Find The Best Xero Alternatives - Top 6 Picks For 2026

As businesses evolve, the need for tailored accounting software grows. Xero has long been a popular choice, but enterprises face specific challenges when using it. Issues like limited support for tax regulations and the rising costs of subscription plans can make it less suitable for certain companies.

The demand for small business accounting tools is now greater than ever, where businesses require seamless integrations with local tax systems, robust customer support, and pricing models that scale with their growth.

In this blog, we’ll explore the best Xero alternatives that meet these needs. We’ll compare each tool based on critical factors such as features, ease of use, pricing, and support.

Whether you’re a small business owner or an accountant, this guide will help you make an informed decision about the best Xero alternatives for small businesses in 2026.

6 Best Xero Alternatives For Better Financial Management

1. Giddh

2. Zoho Books

3. Busy

4. QuickBooks

5. Wave

6. FreshBooks

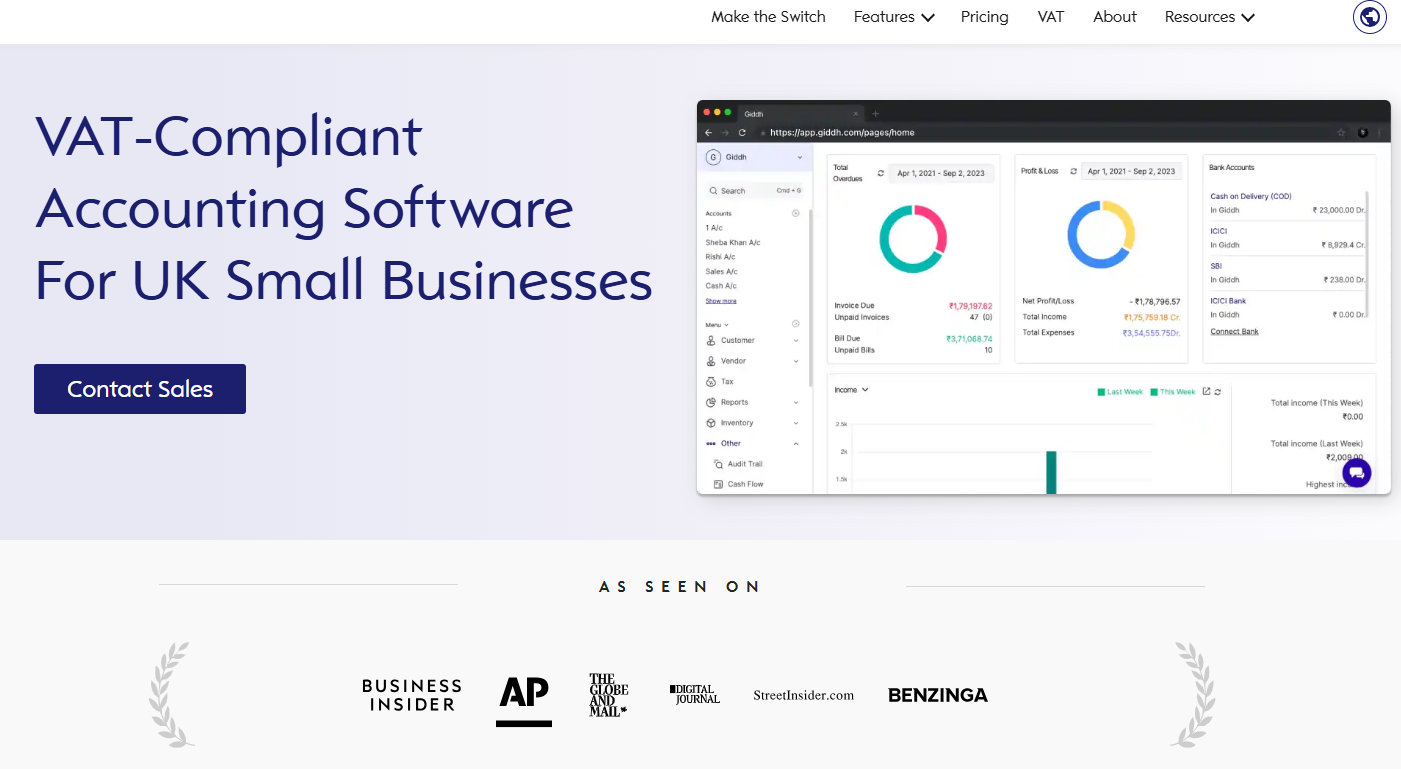

1. Giddh – Cloud Accounting Software (Best Overall Xero Alternative)

For businesses, Giddh stands out as the ideal Xero alternative. This cloud-based accounting software is designed to address the unique needs of companies, accountants, and service firms in India. With a focus on tax compliance, Giddh makes bookkeeping, inventory management, and tax filings simpler for businesses that require seamless integration with tax systems.

Features of Giddh:

-

Ledger-Based Accounting: Simplified bookkeeping with real-time ledger updates.

-

Multi-Currency Support: Handle transactions across multiple currencies with ease.

-

Tax Compliance: Seamless VAT compliance for businesses.

-

White-Label Option: Fully customizable to match your brand identity.

-

Unlimited User Access: Add as many users as needed for scalable team collaboration.

-

Manage Over 100 Companies: Easily manage accounting for multiple businesses from a single account.

-

Asset Management: Track and manage assets effortlessly.

-

Inventory Management: Real-time tracking and management of inventory levels.

-

Bank Reconciliation: Automate bank reconciliation for accurate financial records.

Supported Platforms:

- Web

- IOS

- MAC

- Windows

- Androids

Pricing:

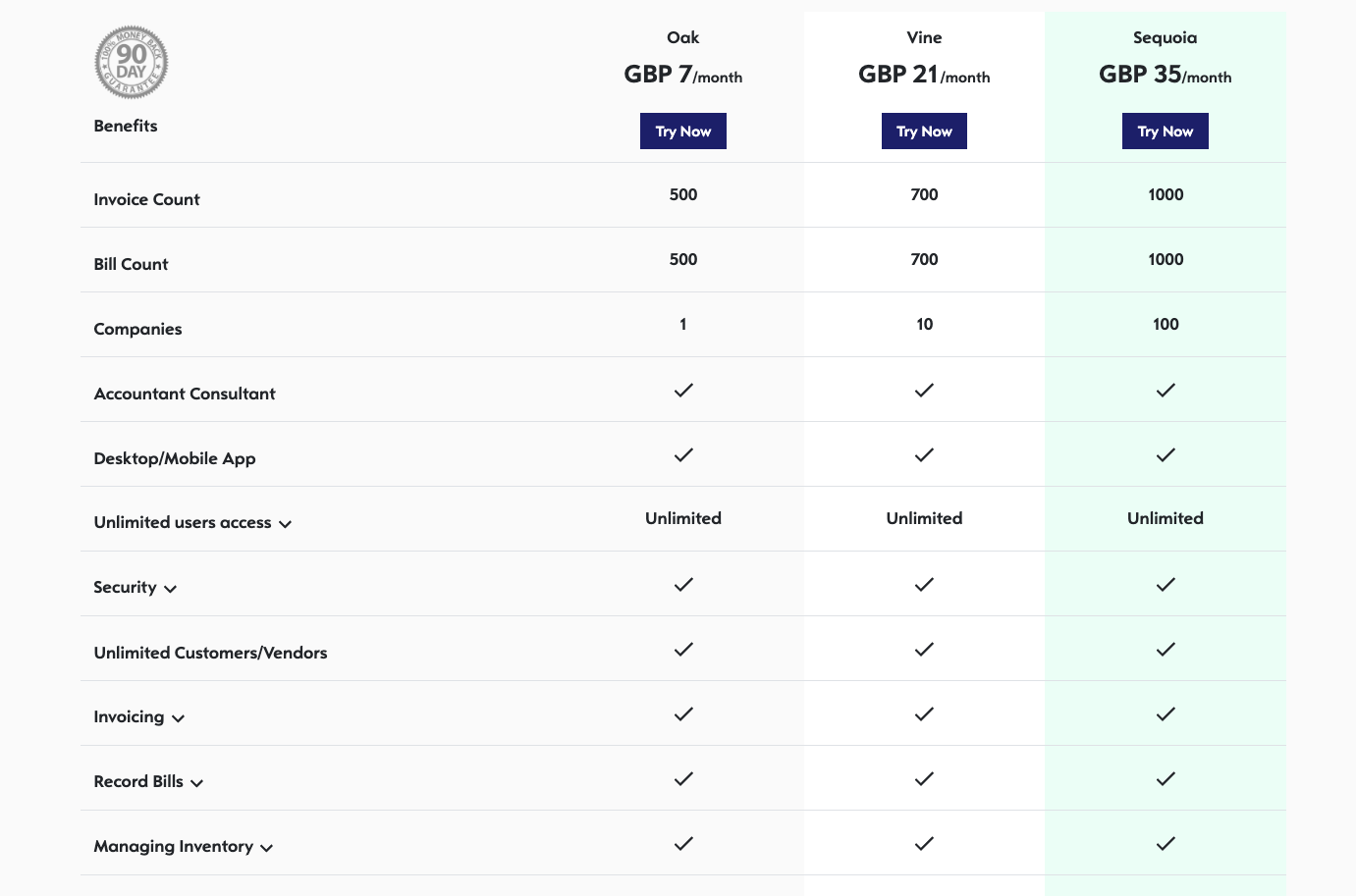

Starts at £7/month, increasing to £35/month, with scalable plans for multiple companies and users.

Pros:

- 100% tax compliant

- Unlimited users

- Mobile access

- Fast customer support

Cons:

- Limited third-party app integrations

- Basic UI for larger enterprises

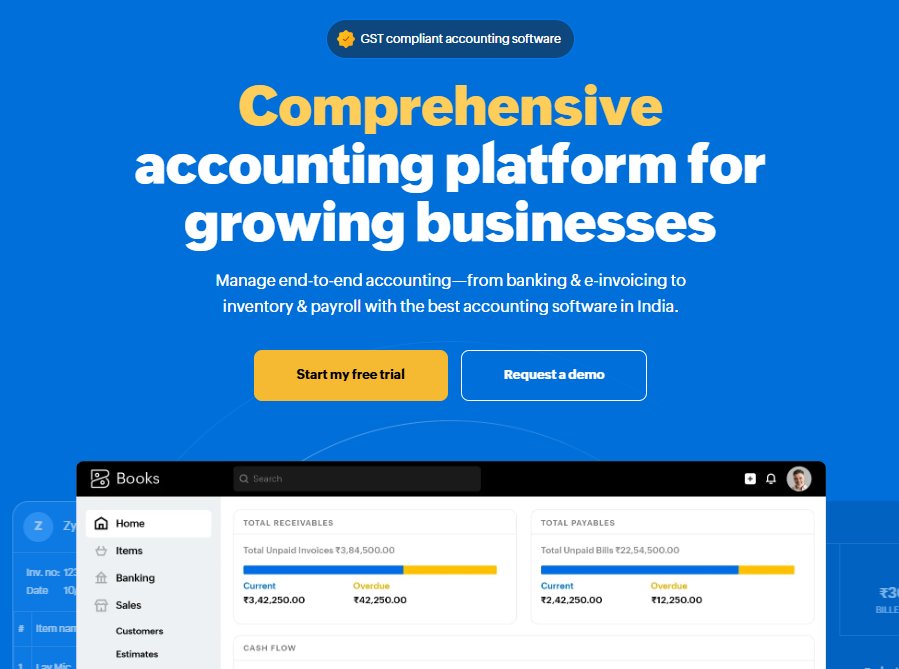

2. Zoho Books

Zoho Books integrates seamlessly into the Zoho ecosystem, making it an excellent choice for businesses already utilising other Zoho products, such as CRM and HR tools. Ideal for companies seeking a comprehensive solution for accounting and customer relationship management.

Zoho Books integrates seamlessly into the Zoho ecosystem, making it an excellent choice for businesses already utilising other Zoho products, such as CRM and HR tools. Ideal for companies seeking a comprehensive solution for accounting and customer relationship management.

Key Features:

- Tax and e-way billing

- Client portal with automation workflows

- Time tracking and project accounting

Pricing:

Starts at ₹899/month, with a free plan available for businesses with a turnover of under ₹ 25 lakh.

Pros:

- Government-compliant

- Deep ecosystem integrations

- Powerful automation tools

Cons:

- Steep learning curve

- It may feel overwhelming for small teams

3. Busy Accounting Software

Best suited for businesses in distribution and retail, Busy is a powerful, desktop-based accounting tool that offers strong inventory management and Tax compliance.

Key Features:

- Multi-location inventory

- Tax handling

- Batch tracking

Pricing:

Starts at ₹9,000/year.

Pros:

- Great for inventory-heavy businesses

- Strong compliance with tax regulations

Cons:

- Desktop-based; lacks cloud support

- UI can feel outdated

Cons:

- Not suitable for service-based or tech companies

- Requires training

4. QuickBooks (Global)

QuickBooks is a globally recognized accounting tool, perfect for businesses with international clients. It continues to function for global operations.

Key Features:

- Invoicing and expense tracking

- Bank sync and cash flow dashboards

Pricing:

Starts at $15/month.

Pros:

- Excellent UI

- Great for international payments

Cons:

- No Tax compliance

5. Wave

Wave is ideal for small businesses and freelancers seeking a free accounting solution. While it doesn't support tax regulations, it offers easy-to-use features for early-stage companies.

Key Features:

- Invoicing

- Expense tracking

- Payment integrations with Stripe and PayPal

Pricing:

Free (with paid add-ons for payments).

Pros:

- Completely free

- Clean and simple interface

Cons:

- Lacks tax compliance

- Limited support

6. FreshBooks

FreshBooks is a cloud-based accounting tool widely appreciated for its easy-to-use interface, making it ideal for solo professionals and small businesses in the service industry.

Key Features:

- Time tracking

- Customizable invoicing

- Expense and mileage tracking

- Online payments and client portal

Pricing:

Starts at $17/month (billed annually).

Pros:

- Easy to set up and use.

- Excellent for client-facing businesses.

- Great customer support.

Cons:

- Not Tax-ready or localized.

- Expensive compared to tools

How to Choose the Right Xero Alternative for Your Business

Choosing the right Xero alternative for your business requires careful evaluation to ensure the software aligns with your specific needs. When selecting an alternative, it’s essential to consider a range of features that will support your business’s growth and ensure compliance with regulations.

Below is a more detailed checklist to help guide you in selecting the best accounting software alternative for your business.

1. UK Compliance (VAT)

Businesses require accounting software that fully supports VAT and complies with Making Tax Digital (MTD) guidelines. This ensures smooth tax reporting and avoids penalties from HMRC. A Xero alternative should offer built-in tools to manage VAT returns and facilitate digital submissions.

-

VAT handling: Support for UK VAT rates, including standard, reduced, and zero rates.

-

MTD compliance: Simplifies submission of VAT returns directly to HMRC, ensuring compliance with digital tax laws.

-

Tax reports: Automated generation of VAT reports for accurate and timely filing.

2. Multi-User & Multi-Branch Access

As your business grows, you may need to provide access to different team members or manage multiple locations. The right software should enable you to add users and manage multiple branches or locations within a single system. It allows easy collaboration and efficient operations across your business.

-

Multi-user support: Allow multiple users to access the system with role-based permissions.

-

Branch/Location management: Manage finances for different locations or departments with the ability to track separate profits, losses, and tax filings.

-

Collaboration features: Enable users to view, edit, and collaborate on financial data in real-time, reducing errors and improving communication.

3. Mobile Support & Real-Time Reporting

In today’s fast-paced business environment, the ability to access your accounting software on the go is essential. Look for an Xero alternative that offers mobile support and real-time reporting, allowing you to make informed decisions anytime, anywhere.

-

Mobile apps: Access and update your financial data on your smartphone or tablet.

-

Real-time data: Get up-to-date financial insights with instant reports, such as profit and loss statements, balance sheets, and cash flow.

-

Notifications: Receive alerts on key financial activities, such as overdue invoices or low account balances, to stay on top of your business operations.

4. Ease of Use for Non-Technical Teams

Your accounting software should be user-friendly, even for team members who don’t have technical or accounting experience. A simple, intuitive interface makes the system accessible to everyone, regardless of their skill level.

-

Intuitive interface: Clean design with easy-to-understand navigation and workflows.

-

Simple setup: Quick installation and setup with step-by-step guidance.

-

User-friendly reporting: Customizable, simple-to-read reports that anyone in your business can understand and act on.

5. Support, Pricing, & Integrations

Support is a key factor in selecting the right software. Reliable customer service can help you resolve issues quickly. Pricing is also a key consideration, especially for small businesses with tight budgets. Ensure the software offers competitive pricing and flexible plans that can scale with your company. Additionally, check if the software integrates well with the other tools your company uses.

-

Customer support: Access to responsive support channels (email, phone, live chat) to resolve issues quickly.

-

Flexible pricing: Different pricing plans tailored to businesses of all sizes, with the option to scale as your needs grow.

-

Integrations: Seamless integration with third-party tools like CRM systems, payroll software, payment gateways, and e-commerce platforms.

-

Trial period: Look for software that offers a free trial or demo period so you can evaluate its features before committing to a subscription.

Final Verdict: Which Xero Alternative Should You Choose?

When it comes to tax-ready, multi-branch, and scalable accounting, Giddh is a top accounting software, like Xero. Designed specifically for businesses, it ensures seamless compliance with different taxation, making it ideal for companies looking to streamline their finances.

If you're already using Zoho products, Zoho Books can be an excellent fit. It integrates smoothly into the Zoho ecosystem, offering robust automation and compliance features.

For businesses focused on inventory management or retail operations, tools like FreshBooks or Busy provide the deep features needed for managing stock and processing large volumes of transactions.

Are you unsure which one works best for you? Try Giddh for free and see how it compares to the best alternatives to Xero, offering a tailored solution for your business needs.

FAQ

1. What is the best Xero alternative for global businesses?

For global businesses, it’s crucial to choose a tool that offers VAT compliance, multi-currency support, and global invoicing capabilities. QuickBooks, FreshBooks, and Zoho Books excel in these areas, offering robust support for businesses across various regions.

2. Is QuickBooks a good alternative to Xero for international businesses?

Yes, QuickBooks is an excellent alternative to Xero, offering strong multi-currency support, international invoicing, and robust accounting features, making it ideal for businesses with global clients.

3. Does Zoho Books support international tax compliance?

Yes, Zoho Books supports international tax compliance, like VAT. It also offers multi-currency capabilities, making it adaptable for businesses worldwide.

4. Can I use Wave as an alternative to Xero for small businesses?

Yes, Wave is an excellent option for small businesses or freelancers. It provides free invoicing, expense tracking, and payment processing. However, it may lack advanced features needed by larger firms.

5. How do I decide between QuickBooks, Zoho Books, and FreshBooks?

Your choice depends on your business’s size and specific needs:

-

QuickBooks: Ideal for growing businesses with complex needs.

-

Zoho Books: Best for businesses seeking a customizable solution with automation.

-

FreshBooks: Perfect for service-based businesses and freelancers due to its easy-to-use interface.

6. What makes Giddh a good Xero alternative for global businesses?

While Giddh is primarily designed for businesses, it offers cloud features, real-time reporting, and multi-branch support, making it a viable option for companies in emerging markets or those requiring local compliance.