Top-Rated Software for GST Filings: Benefits & Use Cases

According to a 2024 report from the GST Council, over 1.3 crore GST returns are filed each month in India. However, many businesses still face challenges with manual filing, leading to errors and compliance risks. The need for a seamless, accurate, and automated filing solution has never been more critical.

In fact, a recent survey revealed that nearly 45% of SMBs struggle to keep up with the frequent changes in GST filing guidelines, often resulting in penalties for late or incorrect filings.

This pressing need for a reliable solution has made cloud-based top-rated software for GST filings a go-to choice for businesses across India. But why are businesses opting for cloud-based tools? How can they improve the accuracy, compliance, and efficiency of GST filings?

In this blog, we’ll dive into the world of GST filing software, highlighting the benefits, use cases, and how you can leverage the right tool to streamline your filing process.

Why Cloud-Based GST Filing Software is a Game-Changer

Manual GST filing is an exhausting and error-prone process, especially for SMBs and tax consultants managing multiple clients. The complexities of GST return filing and ever-evolving tax laws make it challenging to stay compliant. Fortunately, cloud-based GST filing software addresses these issues, providing a suite of features that ensure accuracy, minimize manual work, and save time.

Key Features of Cloud-Based GST Filing Software:

-

Automation: Automatically calculates GST, reducing human errors and ensuring timely filing.

-

Real-Time Updates: Integrates with the latest GST filing guidelines, keeping your filings compliant with current regulations.

-

Data Syncing: Seamlessly syncs data across devices, making it easy for accountants to access information anytime.

-

User-Friendly Interface: Designed with ease of use in mind, even for those who are not tax experts.

-

Cost Efficiency: Reduces administrative overhead by automating tasks that would otherwise require manual intervention.

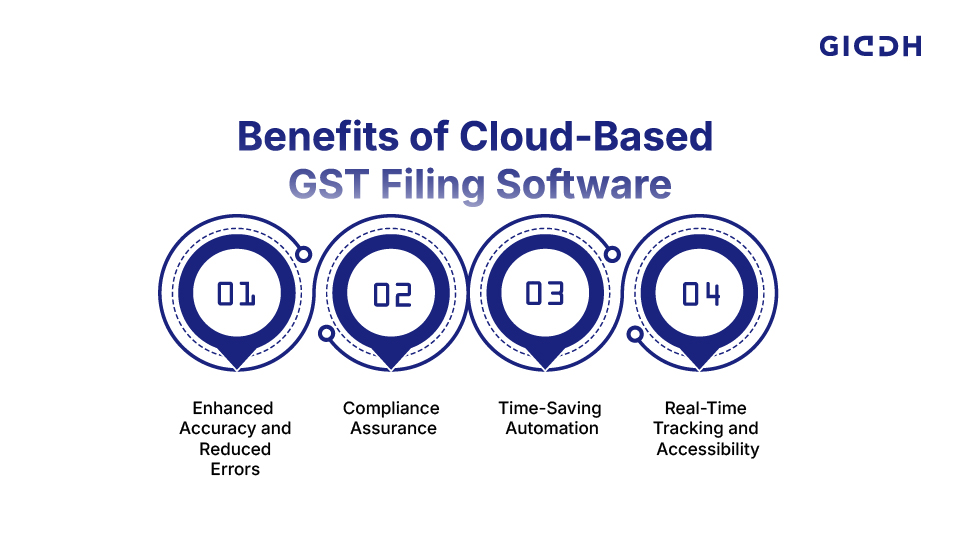

What Are The Benefits of Cloud-Based GST Filing Software

For businesses and tax professionals, the benefits of cloud-based GST filing solutions are abundant. Here are some of the most significant advantages:

1. Enhanced Accuracy and Reduced Errors

Manual calculations are prone to errors. A small mistake in GST calculations could result in hefty penalties or tax issues. Cloud-based GST filing software automates calculations and checks for discrepancies, ensuring accurate returns.

-

Features that help:

-

Automated GST computation based on the latest tax rates.

-

Error-checking mechanisms to identify discrepancies before filing.

-

Integration with accounting software to maintain data accuracy.

-

2. Compliance Assurance

GST regulations can change frequently, and staying compliant requires constant monitoring of new guidelines. Cloud-based accounting tools are constantly updated to reflect the latest GST filing guidelines, ensuring that businesses meet deadlines and remain compliant without extra effort.

-

Features that help:

-

Automatic updates for any changes in GST return filing guidelines.

-

Notifications and reminders for upcoming filing deadlines.

-

Built-in compliance checks to ensure your returns are always up to date.

-

3. Time-Saving Automation

Manual filing is not just tedious but also time-consuming. Cloud-based GST return filing software automates many tasks, from generating invoices to preparing returns. This enables businesses to focus more on their core operations rather than dealing with tedious paperwork.

-

Features that help:

-

Automated invoice generation and categorization.

-

One-click return filing and e-filing features.

-

Integration with banks for automatic reconciliation.

-

4. Real-Time Tracking and Accessibility

One of the significant benefits of cloud-based tools is their accessibility. Tax managers and accountants can track their GST filing status in real time, anywhere, anytime. Whether working from the office, home, or on the go, users can access the business accounting software with ease.

-

Features that help:

-

Real-time data syncing across devices and platforms.

-

Cloud access to tax reports, filings, and payment status.

-

Collaboration features for accountants working on multiple client accounts.

-

Best GST Filing Software: Key Considerations for Businesses

Choosing the right GST filing software is crucial for any business, ensuring streamlined tax compliance and reducing errors. Whether you're a small business or a tax consultant, the software should meet your specific needs and make the filing process easier. Here are key considerations to help you choose the best GST filing software:

Ease of Use

-

User-Friendly Interface: Simple, intuitive design for quick data entry and filing.

-

Minimal Learning Curve: Easy onboarding with tutorials or guides.

-

Streamlined Filing: Features like pre-filled forms and automated calculations.

Integration Capabilities

-

Accounting Software Integration: Sync with tools like Tally, QuickBooks, or Zoho Books.

-

Bank Integration: Seamless reconciliation of payments and tax calculations.

-

Multi-System Compatibility: Syncs with ERP, CRM, or inventory management systems.

Customer Support

-

24/7 Availability: Support should be accessible at all times, especially around deadlines.

-

Multi-Channel Support: Options such as phone, chat, and email.

-

Comprehensive Help Center: FAQs, guides, and video tutorials for easy troubleshooting.

Compliance Features

-

Automatic Updates: Keeps you compliant with the latest GST filing guidelines.

-

Error Detection: Flags discrepancies before filing.

-

Real-Time Alerts: Notifies you of deadlines and regulatory changes.

Price

-

Flexible Pricing Plans: Suitable for businesses of all sizes.

-

Transparent Costs: No hidden fees for updates or support.

-

Free Trials and Demos: Test features before committing.

Choosing the right software ensures smoother GST filings, reduced errors, and better compliance. Make sure the software meets your needs and fits within your budget.

Giddh: A Top-Rated Cloud-Based GST Filing Solution

Among the plethora of GST filing software available today, Giddh stands out as one of the most efficient and affordable solutions. Giddh’s cloud-based GST filing software offers automation, real-time updates, and an intuitive user interface designed for businesses and tax professionals. Here's why Giddh is one of the best GST filing software options:

Key Features of Giddh:

Effortless GST Filing

With Giddh, you can submit your GSTR-1, GSTR-3B, and GSTR-9 directly from the platform. Pre-filled forms significantly reduce manual input, making the filing process faster and more accurate.

-

Submit GST returns directly from Giddh.

-

Pre-filled forms for quicker submission.

-

Easily maintain records for audits and future reference.

Support for Multi-State and Multiple GSTINs

Giddh allows you to manage multiple GST numbers across different states efficiently, ensuring smooth handling of both interstate and intrastate transactions.

-

Manage multiple GSTINs in one account.

-

Efficiently track interstate and intrastate transactions.

-

Automate tax calculations for various states and GSTINs.

Collaborative Accounting

Giddh’s role-based access system empowers your team to collaborate seamlessly with real-time data sharing, making teamwork smoother and more efficient.

-

Assign roles and permissions to team members.

-

Securely share financial data in real-time.

-

Collaborate with accountants for accurate reporting.

Automated GST Calculations

With Giddh, GST is automatically calculated for every invoice and bill, minimizing errors and saving valuable time. The software supports multiple tax rates and GSTINs across different business locations.

-

Automatic GST calculations for sales and purchase transactions.

-

Support for multiple tax rates, exemptions, and GSTINs.

-

Flexible accounting for different tax structures.

Simplified GST Return Filing

Giddh allows you to file GSTR-1, GSTR-3B, and GSTR-9 directly to the GST portal. The platform provides error detection, pre-filled forms, and timely reminders, ensuring that your returns are filed on time and in full compliance.

-

Direct submission to the GST portal.

-

Pre-filled forms for faster and accurate filing.

-

Compliance alerts and due-date reminders.

Create GST-Compliant Invoices

Giddh automatically captures all necessary details—such as GSTIN, HSN/SAC codes, and applicable tax rates—based on the place of supply. This ensures that your invoices are always GST-compliant.

-

Customizable invoice templates to reflect your brand identity.

-

Auto-fill GSTIN, HSN/SAC codes, and tax rates.

-

Effortless handling of both interstate and intrastate transactions.

Giddh provides a comprehensive solution for businesses of all sizes, making GST filing and tax compliance straightforward, efficient, and stress-free.

Use Cases of Cloud-Based GST Filing Software

1. For Small and Medium-Sized Businesses (SMBs):

Managing GST returns manually can overwhelm SMBs, especially when dealing with multiple transactions and clients. Cloud-based GST filing software automates this process, ensuring timely and accurate filings. Giddh simplifies tax calculations, minimizes human error, and keeps businesses compliant with the ever-changing GST laws.

2. For Tax Professionals and Consultants:

Tax consultants and accountants handling multiple clients need a robust tool to manage GST filing for return across various sectors. With cloud-based software, consultants can track filings, generate reports, and ensure all clients remain compliant with ease.

Conclusion:

As businesses and tax professionals navigate the complexities of GST compliance, adopting cloud-based top-rated software for GST filings is a game-changer. These tools offer automation, compliance assurance, and the flexibility needed to keep businesses ahead of the curve. With solutions like Giddh, businesses can significantly reduce the manual effort involved in GST filing, improve accuracy, and stay compliant with the latest regulations. The future of tax compliance lies in automation—don't let your business get left behind.

Try Giddh today for free and experience the convenience of cloud-based GST filing.

Frequently Asked Questions (FAQs)

1. What is the best GST filing software for small businesses?

The best GST filing software for small businesses should be easy to use, cost-effective, and capable of handling multiple transactions. Giddh is one of the top-rated tools for small businesses, offering automation and seamless compliance.

2. Can I file GST returns using free software?

Yes, some GST filing software offers free versions with limited features. However, for businesses with more complex needs, paid software such as Giddh offers more robust features, including real-time updates and advanced automation.

3. How much does GST filing software cost?

The GST filing software price varies depending on features and the scale of your business. Giddh offers flexible pricing, allowing businesses to choose the plan that best suits their needs and budget.

4. Is Giddh suitable for tax consultants?

Yes, Giddh is designed to cater to GST filing software for tax consultants as it allows easy management of multiple client accounts, streamlines return filings, and ensures compliance with updated guidelines.