Financial Reporting Basics: Building the P&L and Balance Sheet Your Investors Want

Did you know that nearly 60% of investors base their decisions on the quality of financial reports? This statistic emphasizes the crucial role that financial statements, particularly the balance sheet and profit and loss (P&L) statement, play in securing investor interest.

For small and medium-sized businesses (SMBs), crafting comprehensive and transparent financial reports is more than a regulatory requirement – it’s an essential tool for growth and investment.

Yet many business owners and financial managers face challenges when building these reports to appeal to potential investors. The problem lies in presenting complex financial data clearly and accurately without overwhelming stakeholders.

This blog aims to provide practical insights into financial reporting basics, especially how to create a balance sheet and P&L statement that will impress investors. By the end, you’ll have the knowledge and tools to build reports that not only meet investor expectations but also foster trust and investment opportunities.

Ready to streamline your financial reporting? Download our free financial reporting template to start building investor-ready P&L and balance sheet reports today!

What Is a Balance Sheet?

When it comes to financial reports, the balance sheet is one of the most fundamental documents for any business. So, what exactly is a balance sheet, and why does it matter?

A balance sheet is a financial statement that summarizes a company’s assets, liabilities, and shareholders' equity at a specific point in time. It provides a snapshot of a company’s financial position and is essential for investors to understand how the business is performing.

Main Components of a Balance Sheet:

-

Assets: What the company owns (e.g., cash, accounts receivable, property, equipment).

-

Liabilities: What the company owes (e.g., loans, accounts payable).

-

Equity: The difference between assets and liabilities, representing the shareholders' stake in the company.

Real-Life Example:

Here’s a simplified version of a balance sheet for a small business:

Assets | Amount | Liabilities & Equity | Amount |

|---|---|---|---|

| Cash | $10,000 | Accounts Payable | $2,000 |

| Accounts Receivable | $5,000 | Bank Loan | $8,000 |

| Equipment | $3,000 | Equity (Owner’s Equity) | $8,000 |

Total Assets | $18,000 | Total Liabilities & Equity | $18,000 |

This balance sheet illustrates that the company’s assets equal the sum of its liabilities and equity, the foundation of financial accounting.

The Key Components of Financial Reporting

Understanding financial reporting basics is key to building strong financial statements. Financial reports help investors assess the health of your business, making them crucial for attracting investment.

The two primary financial statements are:

-

Balance Sheet – Provides a snapshot of your company’s assets, liabilities, and equity.

-

Profit and Loss (P&L) Statement – Shows the company’s revenue, expenses, and profit over a period of time (monthly, quarterly, annually).

The Importance of Accuracy and Transparency:

To win investor trust, your financial reports must be transparent and accurate. Discrepancies or inconsistencies could raise red flags. Investors need to feel confident that the data presented is a reliable reflection of the business’s financial position.

Understanding the Profit and Loss (P&L) Statement

The P&L statement, also known as the income statement, is another essential report for investors. While the balance sheet shows a snapshot of your financial position, the P&L statement provides a detailed look at your company’s profitability over time.

Key Sections of a P&L Statement:

-

Revenue: Total income from sales or services.

-

Expenses: Operating costs, such as rent, salaries, marketing, and supplies.

-

Net Profit: What’s left after subtracting expenses from revenue.

Example of a Basic P&L Statement:

Item | Amount |

|---|---|

| Revenue | $100,000 |

| Cost of Goods Sold | $50,000 |

| Gross Profit | $50,000 |

| Operating Expenses | $20,000 |

| Net Profit | $30,000 |

A strong P&L statement is crucial for demonstrating to investors that your company is profitable and has growth potential.

How to Structure Your Balance Sheet and P&L for Investors

When preparing your balance sheet and P&L statement for investors, clarity and simplicity are paramount. Investors don’t want to sift through complicated data; they need to be able to see at a glance whether your business is financially healthy. The simpler and more transparent your reports are, the more trust you’ll build with potential investors.

Format of Balance Sheet:

A typical balance sheet follows the fundamental accounting equation:

Assets = Liabilities + Equity

This formula forms the foundation of online accounting and ensures the balance sheet remains balanced. When organizing your balance sheet, the key is to present the data in a structured and logical manner. Here are some essential formatting tips:

-

Assets: List assets in order of liquidity, starting with the most liquid (cash) and ending with long-term assets like property or equipment.

-

Current Assets: Cash, accounts receivable, and inventory.

-

Non-Current Assets: Equipment, property, or intangible assets like patents.

-

-

Liabilities: List liabilities from short-term (due within a year) to long-term obligations.

-

Current Liabilities: Accounts payable, short-term loans, and other obligations due within a year.

-

Non-Current Liabilities: Long-term loans, bonds payable, and deferred tax liabilities.

-

-

Equity: This section represents the owner's stake in the business and includes retained earnings and invested capital. It's essentially what’s left over after liabilities are subtracted from assets.

A well-organized balance sheet enables investors to quickly see how much your business owns versus how much it owes. It also highlights the business's liquidity and long-term financial stability.

Formatting Your P&L Statement:

The P&L statement (or income statement) tells investors how well your business is performing over a specific period (monthly, quarterly, annually). Formatting your P&L statement clearly and effectively is crucial for giving investors a straightforward overview of your company's financial performance.

Start by breaking down your P&L statement into the following sections:

-

Revenue: The total income your business generates from sales or services during the reporting period.

- Be sure to specify if the revenue is gross revenue or net revenue, and make it clear whether discounts, returns, or allowances have been accounted for.

-

Cost of Goods Sold (COGS): This represents the direct costs of producing or acquiring the products or services you sell.

- Investors need to know how much it costs to produce the goods or services that generate your revenue.

-

Gross Profit: Subtract COGS from revenue to calculate gross profit.

- Gross profit tells investors how efficiently your business produces or acquires its products or services.

-

Operating Expenses: These are the costs not directly tied to production but necessary to run the business (e.g., salaries, rent, marketing).

- Operating expenses must be broken down into categories like selling expenses, administrative costs, and research & development. Clarity here is key.

-

Net Profit: After deducting operating expenses, you arrive at net profit (or net income), which is the true reflection of your business’s profitability.

- Investors pay close attention to net profit, which shows how much your business earns after covering all expenses, taxes, and interest.

Tip for Investors:

One of the best ways to capture investors' attention is by highlighting gross profit margin and net profit margin in your P&L statement.

-

Gross Profit Margin = (Gross Profit / Revenue) * 100

- This shows investors how much profit your business makes from sales after covering production costs. A higher gross profit margin typically indicates better control over production costs.

-

Net Profit Margin = (Net Profit / Revenue) * 100

- This ratio reflects your business's overall profitability, accounting for all expenses. Investors focus on this to evaluate how much profit the business retains from its total revenue. A high net profit margin can indicate strong operational efficiency and good management.

Additional Formatting Tips:

-

Keep it Simple: Avoid clutter in your reports. Too many unnecessary details or excessive breakdowns may confuse investors. Stick to the most important metrics that directly impact profitability.

-

Use Clear Labels: Clearly label each section of your balance sheet and P&L statement. A well-labeled and easy-to-read financial statement ensures that investors can quickly locate the information they need.

-

Consistency is Key: Ensure that your reports are formatted consistently across periods. If you use different formats each time, it can make comparisons difficult and reduce investor confidence.

By following these formatting guidelines, you can create balance sheets and P&L statements that not only convey your financial health clearly but also help investors make informed decisions quickly. Remember, the goal is to provide transparency and show investors that your business is well-managed, financially stable, and primed for growth.

Common Mistakes to Avoid in Financial Reporting

Small business owners often make several mistakes when preparing financial reports. These errors can undermine the trust of potential investors and make your company less attractive to them.

Common Mistakes Include:

-

Inaccurate Data Entry: One of the most common errors. A simple typo can mislead investors.

-

Overcomplicating the Reports: Investors appreciate clear, easy-to-read reports. Avoid clutter.

-

Failure to Categorize Items Correctly: Ensure that all expenses, assets, and liabilities are properly categorized.

For startups, financial reporting mistakes can be particularly damaging, as they may indicate a lack of attention to detail, which investors could perceive as a sign of instability.

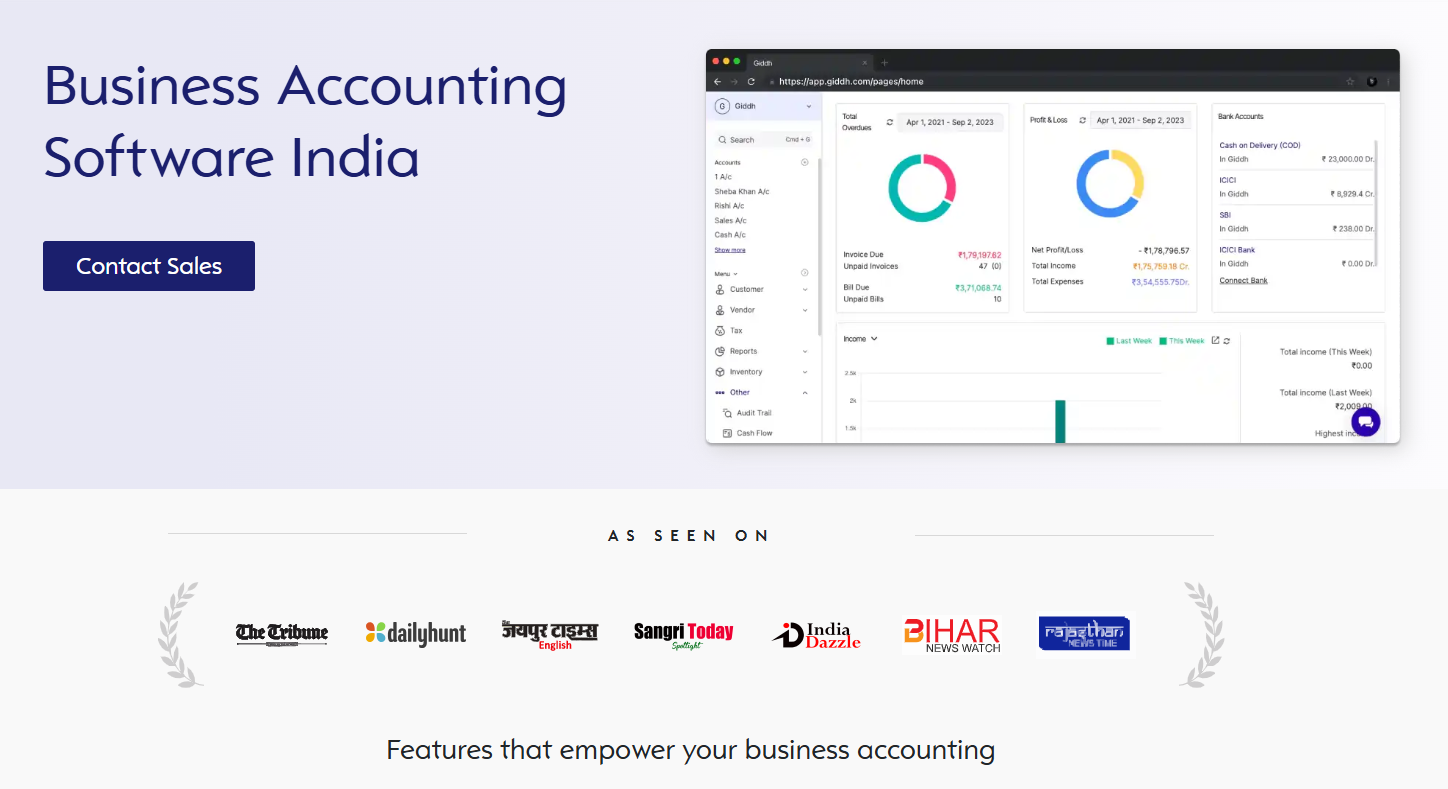

Giddh: Tools to Simplify Financial Reporting

Giddh is an automated accounting tool designed to streamline the creation of balance sheets and P&L statements, making it easier for businesses to generate accurate and professional financial reports.

Why Use Giddh?

-

Automated Reporting

Giddh automatically generates financial reports, saving you time and reducing the risk of errors. It pulls real-time data, ensuring your reports are always up-to-date.

-

Real-Time Collaboration

Collaborate with your team in real time. Giddh enables seamless communication, ensuring all reports are accurate and timely.

-

Investor-Ready Templates

Create professional and investor-friendly financial reports with ease. These templates help highlight key financial metrics investors care about.

-

Easy Data Entry & Insights

Sync your financial data automatically and gain valuable insights into your financial health. Giddh helps you understand your cash flow, profits, and more.

-

Scalable for Growth

As your business grows, Giddh scales with you. It can handle multiple currencies, business units, and more, ensuring consistent reporting as your needs evolve.

With tools like Giddh, you can ensure your financial reports are both accurate and easy to understand, saving you time and effort while impressing investors.

Conclusion

In conclusion, mastering the basics of financial reporting, particularly the balance sheet and P&L statement, is essential for business owners looking to attract investors. A well-organized balance sheet provides a clear view of your company’s financial position, while an accurate P&L statement shows your business’s profitability over time.

By understanding these reports and ensuring they are clear, concise, and transparent, you’ll improve your chances of securing investment.

Don’t forget to download our free financial reporting template to help you create investor-ready reports today. And if you're looking to streamline your financial processes, explore Giddh to simplify reporting and attract more investors.

FAQ

1. What is a balance sheet?

A balance sheet is a financial statement for startups and other companies that shows financial position at a specific point in time. It lists assets, liabilities, and equity to provide a snapshot of the business's health.

2. Why is a profit and loss statement important for investors?

A P&L statement helps investors assess a company’s profitability by showing its revenue, expenses, and net profit. It provides insight into how well the business is managing its finances.

3. How can I make my balance sheet and P&L more investor-friendly?

To make these reports appealing to investors, ensure they are clear, organized, and transparent. Avoid unnecessary complexity and focus on key metrics like gross profit margin and net profit margin.

4. What are some common mistakes to avoid in financial reporting?

Common mistakes include inaccurate data entry, overcomplicating reports, and failing to properly categorize items. Ensure your reports are simple, accurate, and up-to-date.

5. How can Giddh help with financial reporting?

Giddh simplifies the creation of balance sheets and P&L statements with automated reporting, real-time collaboration, and investor-ready templates, saving you time and ensuring accuracy.