Top Benefits of Using Collaborative Accounting Software for SMEs in India

TL;DR: Collaborative accounting software is revolutionizing how SMEs in India manage their finances. From real-time collaboration to seamless GST compliance, this technology offers several benefits, including reduced manual work, enhanced accuracy, and scalability. In this blog, we’ll explore how adopting collaborative accounting software can streamline financial processes for small and medium-sized enterprises, enabling them to stay ahead of the competition. |

In India, multiple small and medium-sized enterprises (SMEs) significantly contribute to the economy; however, many still rely on manual accounting methods that are prone to errors and inefficiencies.

According to a report by the Ministry of Micro, Small & Medium Enterprises (MSME), SMEs account for about 30% of India's GDP. However, many face challenges, including complex tax regulations, manual data entry errors, and a lack of collaboration among finance teams.

This is where collaborative accounting software steps in. In 2023, the adoption of cloud-based accounting software in India increased by 24%, reflecting a growing trend among SMEs to automate and digitize their financial operations.

But is your business leveraging this technology to its fullest potential? Let’s explore how collaborative accounting software can be the game-changer for SMEs in India.

What is Collaborative Accounting Software and How Does It Work for SMEs in India?

Collaborative accounting software is a cloud-based financial management solution designed to streamline accounting processes, enhance collaboration, and ensure accurate and up-to-date financial data. This type of software enables multiple users (e.g., business owners, CFOs, accountants) to access and work on financial data in real-time, regardless of their location.

For SMEs in India, it’s not just about simplifying the accounting process but also about enabling seamless collaboration between stakeholders. Whether it's managing invoices, expenses, payroll, or GST filings, collaborative accounting software makes everything more accessible, reducing the need for manual intervention and enhancing overall operational efficiency.

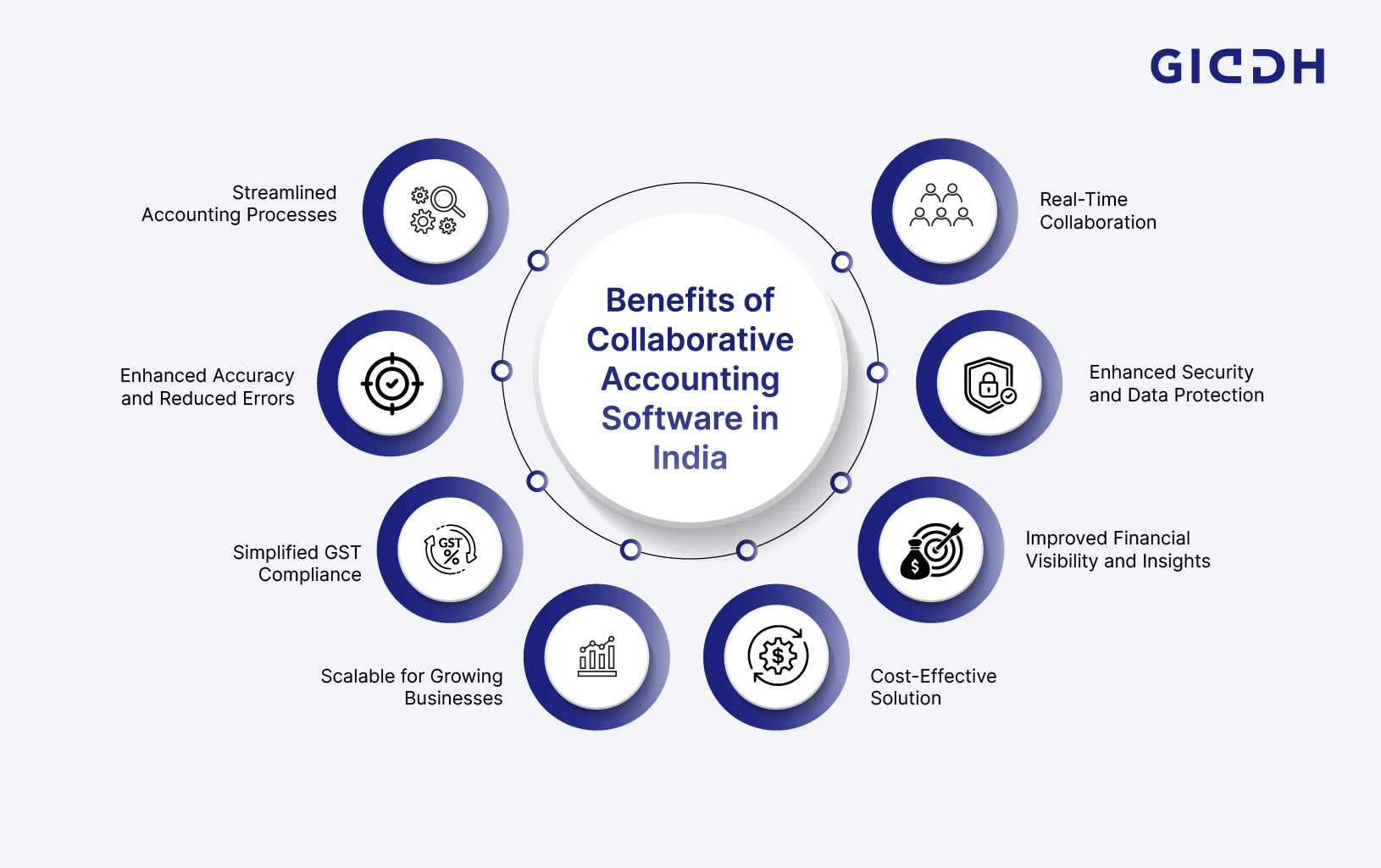

What Are The Benefits of Collaborative Accounting Software for SMEs in India

- Streamlined Accounting Processes

- Real-Time Collaboration

- Enhanced Accuracy and Reduced Errors

- Simplified GST Compliance

- Scalable for Growing Businesses

- Cost-Effective Solution

- Improved Financial Visibility and Insights

- Enhanced Security and Data Protection

As SMEs in India continue to grow and face the challenges of managing their financial operations, adopting collaborative accounting software can significantly improve efficiency and accuracy.

Here are some key benefits for SMEs looking to streamline their accounting processes:

Streamlined Accounting Processes

Collaborative accounting software automates many of the routine tasks that consume valuable time for SMEs. From invoicing and expense tracking to generating reports, automation reduces the manual workload, freeing up time for business owners and accounting teams to focus on strategic initiatives.

-

Reduced manual work: Automation of recurring tasks eliminates tedious data entry.

-

Faster processes: Invoices, reports, and other financial documents are generated instantly.

-

Improved accuracy: Automated calculations reduce the risk of human error.

With collaborative accounting software, SMEs can streamline and accelerate their accounting workflows, resulting in a more efficient use of resources.

Real-Time Collaboration

One of the standout features of collaborative accounting software is the ability for multiple users to access and work on the same data simultaneously. Whether you're an accountant, business owner, or CFO, everyone can collaborate on financial data in real-time, ensuring that updates are instantly visible across all team members.

-

Multi-user access: Enables collaboration among team members, regardless of location.

-

Instant updates: Any change made by one user is immediately visible to all, preventing discrepancies.

-

Faster decision-making: Real-time data improves business decisions, reducing delays.

This real-time collaboration boosts transparency, reduces miscommunication, and enhances overall teamwork within the organization.

Enhanced Accuracy and Reduced Errors

Manual accounting processes are prone to errors, especially when managing large volumes of data. Collaborative accounting software minimizes these risks by automating calculations and ensuring that financial reports are accurate and up-to-date.

-

Error-free calculations: Automation ensures precise data processing, reducing mistakes in tax filings, invoices, and reports.

-

Audit trails: Track all changes to financial data, ensuring accountability and transparency.

-

Instant reconciliations: Automated reconciliations prevent mismatched financial records.

With enhanced accuracy, SMEs can trust their financial data and avoid costly errors or compliance issues.

Simplified GST Compliance

For SMEs in India, staying compliant with GST regulations is a significant challenge. Collaborative accounting software automates the generation of GST-compliant invoices and reports, ensuring businesses meet compliance requirements without manual intervention.

-

GST-compliant invoices: Automatically generate invoices that adhere to GST norms.

-

Automated tax calculations: Software automatically calculates GST amounts based on transactions.

-

GST filing assistance: Generate reports directly for GST filing, ensuring accuracy and timely submissions.

By automating GST compliance, SMEs can avoid penalties and fines for late or inaccurate filings, saving time and money in the process.

Scalable for Growing Businesses

As SMEs grow, their financial management needs become more complex. Collaborative accounting software is scalable, enabling businesses to expand their accounting capabilities without requiring a system overhaul.

-

Add more users: Seamlessly integrate new team members without disrupting your workflow.

-

Adapt to complexity: As your business grows, the software can handle an increasing number of transactions and more complex financial data.

-

Integrate with other tools: Easily integrate with other business software as your needs evolve.

Whether your business is just starting or is rapidly expanding, collaborative accounting software can scale with you, ensuring long-term effectiveness.

Cost-Effective Solution

Hiring a team of accountants or investing in complex accounting tools can be expensive for small businesses. Collaborative accounting software provides a cost-effective solution by automating tasks, which reduces the need for additional staff or costly software.

-

Affordable pricing plans: Choose from flexible pricing options based on your business’s size and needs.

-

Reduce administrative overhead: Automate repetitive tasks to reduce staffing costs.

-

No hidden costs: Transparent pricing ensures no unexpected charges.

This makes collaborative accounting software an ideal option for SMEs looking to streamline operations while keeping costs low.

Improved Financial Visibility and Insights

With real-time access to financial data, collaborative accounting software enables SMEs to maintain a clear and up-to-date view of their financial health. This visibility helps business owners and managers make informed decisions based on accurate data.

-

Comprehensive financial reports: Generate profit and loss statements, balance sheets, and cash flow reports with ease.

-

Informed decision-making: Access to up-to-date financial insights enables better budgeting and forecasting.

-

Performance tracking: Monitor key financial metrics to assess business growth and identify areas for improvement.

By offering better visibility into financial data, collaborative accounting software helps SMEs make smarter, data-driven decisions.

Enhanced Security and Data Protection

Financial data is sensitive and must be protected from unauthorized access or loss. Collaborative accounting software offers bank-grade security features to ensure that your financial data is safe, backed up, and protected from cyber threats.

-

Data encryption: All sensitive financial data is encrypted to ensure secure transactions.

-

Access control: Set role-based access to limit data access to authorized users only.

-

Automatic backups: Regular backups ensure your data is safe, even in case of system failures.

With advanced security features, SMEs can trust that their financial data is secure and protected.

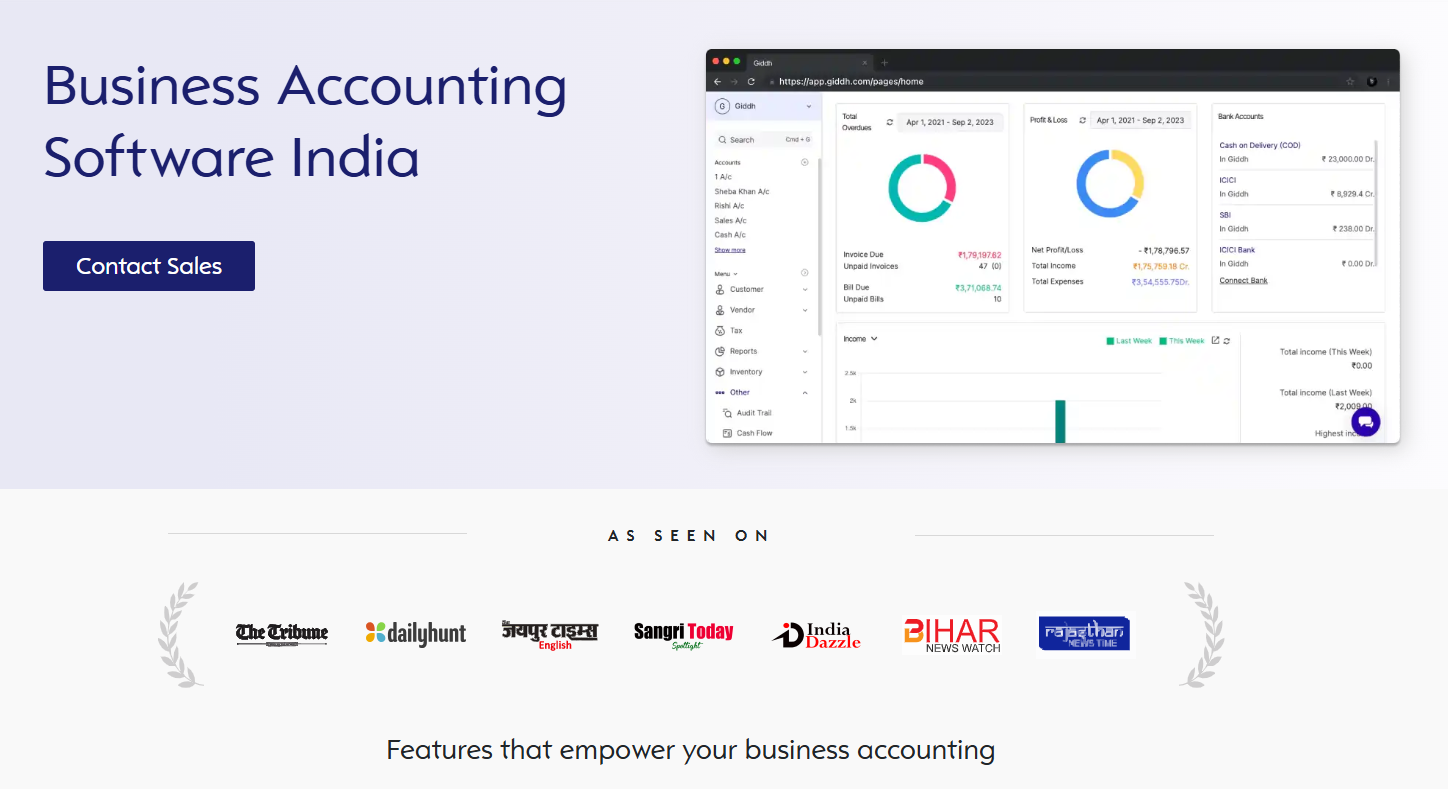

How Giddh’s Collaborative Accounting Software Is Tailored for SMEs in India

At Giddh, we understand the unique challenges that SMEs in India face, especially when it comes to accounting and financial management. Our collaborative accounting software is designed to simplify financial tasks, ensure compliance with Indian tax laws, and foster seamless collaboration between teams.

GST Compliant and Hassle-Free Tax Management

GST compliance poses a significant challenge for many SMEs, particularly in terms of timely filings and accuracy. Giddh simplifies this process by automating GST-related tasks, thereby reducing the likelihood of errors.

-

Automated GST Reports: Automatically generate GST-compliant invoices and tax returns.

-

Error-Free Calculations: Reduce manual errors and ensure accurate GST filings every time.

-

Timely Filing Alerts: Stay compliant with timely reminders for GST deadlines, avoiding last-minute rushes.

With Giddh, you’ll never miss an important tax deadline, and you’ll always be ready for audits.

User-Friendly Interface for Non-Accountants

Many SMEs in India have limited accounting expertise, which can lead to difficulties when managing finances. Giddh’s intuitive interface makes it easy for non-accountants to handle day-to-day accounting tasks efficiently.

-

Easy Navigation: Simple design for quick access to essential features.

-

Quick Invoicing: Generate invoices in a few clicks, even without accounting knowledge.

-

Clear Financial Insights: Dashboards and reports that provide valuable business insights at a glance.

Giddh simplifies accounting complexity, making it accessible to everyone on your team.

Real-Time Collaboration for Seamless Teamwork

Collaboration is crucial for enhancing productivity, particularly for SMEs with teams dispersed across various locations. Giddh’s cloud-based accounting solution enables real-time updates, ensuring everyone stays on the same page.

-

Simultaneous Updates: Multiple team members can work on the same data simultaneously, improving efficiency.

-

Cloud Access: Access your financial data securely from anywhere, at any time.

-

Role-Based Access: Assign specific roles and permissions to team members for better control.

With real-time collaboration, your accounting processes become more streamlined and less prone to miscommunication.

Cost-Effective and Scalable for Growing SMEs

SMEs need an accounting solution that doesn’t break the bank but can still scale as the business grows. Giddh offers affordable plans that grow with your company, ensuring you never outgrow your accounting tool.

-

Affordable Pricing Plans: Various plans to fit your budget, with no hidden fees.

-

Scalable Features: As your business grows, add users and features without hassle.

-

Save on Resources: Automate tasks to reduce the need for additional hires and save costs.

Whether you're just starting or scaling up, Giddh is a cost-effective solution that grows with you.

Data Security and Integration

Security is a top priority for Giddh. We ensure that your financial data is always safe and available when you need it, with robust security features and seamless integration with other business tools.

-

Bank-Grade Encryption: Your financial data is fully protected with industry-leading encryption.

-

Automatic Backups: Regular backups are performed to prevent data loss.

-

Third-Party Integrations: Giddh integrates with various tools to give you a comprehensive financial management system.

With Giddh, you can be confident that your sensitive financial data is secure and always accessible.

Conclusion:

The benefits of using collaborative accounting software are clear: streamlined processes, improved accuracy, enhanced collaboration, and better scalability. For SMEs in India, staying ahead in the competitive business landscape requires leveraging tools that enhance efficiency and reduce the risk of errors.

Collaborative accounting software is not just a luxury; it’s a necessity for businesses that want to stay compliant with tax regulations, reduce manual effort, and scale seamlessly.

If you're still relying on manual accounting methods, now is the time to consider switching to a digital solution that can future-proof your business.

Giddh’s collaborative accounting software is the ideal tool to streamline your financial processes. Ready to take the next step? Schedule a demo and discover how we can help transform your business.