Basic Accounting Terms Every Aspiring Accountant Should Know

Key Highlights: Accounting Terms Dictionary

Accounting Terms A to Z:

1. Accounting Equation: Assets = Liabilities + Owner’s equity, representing the foundational relationship in accounting.

2. Assets: Economic items owned by the company that can be converted into cash, like cash, equipment, and property.

3. Balance Sheet: A snapshot of a business’s financial position, detailing assets, liabilities, and equity at a specific time.

4. Credit: An entry on the right-hand side of the ledger, indicating a decrease in assets or an increase in liabilities.

5. Debit: An entry on the left-hand side of the ledger, indicating an increase in assets or a decrease in liabilities.

6. Equity: The net worth of a business, calculated as assets minus liabilities; also refers to owners' capital contributions.

7. Expenses: The costs incurred in the process of doing business, including fixed, variable, accrued, and operational expenses.

8. Income Statement: A summary of a company’s revenues and expenses, showing profit or loss over a specific period.

9. Liabilities: Financial debts or obligations a business owes, classified as current or long-term.

10. Revenue: Income generated from the sale of services or goods provided by the business.

11. Statement of Cash Flow: A report summarizing the inflow and outflow of cash in a business over a specific period. |

Are you running a business but still find yourself confused by the many basic accounting terms you keep hearing?

You are not alone. Accounting is the backbone of every business, yet most people struggle to make sense of its concepts, functions, and processes. In this blog, you will understand these ideas in a simple way and learn the key terms, principles, and statements that form the base of modern accounting.

By the end, you will have a clear view of the essential basics needed to manage your financial records with confidence.

Basic Functions of Accounting

The main functions of accounting are:

- The collection, compilation, and storage of data for a business’s financial transactions.

- Accounting gathers data and information that can be utilized for decision making through managerial reports, financial statements, and strategic planning.

- Accounting helps to record and process the data accurately, effectively, and efficiently.

Key Objectives of Accounting

-

Recording: The accounting terminology meaning is to maintain a systematic, complete, and accurate record of all business transactions that can be retrieved and reviewed. A reliable financial record is the backbone of an accounting system. Systematic record-keeping will ensure analysis of the financial health of an organization.

-

Planning: Organizations should plan to allocate their limited capital and resources towards cash, labour, materials, machinery, and equipment at regular intervals. Budgeting is an important component of accounting. Budgeting helps to anticipate business needs and resources.

-

Decision: Accounting enables business decisions and helps develop policies efficiently to make organizational processes.

Some of the examples of decisions that can be undertaken with the help of accounting:

- Accounting lets you arrive at operating costs and other related costs involved in the manufacturing of the product. Also, it assists you in arriving at realistic and accurate pricing without being ambiguous.

- At the time of a shortage of funds to maximize profit.

- To make realistic decisions where the organization may need additional funding or financing.

- This is mostly the case in new product launches or when diversifying into a new business.

- The decision regarding credit lending to a customer or client.

-

Performance: By summarizing financial information, accounting helps in ascertaining the quantifiable measures such as sales, revenue, profit, and expenses. A key performance indicator helps in determining to compare themselves against their past performance as well as against competitors

-

Position: Financial positions of businesses are evaluated on the basis of financial statements. The financial position reflects the condition of a business and it helps to take major decisions for the organization.

It helps highlight – how much capital has been invested, utilization of funds in various heads, cumulative profit or loss, liabilities status, and the amount of cash, inventory, machinery, and other assets of the business. -

Liquidity: Accounting helps to meet the business’s financial commitments in real time by determining the fund position and other liquid resources from time to time to reduce the risk of bankruptcy. It is necessary to understand the liquidity position of a business for working capital management.

-

Financing: Accounting information is vital for the organization when there is a need for a bank loan or an investment by shareholders. It is mandatory to provide financial records (profit or loss for the previous five years) as well as the next three years of financial projections. This information will be required by the financiers to be verified by auditors.

-

Control: The prime objective of an accounting system is to place internal controls for the safeguarding of its valuable resources and assets of a business. The control function is required in the accounting policy of an organization to minimize the risk of fraudulent payment.

-

Accountability: Accounting provides an overall performance assessment report over a period of time that helps accountability across several stages of an organization.

-

Legal: Accounting provides financial rights and obligations by an accurate recording of payables, receivables, payments, and receipts of a business, and it is a legal requirement of any business. It requires an organization to maintain financial records and to share the report with its shareholders, tax authorities, and regulators on a regular basis.

Basic Accounting Terms and Concepts

Here are a few important basic accounting concepts and basic accounting principles you should know:

-

Accruals: Accounting transactions are recorded, revenue is recognized when earned, and expenses are recognized when assets are used. A business may recognize revenue/profits based on the cash received. Business records its expenses when they are incurred, rather than when they are paid.

-

Conservatism: In conservative financial statements, expenses are recognized earlier when there is a possibility that they will be incurred, whereas revenue is only recognized when there is a rational certainty that it will be realized.

-

Consistency: Once a business adopts to use a specific accounting method or policy, it should continue using it on a regular basis. By following this principle, useful comparisons of financial statements over multiple accounting periods can be made due to consistent data being used.

-

Economic Entity: The transactions of a business is considered a separate entity from its owner and must be kept separate from the business so there are no personal and business transactions in financial statements.

-

Going Concern: Based on the assumption that financial statements are prepared to anticipate the business is expected to continue indefinitely, and stipulates that revenue and expenses may be deferred.

-

Matching: The matching concept ensures the expenses related to revenue are recorded in the same period when the revenue was recognized in order to provide the company’s financial statements and an accurate picture of the profitability.

-

Materiality: Recording of all important transactions on the books of a company that reasonably influence the decision of the stakeholders, and the events that have an insignificant impact on the books can be overlooked.

What do you mean by Financial Accounting?

Many may wonder what financial accounting is. Financial accounting involves a process of collecting, recording, summarizing, and reporting of business transactions in a systematic manner over a period of time. It records and provides financial statements that include income and expense statements, cash flow statements, and the balance sheet. It also helps people outside the company, such as investors, creditors, suppliers, and customers.

Objectives of Financial Accounting

The core objective of financial accounting is to provide quantitative financial information that can be helpful for users in making decisions. It is a process by which an organization’s receivables and expenses are collected, recorded, measured, and finally presented as a financial statement to the stakeholders. The purpose of financial accounting is to assess the fund position and value of a company.

The three basic financial statements include:

-

Balance sheet: A balance sheet provides your business assets, liabilities, and equity on a particular date for a specific period.

-

Income statement: Income statements can be primarily useful to display net income over a specific period of time.

-

Cash-flow Statement: Cash-flow statements show an accurate picture of incoming and outgoing cash during a particular financial period.

Bookkeeping Basics

Bookkeeping is the recording of your all business transactions by following a systematic process that will produce a set of accounting records. Records include sales, expenses, assets, liabilities, and equity.

The bookkeeping process records all accounting transactions with the use of debits and credits. At the end of the financial period, these transactions form the basis of producing a trial balance and subsequently the income and expense statement, balance sheet, and cash flow statement.

What is Double Entry Bookkeeping?

It is a system of bookkeeping in which ledger accounts are maintained for assets, liabilities, capital, revenue, and expenses. The double entry has two equal sides known as a debit (left side) and credit (ride side).

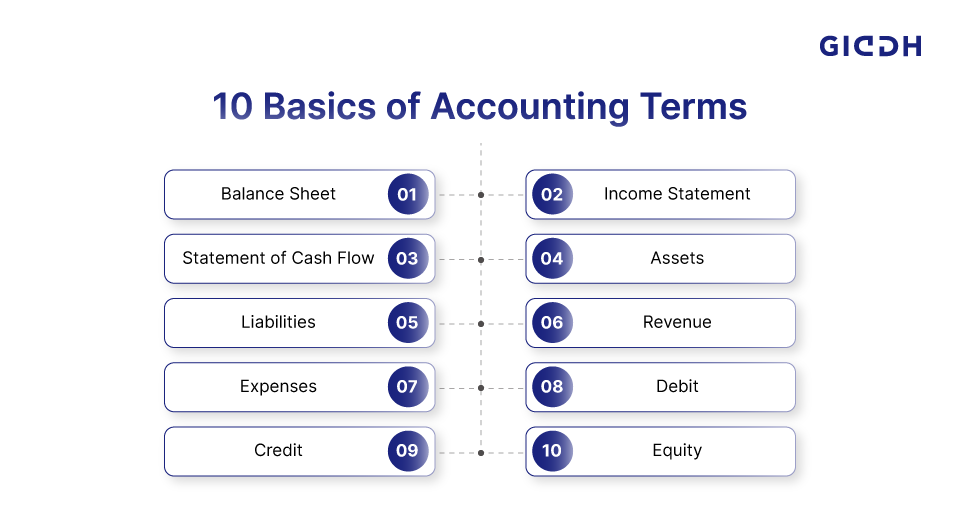

10 Basics of Accounting Terms You Should Know and Understand

-

Balance Sheet: A quantitative summary of a company’s financial position or condition at a particular period. It reports on a company’s assets, liabilities, and equities.

Accounting equation defines: Assets = Liabilities + Owner’s equity

-

Income Statement: The result of operations for an accounting period, summarized in the form of a specific format, is known as the income statement or profit and loss statement. Income = (Revenue – Expenses).

-

Statement of Cash Flow: A summary of actual or anticipated inflows and outflows of cash in a company over a financial period (month, quarter, year).

-

Assets: Any item of economic value owned by the company, particularly that could be converted in cash. Examples: current assets – cash in the bank accounts, petty cash, accounts receivable, and non-current assets – Equipment, land, building, and vehicles. Fixed assets are long-term. Also, an asset is further divided into tangible and intangible assets.

-

Liabilities: Financial obligations and debts incurred during the business operations that legally bind a company to settle a debt. Liabilities are divided into two categories.

Current liabilities are those debts that are payable within a specific period, such as a debt to suppliers, and long-term liabilities are typically payable over a longer period of time, more than one year, such as a multi-year mortgage for office space. -

Revenue: Usually, revenue is called income, any income earned by your business, either through products sold or services rendered to customers.

-

Expenses: Expenditure is an outflow of cash to trade for products or services. There are four types of expenses in the business: fixed, variable, accrued, and operational.

-

Debit: A debit entry is found on the left-hand side of the double-entry bookkeeping. An accounting entry reflects an increase in assets or a decrease in liabilities on a balance sheet.

-

Credit: A credit entry represents a transfer from the account and is found on the right-hand side of the double-entry bookkeeping. An accounting entry reflects that it may either decrease in assets or increase liabilities on a balance sheet.

-

Equity: In general, equity is assets minus liabilities. In other words, equity is the net assets of a business. Equity also refers to the amount of capital contributed by the owners.

Conclusion

We hope our Giddh guide was able to offer a refresher on key basic accounting concepts and basic accounting terms.

Understanding basic accounting concepts helps you read financial statements with clarity, make informed decisions, and manage your business with confidence. From recording transactions to interpreting financial performance, a strong accounting foundation supports every part of your operations. With the right tools and sufficient knowledge, anyone can handle accounting with ease.

FAQs

1. Why are basic accounting concepts important for businesses?

Basic concepts create a clear and consistent way to record and understand financial information. They help businesses stay organized, track performance, and make informed decisions without confusion.

2. What is the main purpose of financial accounting?

Financial accounting summarizes business transactions into statements like the balance sheet, income statement, and cash flow report. These statements help investors, lenders, and other stakeholders understand a company’s financial health.

3. How does bookkeeping differ from accounting?

Bookkeeping focuses on recording daily transactions in an organized manner. Accounting goes a step further by interpreting that data, preparing reports, and helping with planning and decision making.

4. What is double entry bookkeeping and why is it used?

Double entry bookkeeping records each transaction in two accounts—debit and credit—so the books always stay balanced. This method reduces errors and creates reliable financial records.

5. How do financial statements help in decision making?

Financial statements highlight profit, cash position, assets, and liabilities. When businesses review these reports regularly, they can plan better, control costs, and understand where they stand compared to past performance or competitors.