How Cloud Bookkeeping Improves Accuracy and Saves Time

Are you still managing your business finances with outdated, manual bookkeeping methods? If so, you’re likely spending more time than necessary and risking costly errors. But what if there was a better way to manage your accounts that saved you both time and effort while increasing accuracy?

Cloud bookkeeping software is the solution many businesses are turning to for more efficient financial management. With its ability to automate repetitive tasks, reduce human errors, and provide real-time insights, this technology can completely transform how you handle your books.

In this blog, we’ll look at how adopting cloud-based accounting tools can streamline your financial processes, boost accuracy, and free up more of your time for strategic decision-making and growth.

What is Cloud Bookkeeping Software?

Cloud bookkeeping software is a modern solution for managing a business's financial records and transactions. Unlike traditional accounting methods, which rely on manual processes or desktop-based software, cloud bookkeeping allows users to manage their finances online. This means your financial data is stored securely online, accessible from any device with an internet connection.

How It Differs from Traditional Accounting Software and Manual Bookkeeping:

-

No Physical Infrastructure: Traditional accounting often requires expensive hardware and on-site storage, whereas cloud bookkeeping relies solely on the internet.

-

Automated Processes: Manual bookkeeping involves tedious and error-prone data entry, whereas cloud software automates many tasks, thereby reducing human error.

-

Remote Access: Unlike traditional methods, cloud bookkeeping allows business owners and accountants to access real-time financial insights anytime, anywhere.

Key Features:

-

Automatic Data Syncing: Ensures that all financial data is up-to-date across multiple devices without manual intervention.

-

Cloud Storage for Secure, Accessible Financial Records: Offers safe, encrypted storage for your business's financial documents, accessible at any time, without the risk of losing critical data.

-

Real-Time Reporting and Collaboration: Provides live updates on your financial status, enabling quick decisions and seamless collaboration between teams with real-time access to reports and data.

By utilizing cloud-based bookkeeping software, businesses can achieve greater efficiency, accuracy, and flexibility in managing their finances.

How Cloud Bookkeeping Software Improves Accuracy

Cloud bookkeeping software is a game-changer when it comes to enhancing the accuracy of financial management. With its advanced features, businesses can minimize human errors and streamline the bookkeeping process, resulting in more accurate financial records and informed decision-making.

Automated Data Entry:

Cloud-based tools automate various aspects of bookkeeping, including expense categorization and invoicing. This reduces the risk of human error that often occurs during manual data entry.

-

Streamlined Processes: Automatically categorizes transactions and invoices without manual input.

-

Consistency: Ensures that data is entered consistently across different platforms, reducing discrepancies.

Error Reduction Tools:

Cloud bookkeeping software comes with built-in checks and validations that help spot mistakes before they become issues. Features like automatic reconciliations and real-time error alerts ensure accurate financial reporting.

-

Built-in Validation: Alerts users when discrepancies are detected, reducing the likelihood of errors slipping through.

-

Reconciliation Tools: Automates the reconciliation process, ensuring bank statements and financial records align correctly.

Real-Time Data Synchronization:

One of the most significant advantages of cloud bookkeeping is the ability to synchronize data in real time. This eliminates the errors that typically occur when systems are out of sync, ensuring that your financial records are always up-to-date.

-

Instant Updates: Changes made in one place are instantly reflected across all devices, ensuring consistent data across all devices.

-

Accuracy in Reporting: Real-time synchronization ensures that reports are always based on the most up-to-date data, enabling businesses to make informed decisions with confidence.

Integration with Banks and Payment Gateways:

Cloud bookkeeping software can integrate seamlessly with banks and payment gateways, significantly reducing manual data entry and the risk of errors in transaction recording.

-

Direct Sync with Banks: Automatically imports transactions from bank accounts to ensure accurate records.

-

Faster Reconciliation: Transaction data is recorded instantly, improving the efficiency and accuracy of reconciliations.

By leveraging accounting software with these capabilities, businesses can experience improved accuracy, reduce the risk of errors, and enhance overall financial management.

How Cloud Bookkeeping Saves Time

Cloud bookkeeping software is a powerful tool that helps businesses streamline their financial management, drastically reducing the time spent on routine tasks. By automating processes and offering real-time data access, companies can focus on what truly matters—growth and strategy.

Automation of Repetitive Tasks:

Cloud-based accounting tools automate numerous time-consuming tasks, including invoicing, payroll processing, and tax calculations. This saves businesses hours each week that would otherwise be spent on manual entries.

-

Automated Invoicing: Automatically generates and sends invoices, reducing administrative workload.

-

Payroll and Tax Automation: Automates calculations and ensures timely submissions, eliminating errors.

Instant Access to Financial Data:

Unlike traditional bookkeeping methods, which often require waiting for end-of-month reports or sifting through piles of paperwork, cloud bookkeeping offers instant access to financial data. Business owners and accountants can access up-to-date information at any time, from anywhere.

-

Real-Time Data Access: No more delays waiting for reports—access data in real time.

-

Mobile Accessibility: View financial details on the go from any device, whether in the office or on-site.

Collaboration and Multi-User Access:

Cloud solutions enable multi-user to work on the same set of data simultaneously, enhancing collaboration. Accountants, business owners, and other team members can all contribute without worrying about version control or data discrepancies.

-

Seamless Collaboration: Team members can access and update data without conflicts.

-

No Bottlenecks: Everyone works with the same information in real time, reducing delays and confusion.

Faster Decision-Making:

Having access to up-to-date financial information allows businesses to make faster, more informed decisions. Real-time visibility into cash flow, expenses, and profits means decisions can be based on the latest data, rather than outdated reports.

-

Instant Insights: Quickly assess financial performance and make necessary adjustments.

-

Improved Strategic Planning: With clearer financial insights, businesses can better plan for the future.

By understanding how cloud bookkeeping software can improve accuracy and save time, businesses can make quicker decisions that drive growth and profitability.

The Benefits of Using Cloud-Based Bookkeeping for Small Businesses

Cloud bookkeeping software offers numerous advantages, making it an essential tool for small businesses. From cost savings to enhanced security, these solutions are designed to support growth and streamline financial management.

Cost-Effective:

One of the primary benefits of cloud-based bookkeeping is its lower initial investment compared to traditional software solutions. There’s no need for expensive hardware or on-site servers, as everything is hosted in the cloud.

-

Lower Upfront Costs: No need to purchase costly infrastructure or licenses.

-

Subscription-Based Pricing: Pay only for what you use, with scalable plans that fit your budget.

Scalability for Growing Businesses:

Cloud solutions are designed to grow with your business. As small business accounting expands, it often requires more advanced features or additional users. Cloud bookkeeping software provides the flexibility to scale without requiring significant infrastructure changes.

-

Adaptability: Easily upgrade your plan as your business needs evolve.

-

Multi-User Support: As your team grows, multiple users can access and collaborate on the same data.

Security and Data Protection:

Security is a top priority when it comes to financial data. Online bookkeeping solutions utilize advanced encryption techniques and secure data storage to safeguard sensitive information, ensuring it remains protected from unauthorized access or data breaches.

-

Data Encryption: All your financial records are encrypted for maximum security.

-

Automatic Backups: Cloud-based systems automatically back up data, protecting against loss due to hardware failures or human error.

Access to Advanced Features:

Cloud solutions offer businesses features that were previously only available to large enterprises. This includes powerful analytics, real-time reporting, and advanced forecasting tools, helping small businesses stay competitive.

-

AI-Driven Insights: Access advanced analytics to gain insights into cash flow, expenses, and profits.

-

Comprehensive Reporting: Generate detailed financial reports quickly, without the need for complex setups.

By adopting cloud bookkeeping software, small businesses gain access to powerful tools that can streamline their financial processes while supporting future growth.

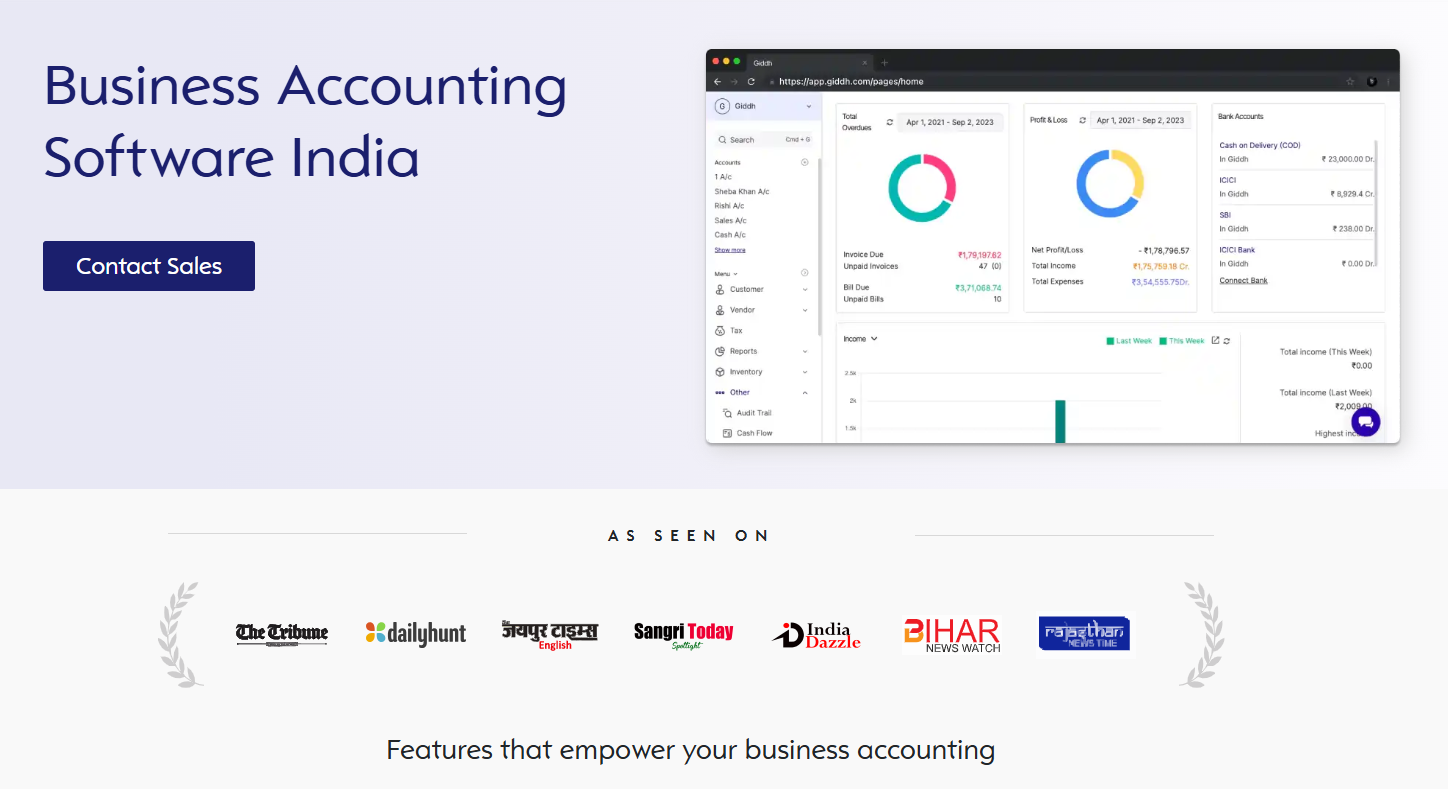

Why Giddh Is The Best Cloud-Based Bookkeeping Software For Businesses

Giddh is an ideal cloud-based accounting solution for small and medium-sized businesses in India. It simplifies bookkeeping and helps business owners, accountants, and finance teams manage their finances efficiently and accurately.

With its user-friendly features and real-time updates, Giddh enables businesses to manage their finances efficiently and effectively.

Overview of Core Benefits:

-

Improved Accuracy: With automated data entry and built-in error-checking tools, Giddh reduces the risk of human errors in your financial records.

-

Time-Saving Automation: Giddh automates time-consuming tasks such as invoicing, payroll, and tax filing, freeing up valuable time for more critical business operations.

-

Instant Access to Financial Insights: With Giddh, you can access real-time financial data from anywhere, enabling faster decision-making and better business planning.

Key Features:

-

GST Compliant: Giddh ensures that all your financial reports and invoicing comply with India’s GST requirements.

-

Smart Mobile Accounting App: Manage your finances on the go with Giddh’s intuitive mobile app.

-

Smart Inventory Management: Easily track stock levels and inventory, helping to streamline supply chain management.

-

Accurate Financial Reports: Generate precise, real-time reports to gain valuable insights into your business’s financial health.

-

Simplify Client Interactions & Billing: Easily create and send invoices, and keep track of payments with Giddh’s client-friendly features.

-

Turn Your Browser into Your Office

Work from any device securely with no installations or extra setup. -

Stay Ahead with Automatic Updates

Enjoy seamless updates with the latest features and security patches. -

Online Vs. Offline Accounting Software

Online software offers real-time collaboration and remote access, while offline tools require manual updates and local storage. -

Advantages of Cloud Accounting Software

Cloud accounting boosts efficiency with anytime access, automatic backups, and scalable growth options.

Conclusion

Cloud bookkeeping software offers significant advantages for small and medium-sized businesses, including enhanced accuracy, time savings, and improved financial management. By automating tasks such as invoicing, payroll, and tax filing it reduces the risk of human errors and allows businesses to focus on growth.

Real-time data access ensures that decisions are based on the most up-to-date financial information, thereby improving overall efficiency and effectiveness. Adopting cloud-based solutions, such as Giddh, is essential for small and medium-sized businesses seeking to remain competitive in today’s fast-paced market.

With Giddh’s powerful features, companies can make informed financial decisions, streamline processes, and scale efficiently. Whether you're looking to improve accuracy, save time, or access real-time insights, Giddh provides the tools needed for success.

Take action now by signing up for a free trial of Giddh or scheduling a demo to see how it can simplify your financial management.