Reverse Charge Mechanism (RCM) in GST: When & How It Applies to Your Business

India's Goods and Services Tax (GST) system is designed to simplify taxation, but its complexity often leaves businesses grappling with certain provisions. Among these, the Reverse Charge Mechanism (RCM) stands out as a common pain point. According to recent statistics, nearly 10% of businesses in India report confusion over RCM, which can lead to compliance errors and even penalties.

So, what exactly is RCM, and why should businesses be concerned about it? The Reverse Charge Mechanism shifts the responsibility of paying tax from the supplier to the recipient of goods or services. This means businesses need to be proactive in identifying situations where RCM applies.

Understanding when and how RCM applies to your business is crucial not just for compliance but also for optimizing tax payment processes. In this blog, we’ll explore the essentials of RCM under GST—when it applies, how to calculate and pay it, and how businesses can avoid common mistakes.

What is Reverse Charge Mechanism (RCM) in GST?

The Reverse Charge Mechanism in GST system requires the recipient of goods or services (instead of the supplier) to pay the applicable GST. In a typical transaction, the supplier collects GST from the recipient and remits it to the government. However, under RCM, the burden of tax payment is reversed.

In RCM transactions, the recipient becomes liable for paying the tax. The supplier does not charge or collect GST; the recipient pays it directly to the government.

Real-World Example

Imagine a business that hires legal services from a lawyer who is not registered under GST. In this case, the business, not the lawyer, is responsible for paying the GST on the legal services, even though the lawyer is providing the service. This is an example of RCM.

Why Businesses Need to Understand RCM

Failing to understand when RCM applies can result in non-compliance, leading to penalties, fines, or unwanted audits. Properly implementing RCM helps businesses avoid these issues and ensures compliance with the GST legal framework.

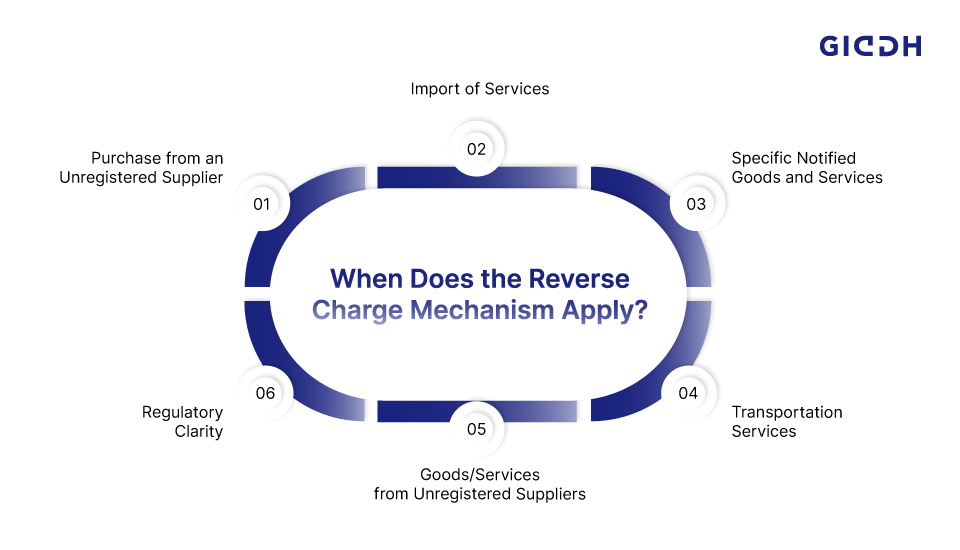

When Does the Reverse Charge Mechanism Apply?

The Reverse Charge Mechanism (RCM) does not apply to every transaction. It only applies in specific situations as defined by the GST Act. Understanding when RCM applies is crucial to ensure compliance. Below are the main scenarios in which businesses account for RCM:

Purchase from an Unregistered Supplier

When a business buys goods or services from a supplier who is not registered under GST, the recipient (the buyer) is required to pay the GST under RCM.

-

Why It Applies:

If the supplier is unregistered, the government shifts the responsibility of tax payment to the buyer to ensure tax collection. -

Example:

A manufacturer purchasing raw materials from a supplier who isn’t registered under GST must pay the tax instead of the supplier.

Import of Services

If a business imports services from outside India, the recipient of those services is responsible for paying the GST under RCM.

-

Why It Applies:

Since the service provider is located outside India and there is no direct GST collection mechanism in place for foreign entities, the recipient is liable to ensure the payment of GST. -

Example:

A company hiring an overseas consultant for services would need to pay the GST on the imported service under RCM.

Specific Notified Goods and Services

Certain goods and services are specifically notified under the GST law where RCM applies, even if the supplier is GST-compliant.

Legal Services:

Services provided by a lawyer or legal firm are often subject to RCM.

-

Why it Applies:

The legal services sector is one of the areas where RCM is implemented due to its high value and specialized nature. -

Example:

A business hiring a law firm for corporate legal services must pay the GST under RCM.

Transportation Services:

Goods transport services, including freight services, are subject to RCM under certain conditions.

-

Why it Applies:

The government applies RCM on goods transport services in certain situations to streamline tax collection. -

Example:

A business using the services of a freight company to transport goods must pay the GST directly to the government.

Goods/Services from Unregistered Suppliers:

If the supplier of goods or services is unregistered under GST, the buyer must account for RCM.

-

Why it Applies:

This prevents tax evasion by unregistered suppliers who don’t collect GST on taxable goods or services. -

Example:

Purchasing raw materials or components from an unregistered vendor will trigger RCM for the buyer.

Regulatory Clarity

Under Section 9(3) and Section 9(4) of the GST Act, the situations where RCM applies are clearly outlined. These sections also define the specific goods and services that are eligible for RCM.

-

GST Council Updates:

The list of goods and services subject to RCM is regularly updated by the GST Council, so businesses should be aware of any new notifications. -

How to Stay Compliant:

It’s essential for businesses to monitor official GST notifications, as the rules around RCM can change, impacting their tax obligations.

How to Calculate and Pay GST Under Reverse Charge Mechanism

Once you know when RCM applies, the next step is understanding how to calculate and pay the GST. Here is a step-by-step guide to help businesses manage RCM.

Step-by-Step Guide

Identify Taxable Goods/Services

The first step is to identify which goods or services are subject to RCM.

-

Tip:

Stay updated by reviewing notifications from the GST Council, as the list of items subject to RCM may change periodically. -

Example:

Goods such as legal and transportation services typically fall under RCM.Determine the Applicable GST Rate

Once the goods or services subject to RCM are identified, determine the applicable GST rate.

-

Example:

-

Legal Services: Typically attract 18% GST under RCM.

-

Freight/Transport Services: Often attract 5% GST under RCM.

Calculate GST

-

To calculate the GST, multiply the taxable value of the goods or services by the applicable GST rate.

-

Formula:

GST = Taxable Value x GST Rate -

Example:

If the taxable value of legal services is ₹50,000, and the GST rate is 18%, the GST payable would be ₹9,000.

Paying GST

The GST amount must be paid directly to the government by the recipient (buyer). This can be done on the GST portal, under the RCM section, during GST filing.

-

How to Pay:

Go to the GST portal → Navigate to the RCM section → Enter details of RCM transactions → Pay GST via available payment modes. -

Tip: Ensure that the GST payment is done on time to avoid penalties and interest.

Example:

Suppose a business purchases raw materials worth ₹50,000 from an unregistered supplier. The applicable GST rate is 18%. The business would need to pay ₹9,000 as GST under the reverse charge.

The process of managing reverse charge mechanism for GST requires careful tracking of taxable transactions. With correct record-keeping and accurate GST filings, businesses can ensure compliance.

Common Challenges and Pitfalls of Reverse Charge Mechanism

While RCM is straightforward in principle, many businesses face challenges in its application.

Challenges

-

Difficulty Identifying RCM Transactions: Determining when RCM applies can be confusing, especially for services such as legal and transport.

-

Confusion Over GST Payments: Many businesses are unsure about how to pay GST under RCM, especially when dealing with unregistered suppliers.

-

Inaccurate Reporting: Improper reporting of RCM transactions in GST returns can lead to audits and penalties.

How to Avoid Mistakes

-

Proper Documentation: Ensure that all RCM transactions are documented, including supplier invoices.

-

Consult Tax Professionals: If unsure about RCM applicability, consult with GST experts to avoid mistakes.

-

Regular Updates: Stay informed about the latest notifications and amendments to the GST Act.

Once you calculate the RCM amount, the next step is recording it correctly in your books. You need to show it as GST payable under reverse charge, even though your vendor invoice doesn’t include GST.

With Giddh, you can track these tax liabilities along with the expense entry, so your GST numbers stay accurate during monthly filing.

Giddh is a cloud-based accounting and GST billing software that helps businesses manage invoicing, expenses, GST compliance, and financial reporting from a single platform.

Key features that help with GST + RCM tracking:

-

GST-ready invoicing and purchase entry management

-

Accurate tax liability tracking (including RCM-related liabilities)

-

Expense recording with clean accounting classification

-

GST reports to support monthly filing and reconciliation

-

Multi-user access for teams handling accounts and compliance

Best for:

Small and medium businesses, service providers, freelancers, retailers, and growing companies that want simple GST compliance and clean accounting without relying on spreadsheets.

Benefits of Understanding and Complying with RCM

-

Reduced Risk of Penalties

By understanding and complying with RCM, businesses can avoid penalties related to late payments or misreporting GST.

-

Improved Financial Planning

Understanding the implications of RCM helps businesses better plan their budgets by enabling them to anticipate tax liabilities in advance.

-

Staying Compliant

Staying compliant with RCM ensures smooth audits and helps businesses build trust with stakeholders.

Actionable Checklist to Stay Compliant with Reverse Charge Mechanism

To ensure RCM compliance, businesses should follow these steps:

-

Identify RCM transactions (e.g., purchases from unregistered suppliers).

-

Calculate GST for each RCM transaction.

-

Keep records of all RCM-related invoices and payments.

-

File GST returns accurately, including all RCM details.

Conclusion

Understanding the Reverse Charge Mechanism (RCM) is crucial for any GST-compliant business in India. By recognizing when RCM applies, calculating and paying GST, and avoiding common pitfalls, businesses can streamline their tax processes and remain compliant.

Tools like Giddh can help simplify the process, making GST reporting and RCM management easier. Stay informed, stay compliant, and avoid costly mistakes by mastering RCM.

FAQ Section

1. When does RCM apply in GST?

RCM applies when businesses purchase goods or services from unregistered suppliers, import services, or deal with specific notified goods/services under GST.

2. How do I calculate GST under RCM?

To calculate GST under RCM, identify the taxable goods or services, apply the correct GST rate, and pay the GST directly to the government.

3. What are the common mistakes businesses make regarding RCM?

Common mistakes include failing to identify RCM transactions, miscalculating GST, and incorrectly reporting RCM in GST returns.

4. How can Giddh help with RCM compliance?

Giddh is a tool that automates GST reporting and helps businesses stay on top of RCM obligations, ensuring accurate tax filings and compliance.