Bank Reconciliation Software Every Finance Manager Needs

Recent industry data shows that finance teams spend 25 to 30 percent of their close cycle resolving reconciliation mismatches across bank accounts, payment gateways, and internal ledgers. A 2024 report by BlackLine also highlights that over half of material accounting errors originate during reconciliation, mainly due to manual processes and spreadsheet dependency.

Transaction volumes are growing, bank accounts are multiplying, and payment methods continue to expand. Finance managers now oversee inflows and outflows across cards, UPI, wallets, and traditional banking channels. Manual reconciliation struggles to keep pace with this complexity. Delays become common, errors go unnoticed, and month-end closing becomes a pressure point rather than a routine process.

This shift explains why bank reconciliation software is no longer viewed as an optional add-on. Understanding why the bank reconciliation system is meaningful now directly impacts reporting accuracy, audit readiness, and leadership confidence. Automation has moved from convenience to necessity.

What Is a Bank Reconciliation System?

A bank reconciliation system compares transactions recorded in a company’s accounting books with transactions reflected in bank statements. The objective is to confirm balances, identify mismatches, and ensure financial records remain accurate and complete.

For finance managers, the difference between manual and automated reconciliation is operational clarity.

Manual reconciliation

- Spreadsheet-based tracking.

- High reliance on visual matching.

- Time-consuming reviews.

- Greater exposure to human error.

Automated reconciliation

- System-driven transaction matching.

- Rule-based logic for recurring entries.

- Exception-focused review.

- Faster and more reliable outcomes.

Bank reconciliation system software automates this comparison process, allowing finance teams to focus on discrepancies rather than reviewing every transaction line by line. This directly strengthens the financial accuracy solution and internal control.

Why Bank Reconciliation Is Important for Finance Managers

Bank reconciliation sits at the core of financial governance. It ensures that reported balances reflect actual cash positions.

Key reasons finance managers prioritise reconciliation include:

- Early detection of posting errors and timing differences.

- Identification of duplicate, missing, or unauthorised transactions.

- Faster month-end and year-end closing cycles.

- Reliable financial data for leadership and auditors.

Without regular and accurate reconciliation, financial reports lose credibility. Decisions are made using incomplete or incorrect data. This is why bank reconciliation system software plays a critical role in maintaining trust across finance operations.

Common Challenges Finance Managers Face Without Automation

Finance managers managing multiple bank accounts often rely on spreadsheets as a temporary solution. Over time, these spreadsheets become fragile, complex, and challenging to maintain.

Common challenges include:

- Heavy manual data entry across multiple files.

- Difficulty tracking transactions from different banks.

- Missed entries due to delayed bank statements.

- Duplicate postings from payment gateways.

- Reconciliation backlogs are delaying the financial close.

For finance leaders like Sarah, managing a growing organisation, reconciliation becomes reactive. Instead of daily visibility, issues surface at month-end when correction windows are limited. This increases stress, review time, and reporting risk.

How Automated Bank Reconciliation Software Solves These Problems

Core Capabilities Finance Managers Should Expect

Effective bank reconciliation software focuses on automation, accuracy, and control.

Key capabilities include:

- Automated transaction matching using predefined rules.

- Real-time bank feeds or statement imports.

- Exception handling for unmatched or suspicious entries.

- Audit-ready reconciliation reports.

Instead of reviewing thousands of transactions, finance teams focus only on mismatches. This shift significantly reduces effort while improving accuracy.

Benefits of Using Accurate Online Bank Reconciliation Software

Online bank reconciliation software delivers measurable operational improvements.

Primary benefits include:

- Reduced human error through system-driven logic.

- Faster reconciliation cycles during month-end.

- Improved cash visibility across accounts.

- Stronger internal controls without added workload.

Accurate bank reconciliation software allows finance managers to move from correction mode to control mode. Reporting becomes timely, reliable, and easier to validate.

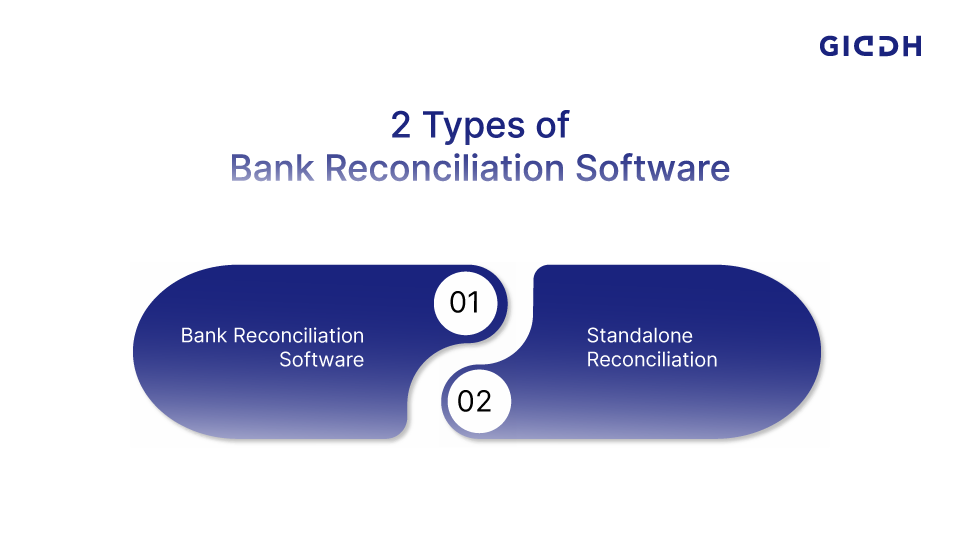

Types of Bank Reconciliation Software Available Today

Bank Reconciliation Accounting Software

Bank reconciliation accounting software includes reconciliation capabilities built directly into accounting platforms. Instead of working across multiple tools, finance teams reconcile transactions within the same system that records journal entries, ledgers, and financial statements.

This approach creates a single source of truth for cash and bank balances. Transactions flow from bank statements into the accounting system, where matching, validation, and adjustments occur without data duplication.

Best suited for:

-

Finance teams are seeking unified workflows across accounting and reconciliation.

-

Businesses managing high transaction volumes across multiple bank accounts.

-

Organisations prioritising end-to-end visibility from transaction entry to reporting.

Key advantages:

-

Direct linkage between bank transactions and ledger entries.

-

Faster issue resolution through contextual transaction details.

-

Reduced reconciliation delays during month-end and audit reviews.

-

Improved accuracy due to consistent data across modules.

Bank reconciliation accounting software reduces tool switching and manual handoffs. Reconciliation aligns directly with ledger activity, making it easier for finance managers to maintain control, track exceptions, and produce reliable reports.

Standalone Bank reconciliation

Standalone reconciliation tools focus only on matching bank statements with internal records. Bank reconciliation free software options fall into this category and are often used as entry-level solutions.

These tools are typically adopted when reconciliation needs are limited or temporary.

Typical scenarios include:

-

Small teams with low transaction volume.

-

Businesses with a single bank account.

-

Short-term reconciliation requirements.

-

Early-stage testing of automated reconciliation processes.

While these tools may address basic matching needs, they introduce constraints as operations grow.

Common limitations include:

-

Manual data uploads from banks and accounting systems.

-

Limited automation rules and matching logic.

-

Minimal exception handling and reporting.

-

Poor scalability as transaction volumes increase.

For growing businesses, standalone and free tools often create new inefficiencies. Finance teams spend time moving data between systems, reviewing unmatched entries manually, and compensating for missing controls. Over time, this erodes accuracy and delays financial close.

For long-term operations, finance managers typically move toward integrated bank reconciliation software that supports automation, scale, and reliable financial reporting.

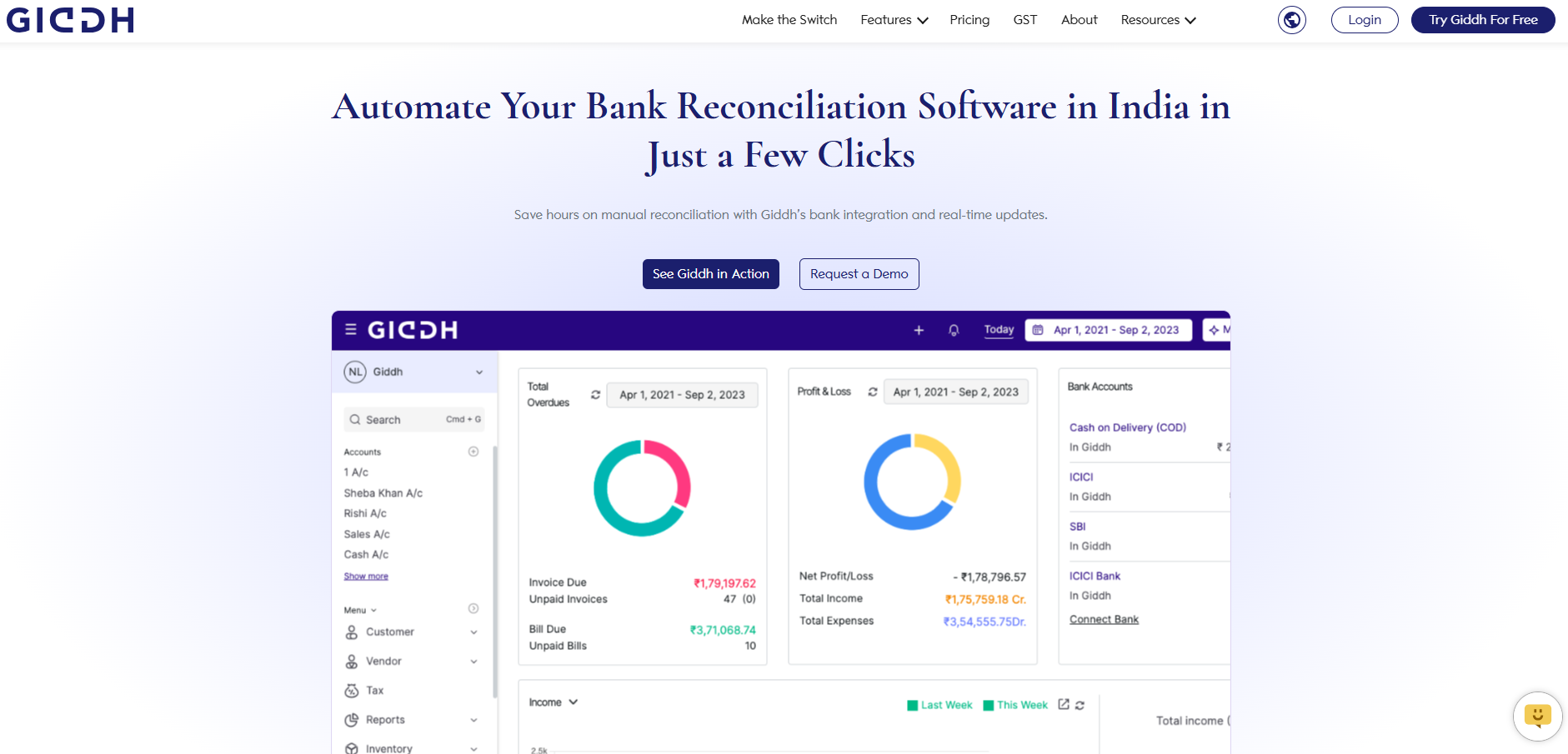

How Giddh Simplifies Bank Reconciliation for Finance Managers

Giddh’s Bank Reconciliation Capabilities

Giddh offers bank reconciliation system software built for small and mid-sized finance teams that need accuracy, scale, and control without operational complexity. The platform integrates reconciliation directly into accounting workflows, allowing finance managers to monitor cash positions and resolve discrepancies in real time.

Core reconciliation capabilities include:

- Automated matching of bank statement entries with accounting records

- Direct linkage between bank transactions and ledgers

- Real-time visibility across multiple bank accounts

- Clear exception tracking to resolve mismatches quickly

By embedding reconciliation into daily accounting operations, Giddh eliminates spreadsheet dependency and reduces manual follow-ups during month-end closing.

🔗 Tool reference: https://giddh.com/in

Giddh’s Key Feature

Giddh goes beyond reconciliation by offering a complete financial management ecosystem. Each feature supports operational efficiency, compliance, and scalability.

GST Compliance

Giddh is built to support GST-compliant accounting for Indian businesses. Ensures accurate tax calculation, reporting, and filing readiness.

Key capabilities:

- GST-ready invoices and ledgers

- Automatic tax calculations

- Compliance aligned reporting for audits and filings

- Reduced risk of tax mismatches

Multi-Currency Support

Designed for businesses handling international transactions.

Overview:

Manages foreign currency transactions with accurate conversion and reporting.

Key capabilities:

- Real-time currency conversion.

- Multi-currency accounting bank reconciliation.

- Accurate exchange gain and loss tracking.

- Consolidated financial reporting.

White-Label Option

Ideal for accounting firms and partners.

Overview:

Allows businesses to brand the platform under their own identity.

Key capabilities:

- Custom logo and brand elements.

- Client-facing reports with firm branding.

- Professional presentation for accounting services.

Unlimited User Access

Built for collaboration across finance teams.

Overview:

Supports multiple users without additional access costs.

Key capabilities:

- Role-based access control

- Collaboration across finance and audit teams

- Secure permission management

Manage Over 100 Companies

Designed for accounting firms and multi-entity businesses.

Overview:

Handles accounting and reconciliation across multiple companies from one dashboard.

Key capabilities:

- Centralised company management

- Separate books and reports per entity

- Easy switching between company accounts

Asset Management

Supports tracking and control of business assets. Manages asset lifecycle from acquisition to depreciation.

Key capabilities:

- Automated depreciation calculations

- Asset categorisation and reporting

- Accurate balance sheet reflection

Inventory Management

Built for businesses with stock movement. Tracks inventory levels and valuation in real time.

Key capabilities:

- Stock movement tracking

- Inventory accounting valuation reports

- Integration with invoicing and accounting

Bank Reconciliation

Core strength of the Giddh platform. Automates reconciliation across multiple bank accounts.

Key capabilities:

- Statement-based transaction matching

- Real-time reconciliation status

- Exception handling for unmatched entries

- Audit-ready reconciliation reports

Invoice Management

Supports end-to-end billing operations. Manages invoices from creation to payment tracking.

Key capabilities:

- GST-compliant invoicing

- Automated invoice posting to ledgers

- Payment status tracking

- Reduced billing errors

Barcode Support

Optimised for inventory-driven businesses.Improves accuracy in inventory and billing processes.

Key capabilities:

- Barcode-based item identification

- Faster billing and stock updates

- Reduced manual entry errors

Why Finance Managers Choose Giddh

Finance managers select Giddh because it balances automation with financial control.

Key reasons teams adopt Giddh:

- Faster bank reconciliation cycles with minimal manual review

- Reduced operational friction during month-end closing

- Scalable architecture supporting business growth

- Cost-effective solution for SMB finance teams

Giddh enables finance teams to maintain accurate books, manage compliance, and complete reconciliation without complexity. The result is predictable financial operations, clearer reporting, and better decision support.

Final Takeaway: Automate Reconciliation, Regain Financial Control

Manual reconciliation creates hidden costs. Time lost on spreadsheets, errors discovered late, and delayed reporting all impact financial confidence. As transaction volumes increase, these issues compound.

Automated bank reconciliation software replaces reactive correction with proactive control. It ensures that books reflect real cash positions, that discrepancies surface early, and that finance teams operate with clarity. For finance managers and accountants, reconciliation should support decision-making rather than slow it down.

Choosing the right bank reconciliation software means fewer errors, faster closings, and greater trust in financial data. Automation is no longer about efficiency alone. It has become a foundational requirement for accurate, scalable financial operations.

👉 Request a free demo today and experience how our bank reconciliation software can simplify your financial operations!

FAQs

What is bank reconciliation system software?

Bank reconciliation system software automatically compares bank transactions with accounting records to identify mismatches and ensure accurate balances.

Why is bank reconciliation important for businesses?

It helps detect errors, prevent fraud, improve reporting accuracy, and maintain reliable financial data for decision-making.

Is bank reconciliation free software sufficient for growing teams?

Free tools may work for basic needs but often lack automation, scalability, and integration required for higher transaction volumes.

How does online bank reconciliation software improve efficiency?

It automates transaction matching, reduces manual review, and provides real-time visibility into bank balances.

How should finance managers choose the best bank reconciliation software?

Evaluate automation depth, multi-bank support, accounting integration, ease of use, and long-term operational efficiency.