Free Trial vs. Paid Plans: Making the Right Accounting Software Choice for SMEs

Small businesses are no longer experimenting with accounting software. They are actively replacing spreadsheets, disconnected tools, and manual bookkeeping. According to recent industry observations, over 70% of SMEs now rely on cloud-based accounting tools to manage invoicing, taxes, and reporting. The question has shifted from whether to adopt accounting software to which model makes sense financially.

Should you start with account software free, rely on a free trial, or invest directly in a paid plan?

For many SME owners, this decision determines reporting accuracy, cash flow visibility, and compliance readiness for the next few years. The wrong choice often leads to data migration pain, feature gaps, or hidden operational costs.

So how do you decide between free trials and paid plans without overpaying or underpreparing?

This guide answers that question with a practical comparison, real SME use cases, and decision frameworks designed for growing businesses.

Why SMEs Look for Account Software Free Options First

Cost pressure remains the strongest driver behind software decisions for SMEs. Early-stage businesses and lean teams often operate with limited financial buffers.

Key reasons SMEs explore free accounting software or trials:

- Uncertain transaction volumes during early growth

- No dedicated accounting team

- Need to understand workflows before committing

- Fear of long-term contracts with unclear ROI

Free access lowers the entry barrier. It allows business owners to validate usability, reporting clarity, and feature relevance without immediate financial risk.

However, free does not always mean suitable for long-term operations.

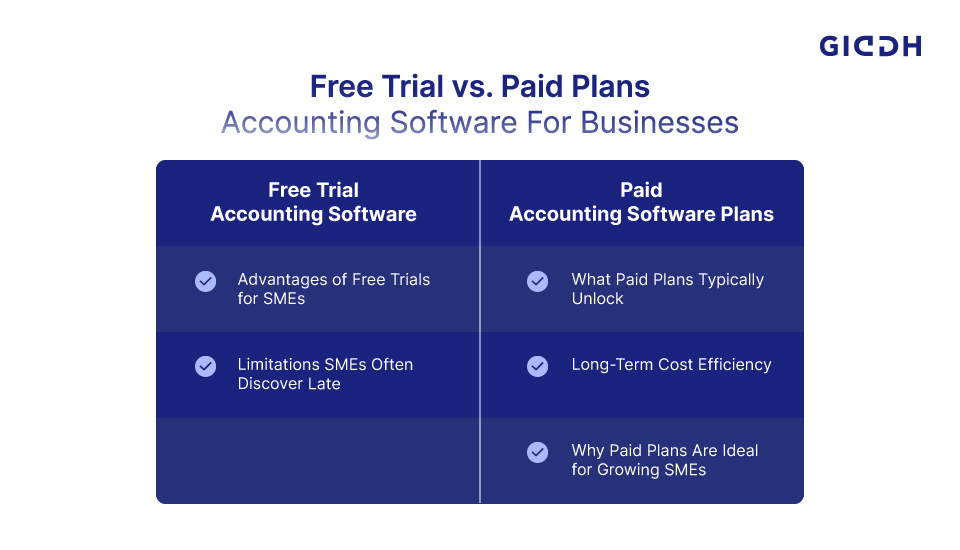

Free Trial Accounting Software: What It Offers and Where It Falls Short

A free trial differs significantly from permanently free accounting software. Trials typically provide full or near-full feature access for a limited duration, allowing businesses to assess the software’s suitability before committing to a paid plan.

Advantages of Free Trials for SMEs

Free trials offer an excellent opportunity for SMEs to explore accounting software hands-on without the risk of immediate financial commitment. Here's what SMEs can gain from using a free trial:

-

Full Access to Key Features: Free trials often unlock features like reporting, invoicing, and reconciliation, allowing businesses to assess their capabilities with real data.

-

Real-World Application: Unlike demos, free trials allow businesses to upload their own financial data and test the software in a real-world context.

-

Hands-On Experience with Dashboards & Automation: SMEs can explore how the software’s dashboards work, automate basic accounting tasks, and get a feel for its usability.

-

Better Understanding of the Learning Curve: First-time users and startups can evaluate how easy or challenging it is to navigate the software and utilize its features effectively.

For startups and first-time users, having this kind of clarity during the trial period is incredibly important, as it helps build confidence in the software’s fit for their needs.

Limitations SMEs Often Discover Late

While free trials can be instrumental, there are also some limitations that SMEs may face, which can affect their decision-making process:

-

Time Pressure to Evaluate Complex Features: Free trials often have short durations, leaving little time to explore the intricate features that may be crucial for business operations.

-

Limited Onboarding Support: Some free trials offer limited access to customer support, leaving businesses to navigate issues on their own and leading to frustration if they encounter roadblocks.

-

Risk of Rushed Decisions: The time-sensitive nature of free trials can push businesses to make hasty decisions, potentially leading to data loss or choosing the wrong software.

-

Short Trial Periods for Complex Software: Some accounting software has a steep learning curve, and a brief trial period may not be sufficient for businesses to fully evaluate its features and decide whether it meets their long-term needs.

In general, free trials work best for businesses that already have a clear understanding of their accounting needs. If an SME is unsure about the software’s capabilities or is evaluating several options, the limited timeframe can make it hard to make a confident, informed decision.

Paid Accounting Software Plans: What You Pay for Beyond Features

While paid accounting software plans are often viewed primarily through the lens of cost, they represent more than just an upfront expense. In practice, paid plans provide operational stability, increased efficiency, and long-term scalability—key factors for growing businesses. As your SME expands, the features and support offered by paid plans become essential for streamlining accounting processes and ensuring financial accuracy.

What Paid Plans Typically Unlock

Paid plans often go beyond the basic features offered by free trials, unlocking advanced functionality that directly impacts business operations. Here's what most paid accounting platforms offer:

-

Unlimited Transactions: No restrictions on the number of transactions processed, which is crucial for businesses with growing transaction volumes.

-

Advanced GST or Tax Compliance: Paid plans provide support for advanced tax features, including GST compliance, automatic tax calculations, and up-to-date regulations.

-

Automated Bank Reconciliation: Automation of bank reconciliations reduces the manual effort required to match transactions, saving time and improving accuracy.

-

Multi-User Access Controls: This feature allows different team members (e.g., financial managers, accountants) to access the system with tailored permissions, ensuring smooth collaboration while maintaining security.

-

Priority Support: Paid plans often include priority customer support, meaning businesses receive faster responses to inquiries and troubleshooting needs.

-

Data Security and Backups: Enhanced security features and regular backups help ensure your financial data is protected, reducing the risk of data breaches or loss.

These features become more important as the business grows, especially as transaction volumes increase and the need for compliance, accuracy, and operational efficiency rises.

Long-Term Cost Efficiency

While the upfront cost of a paid plan may seem higher than that of a free option, paid plans can provide significant long-term cost savings. Here are some ways paid plans help reduce indirect costs that free options cannot address:

-

Time Spent Fixing Manual Errors: Free plans often require more manual intervention, which can result in errors. Paid plans typically offer automation and advanced features that reduce the risk of mistakes and save valuable time.

-

External Accountant Dependency: With a paid plan, many accounting tasks are automated, reducing the need to rely on external accountants for basic bookkeeping and reporting. This can lead to cost savings, especially over time.

-

Compliance Penalties Due to Missed Filings: Paid accounting software ensures that tax filings, invoices, and reports are timely and compliant with legal requirements, reducing the risk of compliance-related penalties and fines.

-

Operational Delays Caused by Limited Reporting: Free plans often offer limited reporting options, which can delay decision-making when decision-makers need financial insights quickly. Paid plans provide advanced reporting tools that generate real-time insights, helping SMEs make faster, better-informed decisions.

For SMEs planning steady growth and seeking to reduce the risk of operational bottlenecks, paid plans can often reduce total costs over time. A higher initial cost can be quickly offset by the time saved, the reduced reliance on external support, and the ability to scale the business without disruptions.

Why Paid Plans Are Ideal for Growing SMEs

Paid plans are vital for SMEs with plans for steady growth or businesses facing complex accounting needs. Here’s why:

-

Scalability: As your business grows, so does the need for robust accounting tools. Paid plans can easily scale with the business, offering additional features, more users, and higher transaction limits as needed.

-

Advanced Features for Complex Operations: Growing businesses often need specialized features such as multi-currency support, advanced reporting, integration with third-party tools (e.g., CRM, payroll), and custom workflows. Paid plans are more likely to provide these advanced features.

-

Risk Reduction: With paid plans, SMEs reduce the risk of errors, non-compliance, and inefficiencies—issues that free accounting software cannot always address.

Paid accounting software plans provide much more than just features—they represent an investment in your business's operational efficiency, stability, and long-term growth. For SMEs focused on growth, having access to advanced tools and support can make all the difference.

Free Trial vs Paid Accounting Software: Side-by-Side Comparison

Decision Factor | Free Trial | Paid Plan |

|---|---|---|

Initial Cost | Zero | Monthly or annual |

Feature Access | Temporary | Full |

Scalability | Limited | High |

Compliance Support | Basic | Advanced |

Long-Term Suitability | Low | High |

This comparison highlights a clear pattern. Free trials support evaluation. Paid plans support operations.

How to Decide What Works for Your Business Stage

The right choice depends on how your business operates today and where it plans to be next year.

Choose Free Trial Accounting Software If:

- Business operations are still stabilising.

- Monthly transactions remain low.

- No immediate GST or compliance complexity.

- Software is being evaluated for the first time.

Choose Paid Accounting Software If:

- Invoicing and expense tracking are daily activities.

- Compliance requirements are non-negotiable.

- Multiple users need access.

- Real-time financial visibility matters.

Best Accounting Software for Business Growth Scenarios

Not all SMEs share the same accounting priorities. Software suitability varies by business model.

Best Accounting Software for Startups

Startups need flexibility and clarity.

Key requirements:

- Simple onboarding

- Cost control

- Scalable plans

- Clear cash flow reports

Free trials help validate fit, but paid plans often become necessary once revenue stabilises.

Best Accounting Software for Ecommerce Businesses

Ecommerce operations introduce complexity.

Important factors include:

- Inventory tracking

- Multi-channel sales reconciliation

- Tax compliance across regions

- High transaction volumes

Free software rarely supports these needs beyond early testing stages.

Best Bookkeeping Software for Small Business

Service-based SMEs and local businesses prioritise:

- Expense categorisation

- Invoicing

- Bank reconciliation

- Tax readiness

Here, long-term paid plans often deliver better value than switching between free tools.

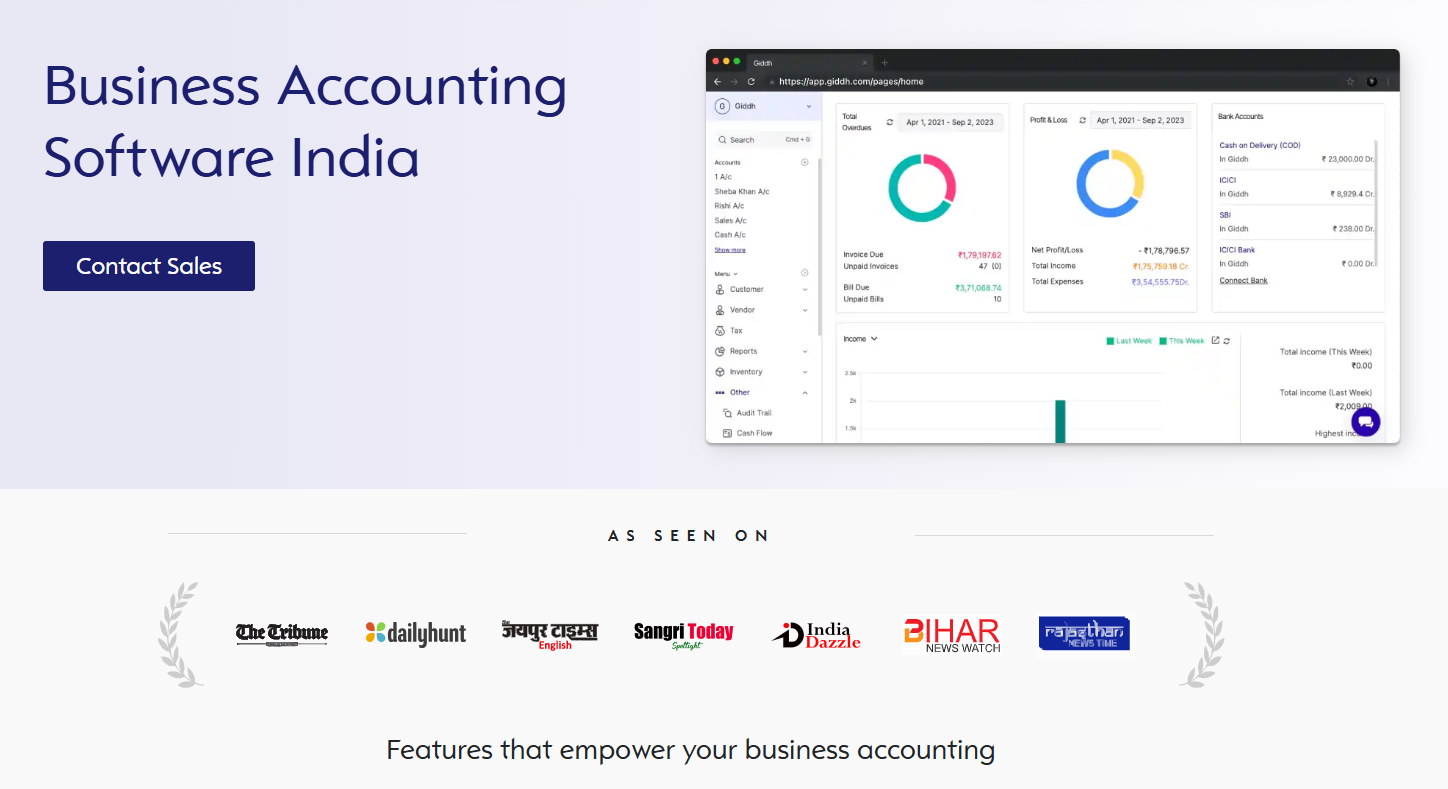

Where Giddh Fits Into the Free vs Paid Decision

Giddh addresses a common SME challenge. Businesses want to test accounting software in real conditions, but also need a clear upgrade path once operations stabilise.

Giddh provides a free trial that reflects actual business workflows, not a stripped-down demo. SMEs can record transactions, generate reports, and evaluate GST readiness using real data. This allows business owners and finance managers to assess usability, reporting accuracy, and operational fit without pressure.

As accounting requirements expand, Giddh’s paid plans scale naturally with business needs.

Key capabilities unlocked at growth stages include:

- Advanced financial reports for profit, loss, and cash flow tracking

- Multi-company and multi-branch accounting from a single dashboard

- Secure cloud access with controlled user permissions

- GST-ready workflows designed for Indian compliance requirements

- Reliable data handling for high transaction volumes

Giddh’s pricing structure is designed around business maturity rather than feature gating. SMEs are not forced into upgrades before they are operationally ready, making it easier to plan costs while maintaining financial visibility.

This balance between flexibility and long-term reliability makes Giddh a practical choice for SMEs compared to account software free trials with paid accounting solutions.

Is Best Accounting Software Free Enough for Long-Term Use?

Free accounting software works under specific conditions.

It may suit:

- Solo founders.

- Very low transaction volumes.

- Short-term bookkeeping needs.

However, limitations surface quickly as businesses grow. Missing features often lead to the use of parallel tools, manual workarounds, and reporting inconsistencies.

For most SMEs, free software acts as a stepping stone rather than a destination.

Conclusion

Free trials and paid accounting software plans serve different purposes. Free trials reduce entry risk and help SMEs understand workflows. Paid plans provide stability, compliance readiness, and operational efficiency.

The mistake many businesses make is treating free software as a long-term solution when it was designed for evaluation. Others commit to paid tools too early without understanding the relevance of features.

The right approach combines clarity and timing. Start a free trial if needed. Move to a paid plan once accounting becomes central to daily operations.

Accounting software should simplify decisions, not complicate them. Choosing the right model ensures financial clarity, compliance confidence, and room to grow without friction.

FAQs

1. Is account software free suitable for small businesses?

Free accounting software works for very small operations with low transaction volumes. As complexity increases, paid plans become more reliable.

2. What is the main benefit of using a free trial instead of free accounting software?

Free trials provide access to full features, allowing a realistic evaluation before committing financially.

3. How long should SMEs test accounting software before upgrading?

Two to four weeks is usually sufficient to assess usability, reporting quality, and workflow fit.

4. Which businesses benefit most from paid accounting software?

SMEs with recurring invoicing, compliance requirements, inventory, or multiple users gain the most value.

5. Does free accounting software support GST compliance?

Most free tools offer limited or no GST support. Paid plans are better suited for compliance-heavy environments.