How to Get Paid Faster Smart Invoicing Tips for Small Businesses

Today, we discuss a simple yet effective way technology can help business owners stay on top of their invoicing and minimize payment issues.

You render a service or sell a product to your clients. Then you get paid for the service or product you served. In an overly simplified way, that’s the definition of a business.

But what if your customers take their sweet time deciding how to get paid? What if the most crucial aspect of any business, getting paid, is

You need cash now. Cash flow is essential to every business. As discussed in last week's post, healthy cash flow is the fuel that keeps a business afloat, functioning properly, and operating effectively.

However, as a business owner, if the flow of cash gets clogged because of slow-paying clients, one soon comes to a realization — the quicker they can get payments, the better.

But how do you make that happen? While you can’t force your clients to pay you faster, there are a few hacks you can apply and a few strategies you can put into place to make it easier for your clients to pay you back.

So, where do you begin? By using one or more of the following tactics, you can help motivate your clients to pay on time:

Tips for Quick Payments

Set up an invoicing system and send invoices sooner.

Well, this might sound obvious, but business owners often lag behind their own invoicing.

This happens because they either lack an effective invoicing system in place, are overwhelmed by excessive work, or are simply forgetful.

Even I, in my freelancing days as a content writer, sometimes forgot to invoice my clients.

Invoicing a client shouldn’t be a dreaded task; you shouldn't stall until the end of a month or even something you feel you need to spend much time on.

I suggest you rely on the best invoicing solution that lets you breeze through the whole process, leaving you more time to take on new clients, projects, or ventures (or to kick back and relax now and again).

You should start by looking for a solution with the following features:

- Customizable GST-compliant invoice templates that will make your invoice appear more professional.

- The ability to send invoices from any device, anywhere, anytime, with the help of an active internet connection.

With an effective invoice system in place, you'll find it easier to stay on top of your invoicing. As soon as your client accepts the work is final, send an invoice. It’s more likely that the sooner you send an invoice, the sooner you will receive your due payment.

Set up Automatic Invoicing

If you provide a monthly service and invoice clients the same amount regularly, consider an invoicing solution that helps you send recurring invoices automatically.

Let’s consider a common scenario.

You are a business owner with a customer who purchases Rs. 25,000 worth of your product every month.

Now, you can either manually prepare an invoice by adding all the details and then send it every month.

Or, take an easier, much faster, and efficient route. You simply use an invoicing solution that supports recurring billing, prepare one invoice for the transaction as mentioned earlier, and automate its regular sending to the customer.

Just think about all the time you can save by automating multiple invoices to your customers.

Now that we have discussed implementing an invoice system and setting up automatic invoices for clients, let’s move on to the third most crucial aspect: getting paid.

Set Up an Easy Payment Strategy

Because the easier it is to pay you, the quicker you will get paid.

People are more likely to complete a task when it’s glaring and easy. And this applies to both getting paid and paying back.

If you’re limiting payment options to methods that take more effort, you’re less likely to have your client pay your invoice promptly. In this highly competitive business landscape, your customers will always have better options for where to take their business.

If your customers or clients encounter difficulties when trying to pay you, they will start to consider taking their business elsewhere.

To avoid such issues, enable multiple payment options to cater to all types of customers, whether tech-savvy or traditional.

You can achieve this by adopting cloud-based accounting platforms. Several accounting platforms offer invoicing features that enable you to provide multiple payment options, including net banking, credit/debit card, and the option to integrate a payment gateway of your choice, making the payment process seamless and hassle-free.

Let’s move to the final aspect of an effective invoicing strategy — follow-ups.

Set Your Follow-Up Strategies

In an ideal world, all services and products would be delivered promptly, and invoices would be paid within minutes.

Unfortunately, it’s not an ideal world we are living in. The truth of the matter is that invoices can typically take anywhere from two to eight weeks to get paid, and that can be a fairly long wait for a small business — remember, as discussed, it’s all about cash flow. This is why every business owner needs to have a follow-up strategy for their invoices.

Business owners should consider using an invoicing platform like Giddh, which enables them to identify outstanding invoices through an aging report. This report provides a comprehensive list of clients who have missed payments, along with the associated amounts.

Additionally, these online invoicing and accounting platforms offer features that send automatic payment reminders to customers if they haven’t paid by the due date.

How Giddh Can Help You Get Paid Faster

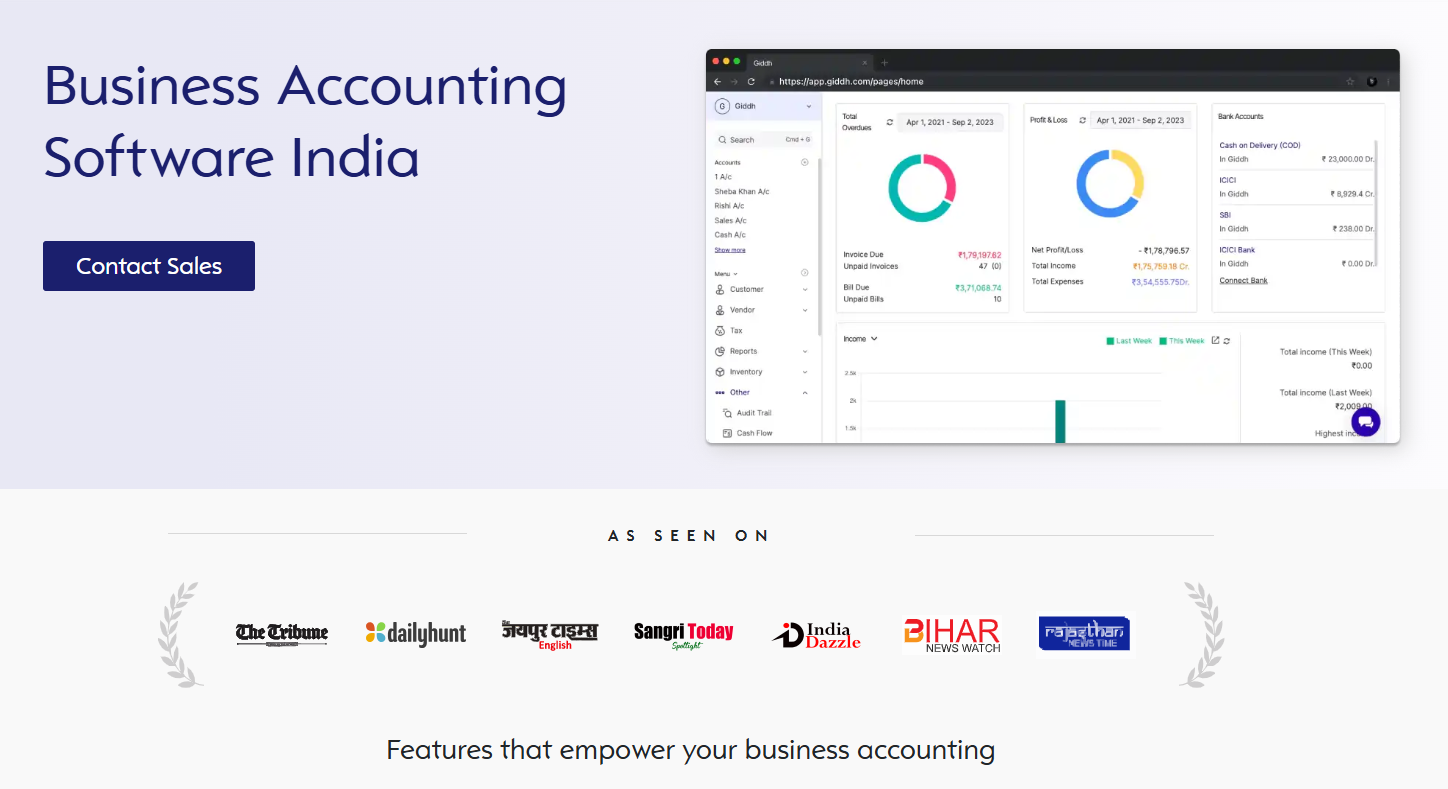

Giddh is an innovative cloud-based accounting and invoicing platform designed to help business owners streamline their financial processes. With its intuitive interface and robust features, Giddh enables businesses to simplify invoicing and facilitate faster payments by integrating multiple payment solutions and providing insightful financial reports.

Features of Giddh:

-

Customizable Invoices: Giddh allows businesses to create professional, branded invoices that are GST-compliant. These customizable templates help businesses present a polished, professional image to clients, which can encourage quicker payments.

-

Automatic Invoice Generation: For businesses with recurring clients, Giddh’s automation tools ensure that invoices are generated and sent at regular intervals without the need for manual intervention. This reduces human error and ensures timely invoicing.

-

Payment Integration: Giddh integrates multiple payment methods, including bank transfers, credit/debit cards, and even payment gateways. This provides clients with a range of convenient options for paying invoices quickly, thereby increasing the likelihood of timely payment.

-

Aging Reports & Follow-Up Reminders: One of the most powerful features of Giddh is its aging report, which helps business owners easily identify overdue invoices. Additionally, automatic reminders can be sent to clients who haven’t paid on time, helping to ensure a more efficient follow-up process.

-

Real-Time Tracking & Analytics: Giddh offers real-time tracking of payments and provides insightful analytics on cash flow, helping business owners make informed decisions about their financial health. This transparency allows businesses to predict payment patterns and address potential issues proactively.

Conclusion

Most importantly, it should be acknowledged that most slow-paying clients aren’t trying to be malicious.

They understand that there are two sides to every business transaction and are willing to pay you for the services you rendered and products you sold. But when a process is complex and uncomfortable, the result is usually avoidance.

So if you want to be paid faster, it all boils down to making invoicing and payment as painless and straightforward as possible for both you and your clients. Once that’s achieved with the help of the right technology tools, the money will flow just as quickly and easily.