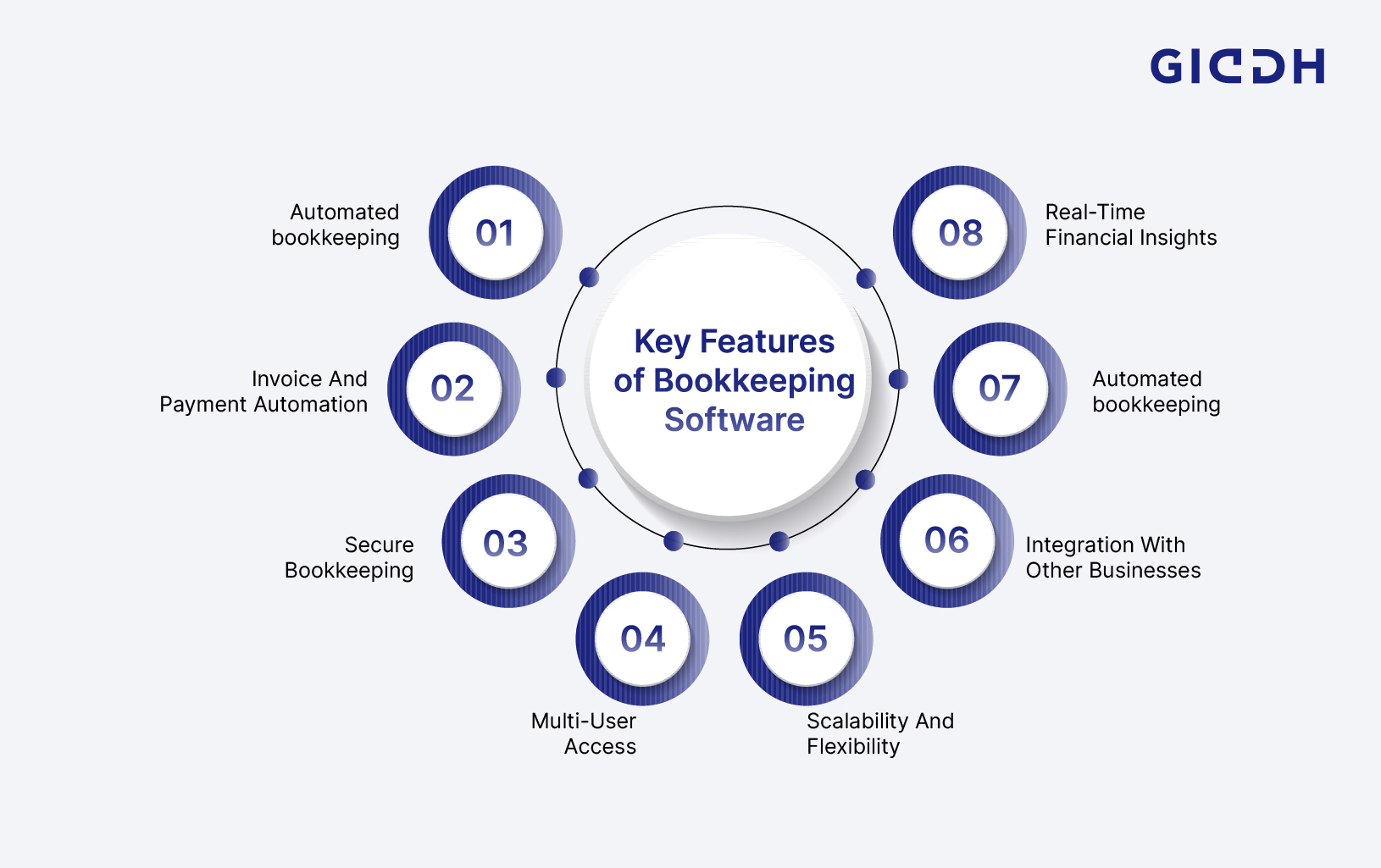

Top Features Of Cloud-Based Bookkeeping Software

Automation replaces manual entries with innovative, rule-based processes. This directly reduces the risk of errors while freeing teams to focus on higher-value activities.

Key advantages:

-

Automatic categorization of transactions

-

Error-free reconciliations with bank feeds

-

Reduced manual data entry

For small businesses with limited staff, automation can lead to fewer mistakes, faster reporting, and increased confidence in financial data.

Invoice And Payment Automation

Cash flow remains the lifeblood of any business. Delayed invoicing or slow collections can create operational bottlenecks. Invoice and payment automation solves this by:

-

Creating recurring invoices for repeat clients.

-

Sending automated payment reminders.

-

Allowing online payment options for faster collections.

This feature ensures smoother revenue cycles and reduces the time finance teams spend chasing overdue payments.

Secure Bookkeeping

Data breaches can cripple businesses, especially those handling sensitive financial records. Secure bookkeeping software provides:

-

Encrypted data storage to prevent unauthorized access.

-

Role-based permissions so only authorized users can view or edit information.

-

Compliance with financial and data protection standards.

Security not only protects sensitive data but also reassures business owners that financial records remain safe from cyber threats.

Multi-User Access

Collaboration is a growing need, especially for businesses with multiple stakeholders. Multi-user accounting access allows:

-

Real-time collaboration between accountants, managers, and teams.

-

Access control to assign roles based on responsibilities.

-

Simultaneous updates without data conflicts.

For small and mid-sized businesses, this feature ensures seamless teamwork, eliminating delays that often occur when relying on a single user for financial updates.

Scalability And Flexibility Benefits

Businesses rarely remain static. As they expand, they need bookkeeping software that grows with them. Cloud-based platforms offer:

-

Support for multi-company and multi-currency accounting operations

-

Ability to manage multiple branches under one system

-

Flexible subscription models to add users or features as required

This ensures that businesses do not need to switch systems every time they scale, protecting long-term ROI.

Integration With Other Businesses

Financial data doesn’t exist in isolation. To get a holistic view of business performance, integration becomes key. Look for software that connects with:

-

ERP systems for seamless operations

-

CRM platforms for customer insights

-

Payroll and tax filing tools for compliance

Integrations prevent duplication of work, reduce manual data entry, and provide a single source of truth for financial and operational data.

Real-Time Financial Insights

Static reports delay decision-making. Real-time dashboards and finance reporting provide instant visibility into metrics such as:

-

Cash flow position

-

Profit and loss statements

-

Outstanding receivables and payables

These insights empower managers to act quickly, whether that means adjusting budgets, optimizing expenses, or capitalizing on growth opportunities.

How Do Cloud-Based Bookkeeping Solutions Drive Overall Business Growth?

By combining automation, collaboration, and real-time reporting, businesses can:

-

Save significant hours on repetitive tasks.

-

Improve compliance and reduce risks.

-

Streamline financial operations for better efficiency.

-

Build a scalable foundation for long-term growth.

The result is not just smoother bookkeeping, but also more confident decision-making, enabling businesses to focus on revenue generation and delivering exceptional customer service.

Why Choose Giddh’s Online Bookkeeping Solutions For Businesses?

When evaluating options, Giddh stands out as one of the best cloud bookkeeping software designed for small and mid-sized businesses.

With Giddh, you get:

-

Automated bookkeeping tools that cut manual work.

-

Invoice and payment automation for faster collections.

-

Secure, role-based multi-user access.

-

Scalable cloud architecture supporting multiple companies and currencies.

-

Real-time dashboards and financial insights.

Best Practices for Maximizing Value from Your Cloud-Based Bookkeeping Solution

Adopting a cloud-based bookkeeping solution is a step toward efficiency and accuracy; however, the actual value lies in how effectively businesses implement and utilize the software. Small and mid-sized companies can maximize results by following proven best practices that go beyond basic adoption.

1. Set Clear Financial Goals

Before implementation, define what you want to achieve. This ensures your software is aligned with business needs.

-

Reduce manual bookkeeping tasks.

-

Improve cash flow tracking.

-

Enable multi-user collaboration.

-

Generate real-time financial reports.

2. Customize Dashboards and Reports

Most platforms enable businesses to customize their dashboards. Utilize this flexibility to emphasize the key metrics that matter most.

-

Cash inflows and outflows.

-

Profit and loss overview.

-

Outstanding invoices and payments.

Customized reporting enables managers to make informed, timely decisions.

3. Automate Repetitive Tasks

Leverage automation features to save time and reduce errors.

-

Set up recurring invoices.

-

Automate payment reminders.

-

Connect bank feeds for seamless reconciliations.

Automation frees up resources and improves accuracy.

4. Ensure Data Security and Access Control

Protecting financial data should be a top priority. Choose secure bookkeeping software and configure access roles.

-

Use encryption and password protection.

-

Assign role-based permissions.

-

Regularly update user access rights.

This strengthens compliance while keeping sensitive information safe.

5. Integrate with Other Businesses

Maximize value by connecting your bookkeeping solution with payroll, CRM, or tax filing systems. Integrations eliminate duplication and create a unified financial view.

-

Sync payroll for seamless salary processing.

-

Connect CRM to link customer transactions with accounts.

-

Automate tax filing to avoid manual entries.

-

Eliminate silos between financial and operational data.

6. Train Teams and Encourage Adoption

Even the best software underperforms without proper usage. Invest in training sessions and create standard practices for data entry, reconciliation, and reporting.

-

Conduct onboarding workshops for staff and accountants.

-

Create user guides for everyday tasks, such as invoicing or reconciliation.

-

Encourage regular system usage to replace manual processes.

-

Monitor adoption rates and provide refresher training as needed.

Conclusion

Business operations thrive when financial management is accurate, secure, and efficient. Manual bookkeeping cannot keep pace with the demands of modern business, leading to errors and wasted hours.

Cloud-based bookkeeping solutions provide a smarter path forward by offering automation, collaboration, and real-time insights. Features such as invoice and payment automation, secure access, and scalability ensure that businesses not only manage their finances more effectively but also position themselves for growth.

For small and mid-sized businesses, adopting the right solution is not just about technology; it’s about unlocking efficiency and clarity in every financial decision.

Platforms like Giddh make this possible by combining automation with a user-friendly design, helping businesses stay ahead in a competitive market.

FAQs

Q1. What are cloud-based bookkeeping solutions, and how do they benefit small businesses?

They store financial data online, offering automation, real-time access, and collaboration. Small businesses benefit through accuracy, reduced manual work, and improved cash flow visibility.

Q2. How does invoice and payment automation improve business operations?

It shortens billing cycles, automates reminders, and enables quicker collections, reducing delays and improving overall cash flow management.

Q3. Is secure bookkeeping software necessary for growing businesses?

Yes. Security features, such as encryption and role-based access, protect financial data and ensure compliance, making them essential for sustainable growth.

Q4. Can multiple team members access cloud-based bookkeeping software simultaneously?

Yes. Multi-user access allows accountants, managers, and teams to collaborate simultaneously without data conflicts, enhancing efficiency.

Q5. Why choose Giddh’s online bookkeeping solutions for businesses?

Giddh offers automation, secure multi-user access, invoice and payment automation, and real-time reporting, making it ideal for small and mid-sized businesses.