Digital Transformation in Accounting for Small and Medium Enterprises

In the rapidly evolving business landscape, small and medium enterprises (SMEs) in India are increasingly turning to digital transformation to gain a competitive edge. According to a recent survey, nearly 70% of SMEs in India are now adopting cloud-based solutions for accounting and financial management, recognizing the efficiency and accuracy they offer.

For many SMEs, traditional manual accounting practices have long been the norm, often involving spreadsheets, paper invoices, and manual tax filings. However, these outdated processes come with several challenges — from human error and inefficiency to struggles to stay compliant with GST regulations.

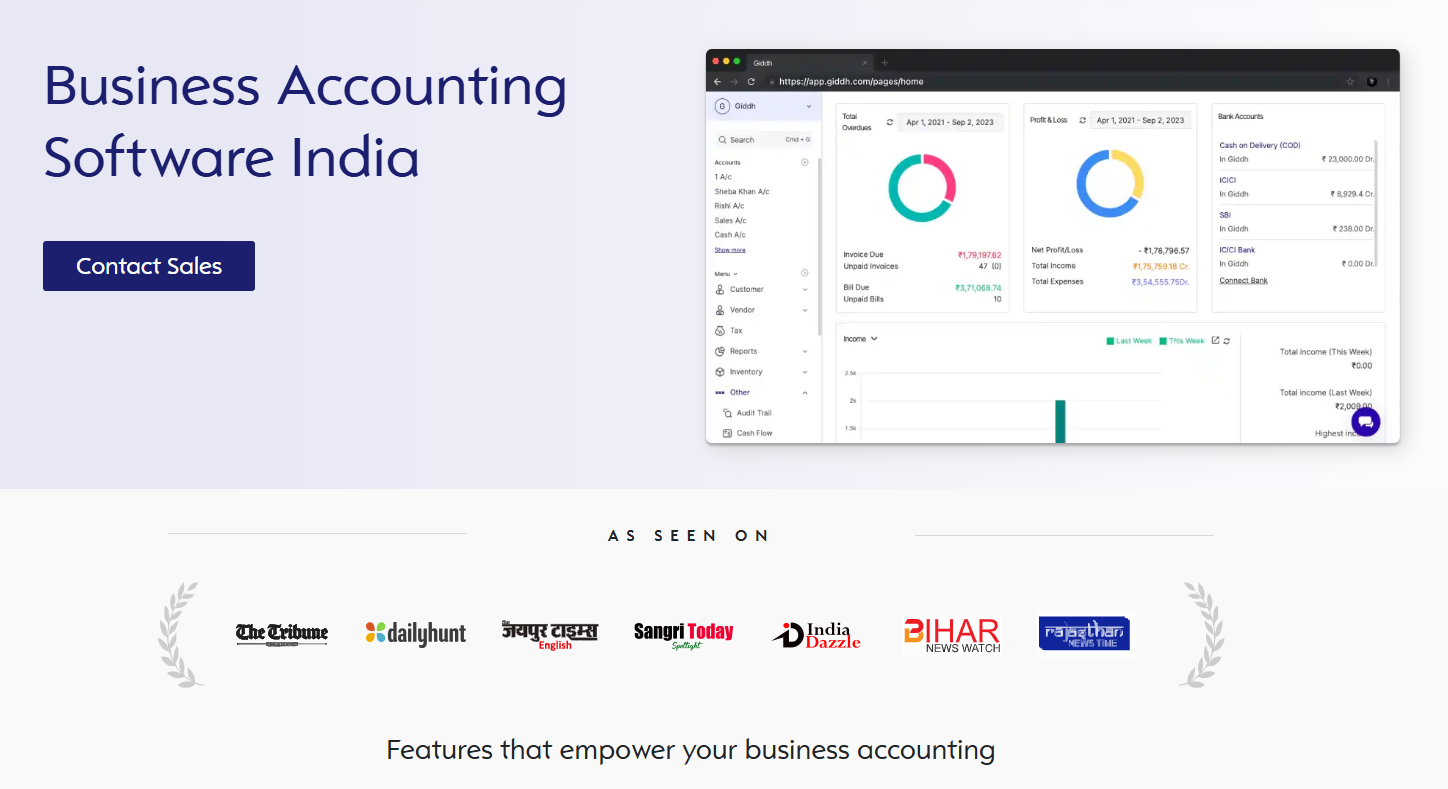

The shift to digital accounting software for small businesses is no longer optional for SMEs that wish to grow and stay competitive. With cloud-based accounting tools like Giddh, businesses can automate their accounting processes, gain real-time insights, and ensure compliance, all while saving time and reducing errors.

What Does Digital Transformation in Accounting Really Mean?

Digital transformation in accounting refers to the use of cloud-based software and automation tools to streamline financial processes. It involves transitioning from manual, paper-based systems to digital systems capable of handling tasks such as invoicing, expense tracking, tax calculations, and reporting, all in real time.

For accounting practices for small and medium enterprises, this transformation means adopting technology that not only simplifies these processes but also makes them more accurate, faster, and scalable. Unlike traditional systems that do accounting for small and medium enterprises, digital solutions offer seamless integration, automated updates, and accessibility from anywhere, which is crucial for today’s fast-paced, remote-friendly work environment.

With cloud-based accounting software for small businesses in India, SMEs like Giddh can access their financial data anytime, anywhere, without the need for cumbersome spreadsheets or manual entry. This shift enables SMEs to focus more on business growth and less on administrative tasks.

Key Problems With Manual Accounting for Small and Medium Enterprises

While SMEs have used manual accounting practices for years, they come with several drawbacks that hinder efficiency and business growth.

Manual Data Entry and Human Errors

In a traditional accounting system for small businesses, manual data entry is prone to errors. Whether it’s an incorrect invoice amount or a missed deduction, these errors can lead to financial discrepancies and tax issues.

For example, many businesses struggle to manually enter invoice data, leading to inconsistencies in financial reporting and errors that affect tax filings. Even a small mistake can have serious consequences when calculating taxes and filing returns.

Time-Consuming Processes and Inefficiency

Manual accounting tasks, such as creating invoices, reconciling bank statements, and filing taxes, are time-consuming and often involve repetitive work. This leaves little time for SMEs to focus on strategic business decisions or growth.

The inability to automate tasks such as invoicing and tax filing means business owners and accountants spend hours each week on administrative tasks. As the business grows, the volume of paperwork increases, making these tasks even more challenging to manage.

GST Compliance Issues

One of the biggest challenges for Indian SMEs is staying compliant with GST regulations. The frequent changes in GST rules, filing deadlines, and tax calculations can create significant confusion for businesses using outdated systems. Manual handling of these tasks increases the risk of GST errors, leading to penalties and fines.

In a manual system, keeping track of multiple GST rates, tax credits, and the details required for filing returns can be overwhelming. This makes it easy to miss deadlines or miscalculate taxes, which could result in costly mistakes.

Lack of Real-Time Insights

Traditional accounting software for small business often fails to provide real-time insights into a business's financial health. Without up-to-date financial data, SMEs cannot make informed decisions quickly enough to react to market changes.

For example, with outdated systems, business owners might not realize that they have overdue invoices or cash flow issues until it’s too late. This lack of real-time visibility makes it hard to track business performance and take timely corrective actions.

Scalability Challenges as Businesses Grow

As SMEs scale, their accounting needs become more complex. Manual systems are ill-equipped to handle multiple accounts, business units, or international transactions. This lack of scalability forces businesses to spend more time managing accounting rather than focusing on growth.

For businesses expanding to new markets or regions, managing multiple currencies, international transactions, and local taxes manually becomes a huge challenge. The inability to scale an accounting system for a small business efficiently can hinder business expansion and growth.

How Digital Transformation Solves These Problems?

Digital transformation offers SMEs a host of benefits that address the challenges mentioned above.

a. Automation

Digital accounting solutions for small and medium-sized enterprises automate repetitive tasks such as invoicing, data entry, and report generation. Automation reduces the chances of human error, saving businesses time and ensuring accuracy in their financial records.

For example, it automates invoice generation, so business owners no longer have to create and send each invoice manually. The system automatically pulls in customer details, calculates the appropriate taxes, and generates invoices at the click of a button.

b. Real-Time Financial Data Access

Cloud-based accounting systems for small businesses provide real-time financial data, allowing SMEs to access up-to-date information on profits, expenses, and cash flow at any time. This immediate access to insights helps businesses make quick, informed decisions.

Having access to real-time financial data means businesses can easily monitor their cash flow, track overdue invoices, and adjust their strategies as needed. For example, if a business notices a drop in cash flow, it can immediately take action, such as following up on overdue payments.

c. Built-In Tax Compliance (GST)

With digital accounting solutions, GST compliance becomes easier. Giddh automatically calculates taxes, generates GST-compliant invoices, and helps businesses file returns on time. This ensures that SMEs are always in line with the latest GST regulations, reducing the risk of errors or missed deadlines.

Giddh keeps track of the latest GST rules, updates tax rates accordingly, and automatically generates reports in the correct format for filing. This takes the burden off business owners and ensures they are always up to date on compliance requirements.

d. Cloud Accessibility

Digital accounting solutions allow businesses to access their data from anywhere. Whether working from the office, at home, or on the go, cloud-based accounting software for small business in India enables SMEs to manage their finances remotely, which is especially important in today’s increasingly mobile and remote work environment.

This flexibility is vital for SMEs with remote teams or businesses that need to stay on top of their finances even while traveling. Cloud accessibility enables seamless collaboration, ensuring everyone involved in the company can access financial data when required.

e. Scalability

As businesses grow, so do their accounting needs. Digital accounting systems for small businesses, like Giddh, are designed to scale with a business. Whether it’s handling multiple companies, multi-currency transactions, or large volumes of data, digital tools grow alongside the industry, ensuring that accounting remains efficient and manageable.

Giddh allows SMEs to scale easily by adding new users, integrating multiple business locations, or handling international payments. This ensures that as the business grows, accounting processes remain smooth and manageable.

Top Features Small and Medium Businesses Need in Accounting Software

When choosing easy accounting software for small business, SMEs should look for tools that offer features tailored to their needs:

GST-Ready Invoicing & Reporting

The accounting software for small business in India should automatically calculate and generate GST-compliant invoices and reports. This reduces manual effort and ensures compliance with India’s GST laws.

Automated Bank Feeds & Reconciliation

Easy accounting software for small business should automatically reconcile bank transactions, saving businesses time on manual matching and ensuring accuracy.

Multi-User Role Permissions

The best accounting software for small and medium businesses should support multiple users with different roles, allowing enterprises to manage permissions and workflows securely.

Custom Reporting & Dashboards

The ability to create customized reports and access dashboards that provide insights into key financial metrics helps businesses make data-driven decisions.

Secure Cloud Storage & Backups

Cloud-based accounting solutions ensure that all financial data is stored securely and backed up automatically, reducing the risk of data loss.

Why Giddh is the Perfect Digital Accounting Solution for SMEs

Giddh is designed to meet the specific needs of SMEs. Here's why it stands out:

a. Designed for SME Needs

Giddh is built to simplify GST compliance, invoicing, and tax filings for SMEs. The platform is user-friendly, making it the best accounting software for small businesses free and easy, without needing an expert

b. Automation & Accuracy

With automated invoicing, expense tracking, and report generation, Giddh saves businesses time and ensures accurate records, reducing the risk of errors.

c. Real-Time Insights

Giddh provides real-time financial dashboards and reports, giving SMEs the tools they need to make informed decisions.

d. GST Compliance & Filing

Giddh automatically calculates GST, generates compliant invoices, and helps with filing returns such as GSTR-1 and GSTR-3B — ensuring businesses remain compliant.

e. Scalable & Easy to Use

As businesses grow, Giddh grows with them. It allows SMEs to manage multiple companies, currencies, and complex transactions with ease. Plus, its cloud-based platform ensures businesses can access their financial data from anywhere.

Conclusion

In today’s competitive environment, digital transformation in accounting practices for small and medium enterprises is essential. By adopting cloud-based accounting software like Giddh, businesses can automate tasks, gain real-time financial insights, and ensure GST compliance — all while scaling their operations efficiently.

For small and medium enterprises, this transformation not only improves operational efficiency but also lays the foundation for sustainable growth. Get started with digital accounting tools to stay competitive, compliant, and prepared for the future.

FAQ

-

What is digital transformation in accounting?

Digital transformation in accounting involves using cloud-based tools to automate financial processes, improve accuracy, and streamline workflows.

-

How does digital accounting help with GST compliance?

Digital accounting tools automatically calculate and generate GST-compliant invoices, making it easier for SMEs to stay compliant with the latest tax laws and regulations.

-

What are the main benefits of using cloud-based accounting software?

Cloud-based accounting software provides real-time financial data, improves collaboration, reduces the risk of data loss, and offers secure, remote access to financial records anytime, anywhere.

-

Can digital transformation in accounting help businesses scale?

Yes, digital solutions allow businesses to handle complex accounting tasks as they grow, from managing multiple entities and currencies to providing real-time insights across locations.

-

Can I access my financial data remotely with Giddh?

Yes, Giddh is a cloud-based solution, meaning you can access your financial data from anywhere, ensuring flexibility and efficiency for remote teams.