How to Forecast Expenses - A Simple Guide for Better Financial Planning

How long will your cash last? It's a fundamental question that every business leader must answer. However, a simple snapshot isn't enough; you need to forecast expenses based on your plans to predict your cash flow over time. This type of financial foresight helps businesses understand their cash burn rate and plan accordingly.

While executives can control key aspects like sales, marketing strategies, and product development, the broader market ultimately determines revenue and profits. Market conditions fluctuate, impacting both micro and macroeconomic levels.

Though you can’t control the market, you can control your expenses. In this blog, we’ll focus on how to forecast expenses, an essential skill for any business seeking to maintain financial stability and grow predictably. Let’s dive in!

What is Expense Forecasting?

Expense forecasting is the process of predicting future business expenses management based on historical data, trends, and expected changes in operations. It helps companies estimate the amount of money they will spend over a specific period, such as a month, quarter, or year.

By having a clear understanding of future costs, businesses can prepare for any financial challenges and make informed decisions to keep their operations running smoothly.

There Are 2 Types of Forecasting-

| Short-Term Forecasting | Long-Term Forecasting |

|---|---|

| Estimates expenses for a period up to one year. | Looks ahead to expenses over three to five years or more. |

Focuses on immediate needs, such as payroll, utility bills, and office supplies. | Includes larger investments like equipment, R&D costs, and business expansion. |

Regularly updated to account for fluctuations in business conditions. | Requires analysis of market trends and economic conditions for accuracy. |

How To Create A Monthly Expense Forecast

Creating an accurate monthly expense forecast is essential for managing your finances effectively. Whether you're a business owner, an accountant, or someone simply managing household budgets, understanding how to forecast expenses can lead to better financial control. Here's how you can break down your monthly payments into two major categories to help you get started.

1. Fixed Costs: The Reliable Expenses

The first category to consider when forecasting expenses is fixed costs. These are the regular payments that remain the same every month or change only occasionally. Fixed costs are predictable, making them easier to track and forecast. Here are the common types of fixed expenses:

-

Utility Bills: Whether it's electricity, water, or heating, these costs remain consistent for the most part. They may fluctuate slightly based on usage, but you can estimate a general amount based on past bills.

-

Rent: For businesses or personal living situations, rent is typically a fixed monthly amount that must be paid. It’s one of the most predictable expenses in a forecast.

-

Salaries/Fees: This includes wages for employees and any regular payments to contractors. If you have a set payroll, it’s easy to predict.

-

Accounting/Bookkeeping: If you outsource accounting or bookkeeping services, the monthly fee will usually remain stable, unless there’s a change in scope or service rates.

-

Phone Bills/Communication Expenses: Monthly charges for business or personal communication services can be estimated based on previous bills, as they remain relatively stable.

-

Licensing Fees/Legal Expenses: Depending on your industry, you may have licensing renewals or require regular legal services, which necessitate ongoing payments. These are typically due annually but may be spread across monthly payments.

-

Technology Upgrades: Software subscriptions, cloud storage, or other digital tools may incur fixed costs. Although technology can change over time, most businesses pay for tools on a monthly or annual subscription basis.

-

Advertising/Marketing: Many businesses budget for monthly or quarterly advertising. These costs often remain consistent depending on the advertising strategy.

By categorizing these types of costs, you can predict and forecast expenses with confidence, knowing that they will remain relatively the same each month.

2. Variable Costs: The Costs That Fluctuate

The second category is variable costs. Unlike fixed expenses, these costs change from month to month depending on several factors, such as production levels, sales, or seasonal demands. Here are the common types of variable expenses you should consider:

-

Direct Labor Costs: This category encompasses wages and commissions for employees directly involved in sales, marketing, customer service, or production. Since this cost depends on the number of hours worked or sales made, it can fluctuate from month to month.

-

Cost of Goods Sold (COGS): This includes expenses like raw materials, supplies, and packaging. For businesses involved in production or sales, this category will change based on the volume of production or sales. If you’re a retailer, your cost will also depend on the number of units sold.

-

Marketing and Sales Expenses: Unlike regular advertising costs, these costs can vary based on the sales campaigns you run, the number of leads you generate, or other marketing strategies you implement. For instance, if you're launching a special promotion, your marketing expenses could increase for that month.

-

Shipping and Distribution Costs: If you sell physical products, shipping is another fluctuating cost. Depending on the volume of orders or the geographical reach of your customers, shipping expenses can vary significantly from month to month.

-

Miscellaneous Operational Costs: These are the costs that don’t fit neatly into the fixed or direct categories but still fluctuate. These could include office supplies, business travel, or one-off expenses related to particular projects or events.

Difference between Manual vs. Automated Forecasting:

| Manual Forecasting | Automated Forecasting |

|---|---|

Pros | |

Offers complete control over the forecasting process, allowing businesses to tailor it to their specific needs. Cost-effective for smaller businesses as it requires no investment in tools or software. | Software tools automatically update and adjust forecasts based on real-time data, reducing errors. Time-saving, enabling focus on decision-making rather than spending time on data entry. |

Cons | |

Creating and updating forecasts manually can be a time-consuming task. The likelihood of human error increases significantly when dealing with large datasets or complex expenses. Limited scalability as manual forecasting becomes less efficient and more complex to manage. | Many automated tools require an upfront investment or subscription fee. A brief learning period may be required to become comfortable with new software and its features. Automated tools can easily handle increased complexity and volume without extra effort. |

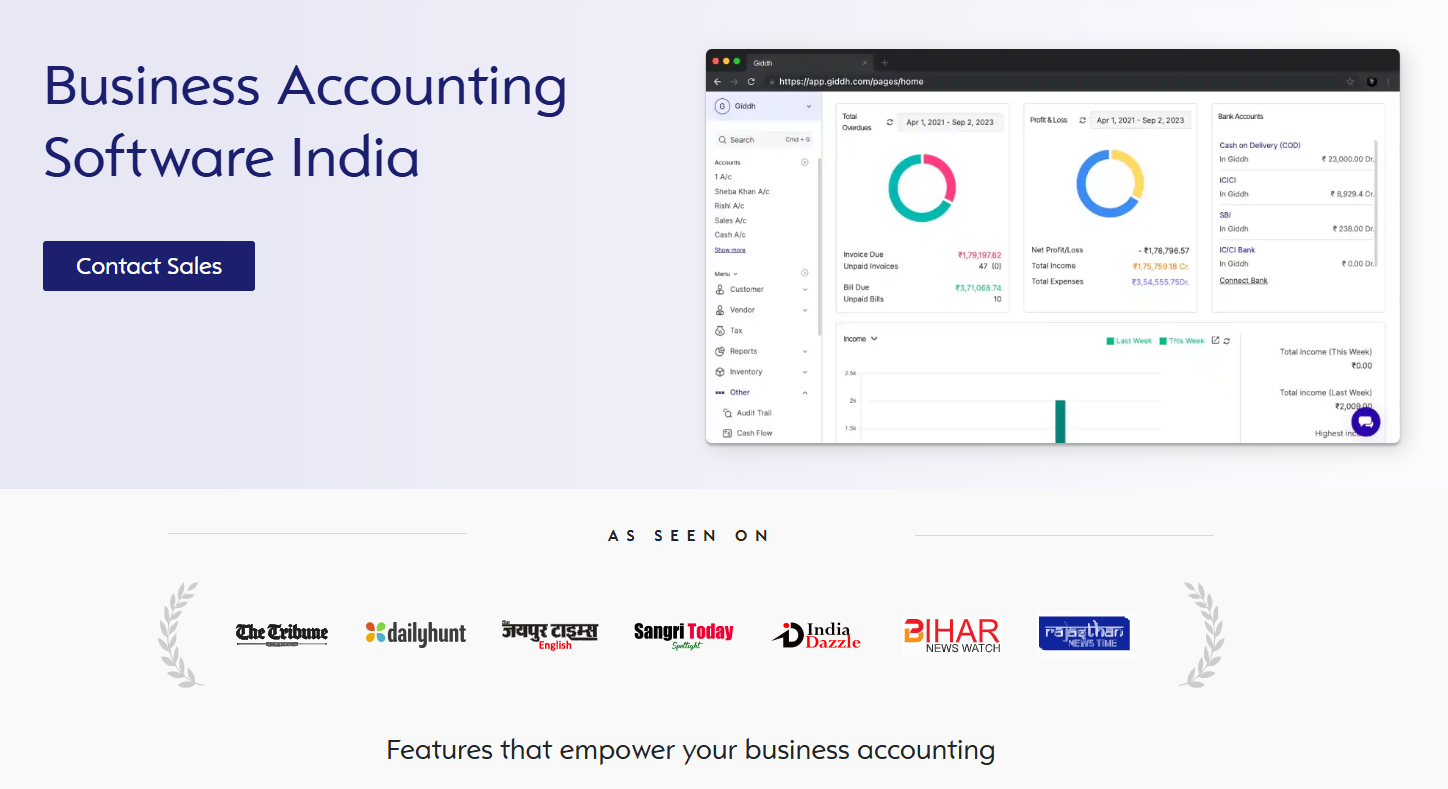

Get Accurate Forecast Expenses With Giddh

Giddh is designed to simplify expense forecasting for businesses, regardless of their size and complexity. With its easy-to-use interface, it allows you to track and forecast expenses with minimal effort and maximum accuracy.

Here’s how Giddh makes forecasting easier:

-

Based Accounting: Giddh’s based accounting system ensures that all financial transactions are automatically categorized and updated, which streamlines the expense forecasting process.

-

Multi-Currency Support: For businesses operating internationally, Giddh offers multi-currency support, enabling easy budget forecasting of expenses across different currencies with real-time conversions.

-

GST & VAT Compliance: Giddh automatically calculates and applies the correct GST and VAT rates to your transactions, ensuring that your expense forecasts align with regional tax requirements.

-

White-Label Option: For businesses that want to maintain their branding, Giddh offers a white-label solution that allows you to customize the interface for your use fully.

-

Unlimited User Access: Whether you’re a small team or a large organization, Giddh allows for unlimited user access, making collaboration and sharing of forecasting data easy across departments.

-

Manage Over 100 Companies: Giddh supports businesses that operate across multiple locations or subsidiaries, enabling you to manage expenses and forecasts for over 100 companies from a single platform.

-

Asset Management: Giddh includes asset management features, helping businesses forecast expenses related to asset depreciation and maintenance costs.

-

Inventory Management: Forecasting expenses related to inventory can be challenging, but Giddh simplifies it by integrating inventory management with expense forecasting, providing businesses with a clearer picture of their spending.

-

Bank Reconciliation: Giddh ensures that your expense forecasts align with actual bank transactions by automatically reconciling your bank statements with recorded expenses, reducing errors and discrepancies.

Things To Remember While Forecasting Expenses

1. Monitor direct sales and customer service

Ensure you track your direct sales and customer service time accurately. Include these as a direct labour expense even when you are the one doing all these activities at the start of your business. This is because when you have more clients, you will likely delegate tasks to them, which will incur additional expenses in the process.

2. Double your marketing estimates

Marketing is an activity that directly relates to getting more sales. Therefore, this activity shouldn’t be compromised. Always double your advertising and marketing estimates, as they are likely to escalate due to changing market trends, new laws, or emerging competitors.

3. Triple your legal estimates

At the start of your business, you will end up overpaying legal expenses due to a lack of experience or overwhelming information about taxes. Triple your estimates for insurance, licensing fees or any other legal expenses.

4. Get an intuitive accounting software

Ensure your fixed cost expense on the accounting ledger is worthwhile. Utilize a cloud-based accounting software, such as Giddh, that automates tasks and enables you to make realistic estimates of your finances.

We are on a mission to take sound finance and accounting practices within the layman's understanding. If you have any questions about the finance or accounting of your business, give us a call.

Final Thought:

Creating a monthly expense forecast is essential for managing finances effectively. By categorizing expenses into fixed and variable costs, you can gain a clearer picture of your financial commitments.

Fixed costs, such as rent and salaries, are predictable, whereas variable expenses, including raw materials and labour, can fluctuate from month to month. This simple categorization helps businesses stay on top of their spending and plan for both expected and unexpected expenses.

Using Giddh simplifies the process of forecasting expenses with its easy-to-use tools that ensure accuracy, reduce errors, and provide real-time financial insights. Giddh’s features, like multi-currency support, GST compliance, and asset management, make expense tracking and forecasting a breeze for businesses of all sizes.

Ready to streamline your expense forecasting? Try Giddh today and take control of your financial future with ease.

FAQs

1. Why is forecasting expenses necessary for small businesses?

Forecasting expenses enables small businesses to plan for future costs, mitigate cash flow issues, and make informed decisions. It ensures that funds are allocated effectively, helping companies to stay on track with growth and profitability.

2. What tools can help with forecasting expenses?

Tools such as accounting software, spreadsheets, and specialized financial forecasting tools can help track and accurately predict expenses. Popular tools include Giddh, QuickBooks, and Microsoft Excel.

3. What’s the difference between budgeting and forecasting?

Budgeting sets a financial plan for expenses over a period, while forecasting predicts future costs based on trends and historical data. Budgeting is fixed, while forecasting is flexible and updated on a regular basis.

4. Can accounting software help in forecasting business expenses?

Yes, accounting software like Giddh can automate expense tracking, generate forecasts, and reduce errors. These tools provide real-time insights, ensuring more accurate financial planning.

5. Why is accurate expense forecasting important?

It helps businesses allocate resources efficiently, avoid cash flow issues, and make informed strategic decisions

6. How often should expense forecasts be updated?

It's advisable to update forecasts quarterly or whenever significant changes in the business environment occur.