Top Bookkeeping Tips for Businesses to Save Time and Reduce Errors

TL;DR: Manual bookkeeping can be time-consuming and prone to costly errors—automation is the smarter path. Using the right software and apps specifically designed for SMEs allows you to streamline operations and stay compliant with VAT. We’ll walk you through practical tips—from separating personal finances to weekly rituals—and show you how intuitive tools make it all easier. 👉 Bonus: Discover how Giddh can automate bookkeeping for businesses, reduce errors, and free up your time.

A recent study found that nearly 60% of small businesses struggle to keep their financial records up to date, resulting in inaccurate books and increased tax-time stress.

Managing bookkeeping for businesses isn’t just about tracking receipts—it’s about avoiding fines, maintaining cash flow, and running a business that scales.

Whether you’re a business owner or a finance manager juggling VAT compliance, invoices, and reporting, this guide outlines actionable bookkeeping tips and tricks to reclaim time, reduce errors, and lay the foundation for smooth growth.

Bookkeeping vs Accounting (and Why It Matters)

Before you tackle “bookkeeping for businesses,” you need to understand what it really means—and how it differs from accounting.

-

Bookkeeping is the daily task of recording transactions, including income, expenses, invoices, and reconciliations.

-

Accounting takes that data and interprets it, providing financial statements, tax reporting, and strategic insights.

For small to mid‑sized businesses, confusing the two can lead to: -

Missing or misclassified transactions.

-

Poorly timed GST filings and penalties.

-

Lack of clarity on cash flow or profitability.

Bottom‑line: Focusing on “bookkeeping for businesses” ensures your foundation is solid, so any later accounting or reporting rests on correct data.

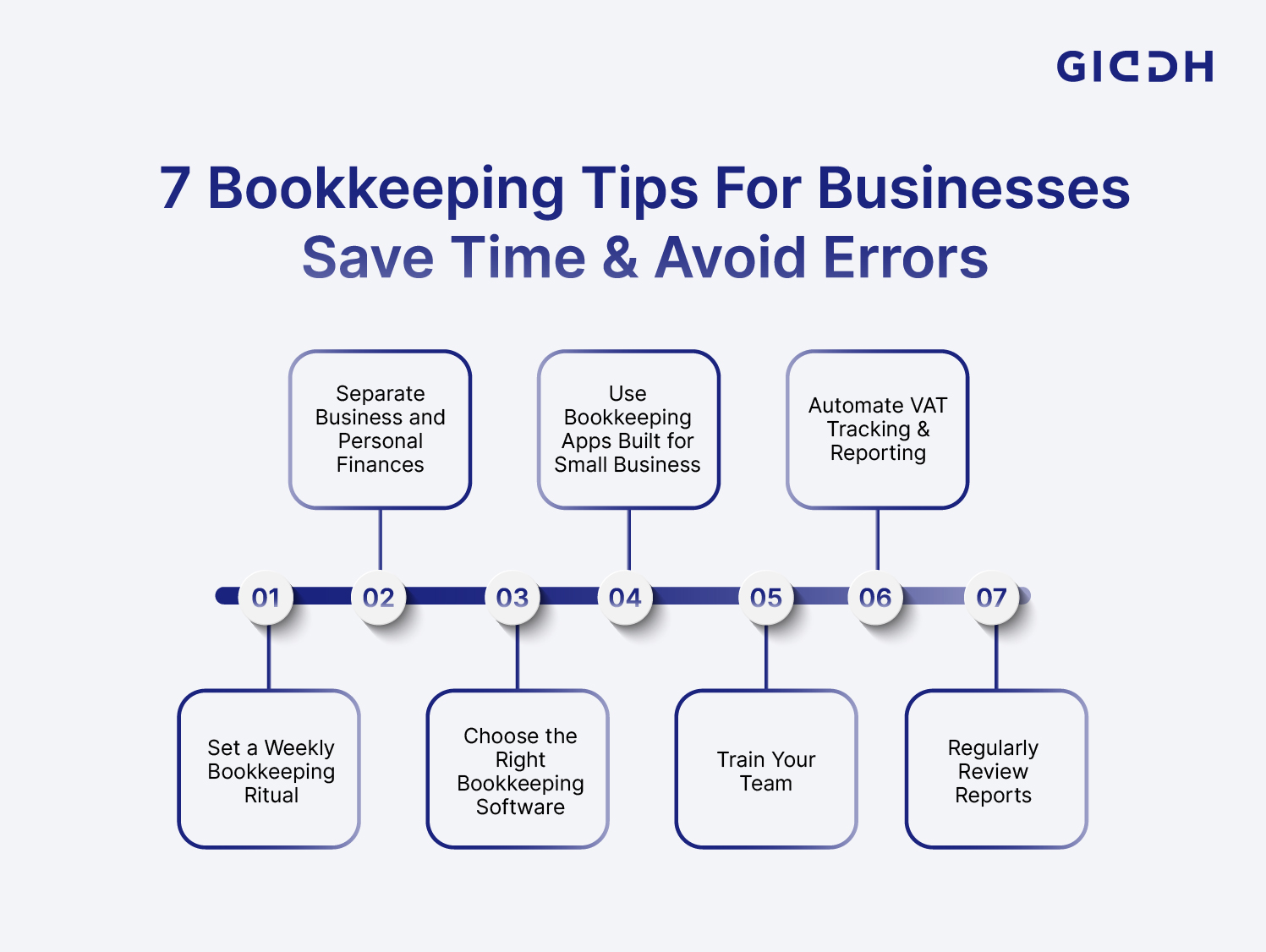

7 Bookkeeping Tips to Help Businesses Save Time & Avoid Errors

✅ Tip #1: Keep It Clean — Separate Business and Personal Finances

One of the most damaging mistakes small businesses make is mixing personal and business finances. It blurs cash flow visibility, complicates VAT filing, and makes audits a nightmare.

Here’s why it’s a top problem:

-

Personal purchases are often misclassified as business expenses, resulting in inaccurate records.

-

You risk overstating deductions, which can lead to potential fines or rejections.

-

Tax-time reconciliation takes longer when entries have to be manually sorted.

How to set it up correctly:

-

Open a dedicated business bank account. Keep all income and expenses flowing through this channel.

-

Get a separate business credit/debit card. Avoid using your personal card, even temporarily.

-

Use your software to categorize transactions automatically. Tools like Giddh enable real-time syncing, keeping business expenses separate by default.

Bonus: Clean books make audits smoother, tax prep faster, and business health easier to assess. This one change simplifies everything else that follows.

✅ Tip #2: Go Digital — Use Bookkeeping Apps Built for Small Business

Still using Excel sheets or paper logs? You’re doing more work than needed—and increasing your error margin.

Manual methods lead to:

-

Misplaced receipts.

-

Data entry errors.

-

Forgotten or double-recorded transactions.

-

Difficulty in collaboration across departments.

Why small businesses need dedicated bookkeeping apps:

-

They reduce human error with automation.

-

They centralize financial data.

-

They’re designed for non-accountants, featuring simple and intuitive dashboards.

Compare top app features to look for:

-

Bank feed integration – syncs live with your accounts.

-

Invoice generation – create, send, and track invoices from a single location.

-

Mobile receipt capture – upload bills on the go.

-

Tax-ready reports – get VAT/GST summaries automatically.

Must-have integrations:

-

Banking platforms.

-

Payment gateways (Razorpay, Paytm).

-

Payroll systems.

-

Tax portals (GST Network in India).

Digital bookkeeping solution isn’t just more efficient—it’s more compliant.

✅ Tip #3: Automate VAT Tracking & Reporting to Avoid Penalties

Incorrect VAT filings are one of the most common—and costly—mistakes for SMEs. Many teams still use spreadsheets, relying on manual input, which can lead to late fees or audit red flags.

Why automation matters:

-

Real-time compliance: Automatically tag transactions with correct VAT categories.

-

Avoid late penalties: Set reminders and auto-generate returns before the due date to ensure timely submission.

-

Error-free calculations: The system handles percentages and special exemptions.

Example: A Mumbai-based SME missed its quarterly VAT deadline and was fined ₹10,000 due to errors in manual entry. After switching to automated software like Giddh, their compliance rate hit 100%.

With automation, you shift from reactive fire-fighting to proactive control.

✅ Tip #4: Set a Weekly Bookkeeping Ritual (It Takes Less Time Than You Think)

Waiting until the end of the month or quarter to review your books is asking for stress. Minor issues compound fast.

Instead, carve out 30–45 minutes every week to:

-

Reconcile your bank and card transactions.

-

Check for unpaid invoices or overdue bills.

-

Validate VAT tags and check for anomalies.

-

Review weekly cash inflows vs. outflows.

-

Archive receipts and invoices in the system.

Use a simple checklist:

-

✅ Transactions imported and matched.

-

✅ Invoices sent and followed up.

-

✅ Expenses categorized.

-

✅ VAT liability updated.

-

✅ Notes added for special entries.

A weekly rhythm keeps your books clean and your stress low.

✅ Tip #5: Choose the Right Software — Built for Indian SMBs

Many global tools don’t fully cater to Indian accounting needs. They lack support for GST norms, Indian banking formats, or local customer support.

What most international tools miss:

-

Indian-style invoice templates (with GSTIN fields).

-

E-invoicing solution & TDS support.

-

Multi-currency with INR as default.

-

Indian payment gateway integrations.

Checklist to evaluate software for Indian SMBs:

-

🇮🇳 Localization: GST-ready invoices, multi-language support.

-

🔄 Integration: Works with Tally, ZohoBooks, Razorpay, and Indian banks.

-

📱 Ease of use: Shouldn’t need an accountant to navigate.

-

🕒 Real-time compliance: Auto-generated GST reports, return-ready.

-

📊 Reporting: Clear financial dashboards customized for Indian formats.

Choose the best accounting software made for your market—otherwise, you’ll be manually fixing gaps the system should solve.

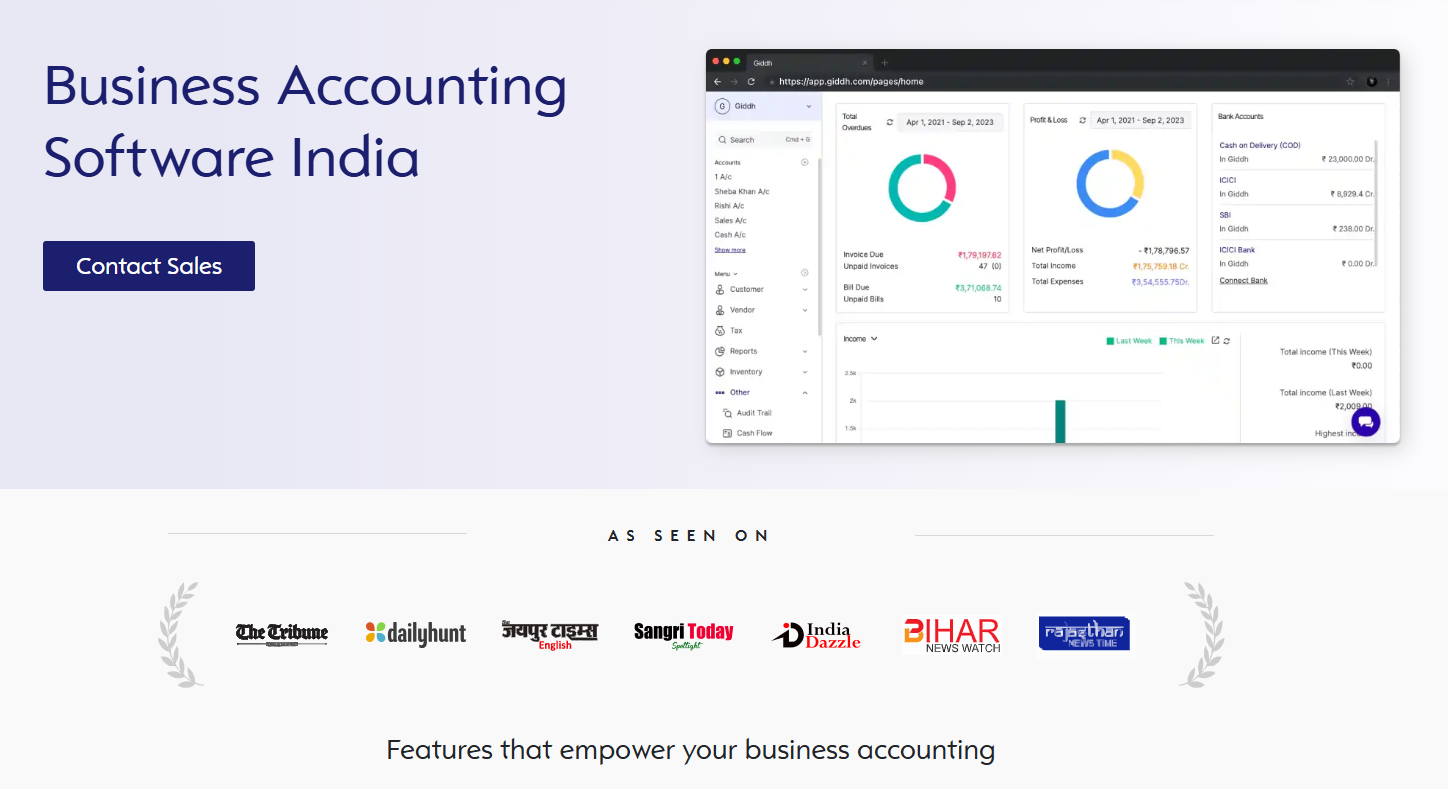

✅ Giddh — Best Bookkeeping Solution That Works for You

Giddh is a cloud-based bookkeeping platform built for Indian businesses—and designed to eliminate the pain points you’ve just read about.

Here’s what Giddh does best:

-

Syncs live with your bank accounts and auto-records transactions.

-

Tracks GST/VAT in real time and generates tax-ready reports.

-

Offers Indian invoice formats with QR codes and e-invoicing.

-

Supports team collaboration with different user access levels.

-

Integrates seamlessly with other Indian tools, such as Tally and Razorpay.

Why businesses love it:

-

Saves up to 60% of time spent on manual bookkeeping.

-

Reduces error-related penalties by automating tax logic.

-

Helps finance managers focus on strategy—not spreadsheets.

✅ Tip #6: Train Your Team (Even Non-Finance Folks Can Handle This)

Your software is only as effective as the people using it. Most small teams don’t have dedicated bookkeepers, so your staff must know how to log and track correctly.

Here’s how to make it work:

-

Create step-by-step SOPs for invoice creation, payment logging, and receipt capture.

-

Use in-app tutorials and documentation for self-paced onboarding.

-

Assign clear roles: who enters expenses, who verifies entries, who checks reports.

-

Encourage use of tags and categories for each entry (e.g., Travel, Office Supplies, GST Applicable).

Why this matters:

-

Reduces data entry errors.

-

Builds internal accountability.

-

Keeps your books audit-ready without extra hires.

With Giddh’s simple UI, even your operations or admin staff can handle 80% of entries—freeing up your finance lead for strategic tasks.

✅ Tip #7: Regularly Review Reports — Especially Before Tax Season

Recording transactions is just half the work. Reviewing them regularly helps you catch mistakes and gain a better understanding of your financial direction.

Every month or quarter, review these key reports:

-

Trial balance: Ensures debit and credit balances match.

-

Cash flow report: Know how much money is actually moving in and out.

-

VAT summary: Ensure filings match collected tax.

-

Accounts receivable: Who still owes you and how long it's been.

-

Profit and loss: Quick snapshot of performance vs expenses

Watch for red flags:

-

Duplicate entries.

-

Transactions without GST tags.

-

Unmatched bank feeds.

-

Suspiciously high expenses in one category.

Tools like Giddh can highlight these anomalies with color-coded alerts and suggestions—so you don’t miss critical issues before deadlines.

Conclusion

Good bookkeeping isn’t a chore—it’s a time‑saving, error‑reducing engine for your business. If you set up the right systems, establish smart habits, and choose the right tools, you give yourself clarity, control, and compliance.

For small to mid‑sized businesses managing VAT, invoices, and growth, the difference between manual chaos and automated precision is massive. With Giddh, you have a partner built for your market, built to address your challenges.

👉 Ready to streamline your bookkeeping and save hours every week? Sign up for a FREE trial with Giddh today.

FAQ

Q1: What is the difference between bookkeeping and accounting?

A: Bookkeeping involves recording and organising transactions day‑to‑day. Accounting interprets that data into reports, tax filings, and strategic decisions.

Q2: Can I use any bookkeeping app, or do I need one specifically for small businesses?

A: You should choose an app designed for small business needs—bank‑feed automation, invoice tracking, VAT/GST tagging, and scalability.

Q3: How often should I review my bookkeeping?

A: Set a weekly ritual for basics and monthly/quarterly reviews for deeper insights and readiness before tax season.

Q4: Will using bookkeeping software eliminate all errors?

A: It significantly reduces human error and calculation risk, but you still need regular reviews and proper tagging to catch anomalies.

Q5: Do I need a separate bookkeeper if I use software?

A: Not necessarily. With the right software and team training, you can manage bookkeeping internally. But growth or complexity might signal the time to bring in a professional.