Finance Basics for Forecasting Revenue Growth

If you wish to be mighty, you should rise more often than you fall. But falling is something you cannot avoid. In business, you must make projections in order to forecast the falls and find ways to rise.

In the three-part series, we learnt to how to forecast expenses and then how to forecast revenues.

After you have done these projections, you will have a clear idea of how you are growing and at what rate. But how to make growth projections. Here’s how:

What Financial Forecasting Means

Financial forecasting is the process of estimating future revenue, expenses, and cash flow based on past financial data, market trends, business plans, and economic factors. By studying historical performance and current indicators, businesses gain clarity on likely financial outcomes and overall performance, supporting more thoughtful planning and growth decisions.

Although forecasts never guarantee exact results, they offer a structured way to prepare for risks and uncertainties. Business leaders rely on projections to set sales goals, manage inventory, plan hiring, and decide on investments. Forecast reliability depends strongly on data accuracy and the right choice of forecasting approach.

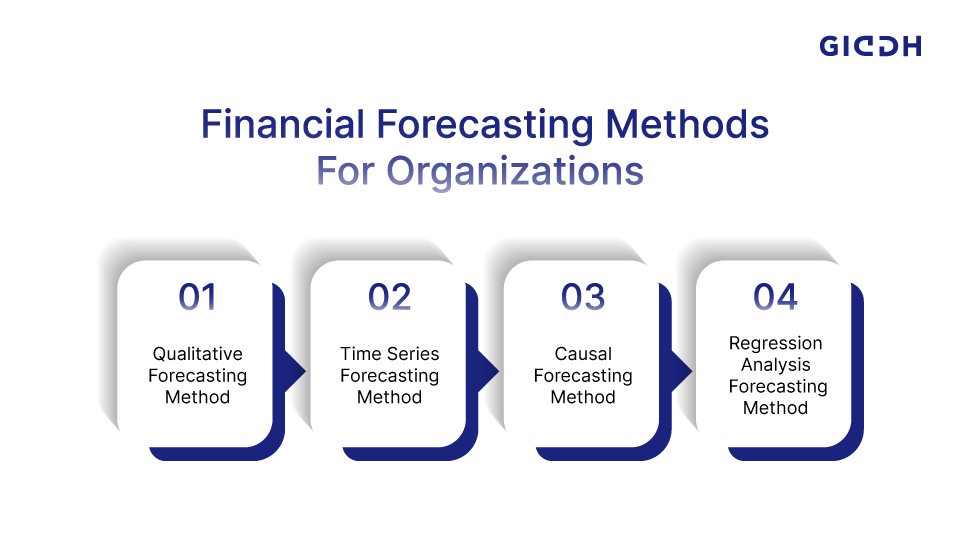

What Are the 4 Financial Forecasting Methods?

Financial forecasting methods help organizations predict future income, expenses, and cash flow using different data-driven and judgment-based approaches. Selection depends on data availability, business maturity, and forecasting goals. Below are four widely applied methods with detailed breakdowns.

1. Qualitative Forecasting Method

Based on expert judgment, market understanding, and industry knowledge rather than numerical past data. Best suited for new businesses, new product launches, or rapidly changing markets.

-

Input from industry experts, business leaders, and consultants

-

Sales team insights based on customer interactions

-

Customer surveys, feedback, and market research

-

Useful when historical data is unavailable or unreliable

-

Helps assess demand for new products or services

-

Quick to implement, flexible to changing conditions

-

May carry personal bias due to the opinion-based nature

2. Time Series Forecasting Method

Uses historical financial data to predict future performance by identifying past patterns and trends.

-

Analysis of past sales, revenue, expenses, and cash flow

-

Identification of seasonal trends and recurring cycles

-

Trend analysis to track long-term business direction

-

Moving averages to smooth data fluctuations

-

Suitable for stable businesses with consistent demand

-

Reliable for short-term and medium-term forecasting

-

Less effective during sudden market disruptions

3. Causal Forecasting Method

Built on a cause-and-effect relationship between business outcomes and external or internal influencing factors.

-

Links revenue with marketing spend, pricing, demand, or economic conditions

-

Studies the impact of market growth, inflation, and consumer behavior

-

Evaluates effect of production capacity and supply chain changes

-

Supports scenario-based forecasting and strategic planning

-

Useful for businesses sensitive to market drivers

-

Requires accurate identification of influencing variables

-

More complex than time series forecasting

4. Regression Analysis Forecasting Method

Statistical approach that measures how multiple independent variables affect financial outcomes.

-

Uses mathematical models to define variable relationships

-

Incorporates multiple factors such as pricing, promotions, footfall, and demand

-

Helps predict revenue, costs, and profitability

-

Supports multi-variable business planning

-

Data-driven and highly accurate when inputs are correct

-

Useful for large datasets and advanced forecasting

-

Requires strong data quality and analytical skills

Cross-Check Key Ratios Along With Your Projections

You learnt how to make aggressive revenue forecasts but that would also tempt you to overlook expenses. Don’t make that mistake. It’s convenient to assume that the expenses can be adjusted to accommodate real-time finances even if the revenue doesn’t really come as expected. You need to grow sales but you also need to pay your bills. So how do you reconcile both revenue and expense projections? By identifying key ratios. Here are some key ratios to consider:

Your Gross Margin

Find out the ratio of total direct costs to total revenue during a given year or quarter. You will typically find your aggressive assumptions looking unrealistic. But avoid assumptions that make your gross margin increase from 10 to 50 percent. If your expenses on customer service and direct sales are high now, they will only go up in the time to come.

Your Operating Profit Margin

Now find out the ratio of total operating costs-direct costs and overheard, excluding financing costs-to total revenue during a given period. Ideally you should have positive movement with this ratio. When your revenues grow, overhead costs should be a small proportion of total costs and your operating profit margin should become better. Don’t make the mistake of forecasting this break-even point too early and assuming you won’t need much financing to reach this point.

Get Total Headcount Per Client

This is especially essential if you are a sole proprietor and wish to grow the business on your own. Divide the number of employees at your company-which will be only one in case of your sole proprietorship-by the total number of clients you have. Now would you want to be managing all these accounts in five years as well? If not, do revisit your assumptions about revenue or payroll expenses or both.

Accuracy in growth projections is a matter of consistency. You need to continually make these projections to get better. Business planning and projections prepare your for unforeseen expenses in future.

A vital step towards getting quicker growth projections would be invest in a good cloud-based accounting software. We have got a customized accounting solution for you. Do give us a call.

How Giddh Supports Financial Forecasting for Businesses

Giddh online accounting and financial reporting software helps businesses manage financial data with clarity and control. Real-time accounting, automated reporting, and cloud-based access support accurate forecasting and long-term financial planning. Built for Indian startups, SMEs, accountants, and growing enterprises, Giddh simplifies complex financial processes while ensuring GST compliance.

By maintaining structured, up-to-date financial records, Giddh strengthens foundation required for reliable revenue forecasting, expense planning, cash flow management, and strategic decision-making.

Giddh Features That Help in Finance & Forecasting

-

Real-Time Accounting Data

Up-to-date income, expense, and cash flow visibility for accurate forecasting -

Automated Financial Reports

Profit & Loss, Balance Sheet, Trial Balance, and Cash Flow reports -

Multi-Company Accounting

Consolidated financial forecasting across multiple businesses -

Sales & Purchase Tracking

Clear demand and expense pattern analysis for time series forecasting -

GST-Ready Compliance

Structured tax data for safe financial projections -

Budgeting & Cost Control

Better expense planning and financial discipline -

Cloud-Based Access

Anytime, anywhere financial monitoring for leadership teams -

Role-Based Access Control

Secure data sharing for finance teams and business owners -

Invoice & Payment Tracking

Predictable cash inflow forecasting -

Data Accuracy & Audit Trail

Clean data foundation for regression and causal forecasting

Conclusion

Financial forecasting plays essential role in shaping business growth, stability, and profitability. By understanding and applying right forecasting methods—qualitative, time series, causal, and regression—businesses gain clarity over future revenue, expenses, and cash flow. Strong forecasting supports better budgeting, smarter investments, and informed strategic decisions.

However, forecasting accuracy depends heavily on quality of financial data. With real-time accounting, automated reports, and GST-ready compliance, Giddh empowers businesses with reliable financial foundation required for confident forecasting. Whether startup, SME, or growing enterprise, right forecasting strategy supported by powerful accounting tools like Giddh helps transform uncertainty into opportunity.