Cloud Accounting Software Pricing 2026: Complete Cost Breakdown & ROI Analysis

The accounting landscape is rapidly changing, with cloud-based solutions becoming the preferred choice for businesses aiming to scale efficiently. According to a recent report, over 50% of businesses globally have already transitioned to cloud accounting, and that number is expected to continue growing sharply in 2026. With more small businesses seeking cost-effective, scalable financial solutions, cloud accounting is proving to be a game-changer.

So, what’s driving this shift? For many, it’s about ditching outdated, manual processes in favor of more efficient, accurate, and transparent systems. As small to medium-sized businesses (SMBs) and enterprises evaluate their accounting tools, the need for a clear pricing structure and return on investment (ROI) is more crucial than ever.

Ready to explore cloud accounting software pricing? Keep reading for a complete pricing breakdown and ROI analysis to make the best choice for your business.

What is Cloud Accounting Software?

Cloud accounting software is a digital tool that allows businesses to manage their financial transactions online. Unlike traditional accounting systems that rely on desktop software or paper records, cloud accounting software is hosted in the cloud, enabling businesses to access their financial data anywhere and at any time with an internet connection.

Key Benefits:

-

Flexibility: Easily access data from anywhere, whether on-site or remotely.

-

Scalability: Can grow with your business, adding features as needed.

-

Real-Time Updates: Keeps your financial data updated in real time.

-

Reduced Manual Processes: Automates tasks such as invoicing, reconciliation, and expense tracking.

With real-time financial reporting, automatic updates, and seamless integration with other business tools, cloud accounting software helps businesses streamline operations and reduce manual entry errors.

How It Works

Cloud accounting software securely stores your financial data online, accessible via a web browser or mobile app. Integration with tools such as payment gateways, tax management systems, and other small-business accounting software further enhances its utility. For small businesses, this means less time spent on repetitive tasks and more focus on core business activities.

Example:

A small business using cloud accounting software can automatically track expenses, manage invoicing, and even integrate directly with their bank account for smoother reconciliation.

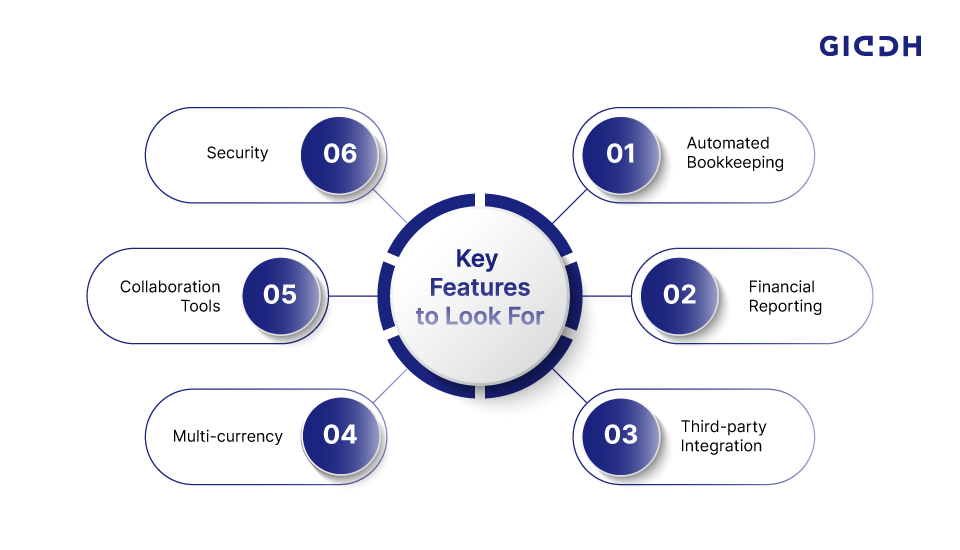

Key Features and Pricing Models of Cloud Accounting Software

When evaluating cloud accounting software, there are several key features that set the best apart from the rest:

-

Automated Bookkeeping: Automatically syncs your business transactions to maintain accurate books.

-

Real-Time Financial Reporting: Provides live financial insights for timely decision-making.

-

Third-Party Tool Integration: Easily integrates with CRM, payroll, and tax systems.

-

Multi-Currency and Tax Management: Essential for international businesses with global transactions.

-

Collaboration Tools: Allows multiple users to collaborate seamlessly on the platform.

-

Security: Cloud-based systems typically provide robust data encryption and automatic backups to safeguard sensitive financial information.

Pricing Models

The pricing for cloud accounting software varies widely depending on the model and the business’s needs:

-

Subscription-Based Pricing: Monthly or annual subscriptions are the most common pricing structure. Typically, the price scales with the number of users or features.

-

Per-User Pricing: Ideal for SMBs, where costs are proportional to the number of users who require access to the platform.

-

Freemium Options: Many platforms offer free versions with basic features, allowing businesses to start without an upfront cost (e.g., free cloud accounting software). These are often ideal for startups but may require upgrades as the business grows.

Factors Affecting Pricing

Several factors influence cloud accounting software pricing:

-

Business Size: Pricing often differs for small businesses versus larger enterprises.

-

User Count: Many platforms charge per user, so larger teams may face higher costs.

-

Features Required: Advanced features like multi-currency support, custom reports, and integrations can increase costs.

-

Industry-Specific Needs: Retail businesses with complex inventory management, for example, may need more specialized solutions.

Cloud Accounting Software Pricing 2026: The Complete Breakdown

Pricing Trends in 2026

In 2026, the trend in cloud accounting software pricing will continue to shift towards more competitive, flexible options. As the market matures, pricing is likely to become more granular, allowing businesses to pay only for the features they need. Expect to see:

-

Tiered Pricing: Software platforms offering multiple levels of service depending on the business’s requirements.

-

Pay-As-You-Go: Some providers may shift to a more flexible pricing model based on actual usage (e.g., transaction volume).

Price Ranges for Popular Cloud Accounting Software

-

Small Business Cloud Accounting Software: Platforms like QuickBooks and Xero offer basic features starting at $12- $25 per month.

-

Mid-Market Solutions: More robust solutions like FreshBooks or Zoho Books can range from $30 to $50 per month for small to medium-sized businesses.

-

Enterprise Solutions: Advanced platforms like Sage and Oracle can start at $100 per month or more, depending on the size and complexity of the business.

Hidden Costs

While many cloud accounting tools offer transparent pricing, hidden costs can sometimes arise:

-

Setup Fees: Some platforms charge an initial setup or customization fee.

-

Support Costs: While many offer basic support, advanced help may require additional fees.

-

Premium Features: Many platforms offer add-ons for features such as payroll, advanced reporting, or tax management.

Case Study Example

Business A: A small business using Xero (priced at $20/month) for basic accounting saw significant efficiency gains after automating invoicing and expense tracking.

Business B: A mid-market business using FreshBooks for $45/month experienced increased scalability as it added more users and integrated additional features.

ROI Analysis: Is Cloud Accounting Software Worth the Investment?

Calculating ROI

For businesses evaluating the ROI of cloud accounting software, several metrics are essential:

-

Time Savings: Automating accounting tasks can save hours per week.

-

Improved Accuracy: Cloud accounting reduces human error and ensures financial accuracy.

-

Scalability: Cloud software grows with your business, offering features as needed.

Businesses can calculate ROI by measuring:

-

Time saved by automating bookkeeping tasks.

-

Reduced errors leading to fewer costly mistakes or audits.

-

Improved decision-making based on real-time financial insights.

Long-Term Benefits

-

Cost Savings: Moving to cloud accounting can reduce hardware costs, manual processes, and the need for expensive on-site software updates.

-

Operational Efficiency: By streamlining workflows, cloud accounting software enables businesses to make faster, more informed decisions.

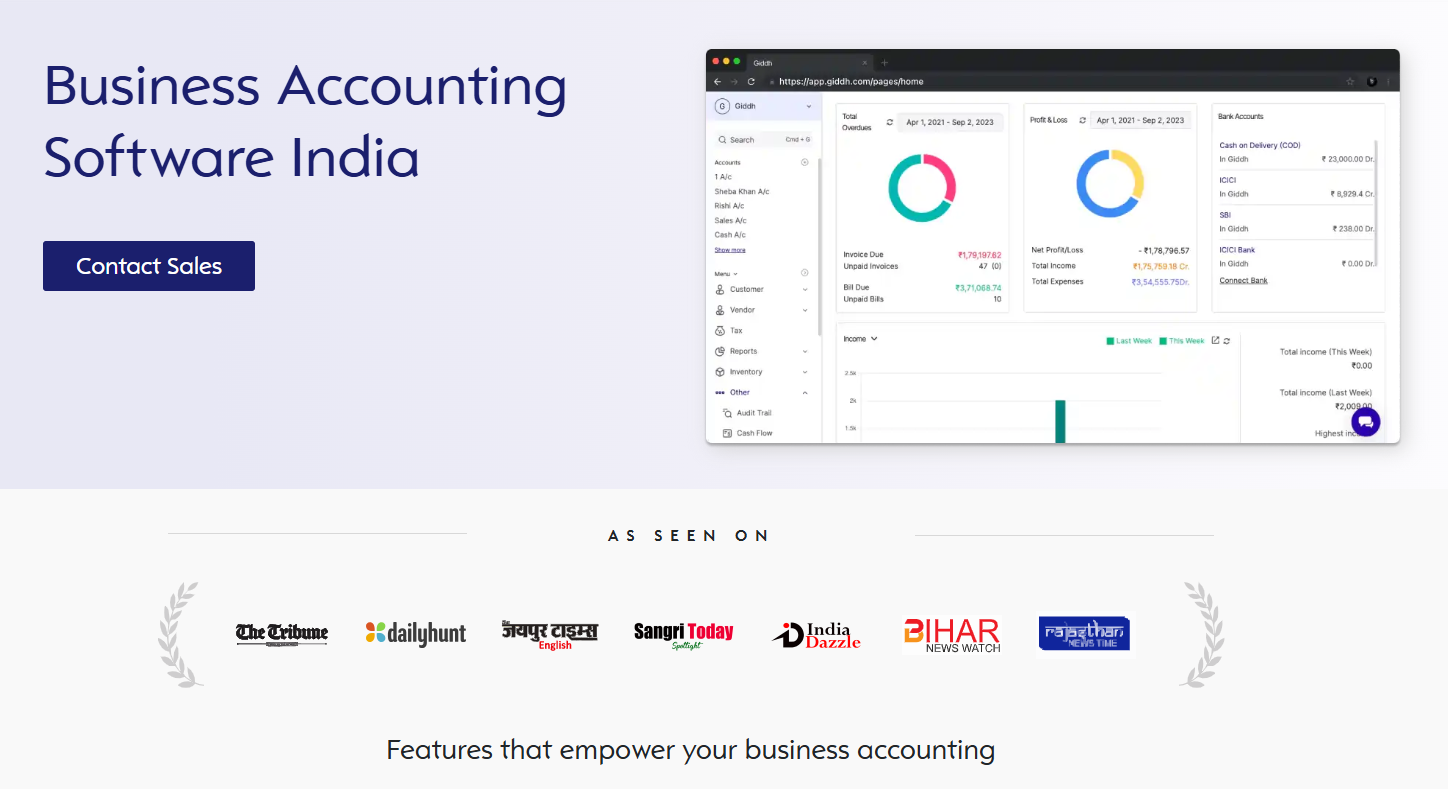

Best Cloud Accounting Software for India

In India, localized solutions like Giddh stand out by offering features tailored to the Indian market, such as GST reporting, multi-currency support, and integration with local payment gateways.

Giddh: Your Ideal Cloud Accounting Solution

Giddh is an affordable, scalable cloud accounting tool specifically designed for businesses in India. It offers everything from real-time accounting to seamless GST integration, making it the perfect solution for both small businesses and growing enterprises.

Key Features:

-

Real-Time Accounting: Track your finances in real-time for faster decision-making.

-

Seamless GST Integration: Automatically generate GST-compliant invoices and reports.

-

Multi-Currency & Multi-User Support: Ideal for businesses with global transactions and teams.

-

Customizable Features: Tailor reports and workflows to fit your business needs.

-

Advanced Reporting: Generate detailed financial reports with ease.

-

Cloud Storage & Backup: Secure data backup in the cloud, accessible anytime, anywhere.

Costing:

Giddh offers flexible pricing plans that grow with your business:

-

Affordable for Small Businesses: Cost-effective plans to suit your budget.

-

Scalable for Enterprises: More advanced features as your needs expand.

Why Giddh?

Giddh combines affordability with robust features, making it the ideal choice for businesses in India looking for a scalable, efficient accounting solution.

Factors to Consider Before Making a Final Decision

-

Customization Needs: Does the software align with your unique business processes?

-

Support and Training: Is ongoing customer support available for easy onboarding?

-

Scalability: Will the software continue to meet your needs as your business grows?

-

Security: Ensure the platform has strong encryption and secure backup options.

Conclusion

In 2026, cloud accounting software is not just a trend but a necessity for businesses looking to streamline their financial operations. With flexible pricing models, real-time data, and significant ROI potential, transitioning to cloud-based accounting solutions can revolutionize the way your business handles finances.

Whether you are just starting or scaling your operations, cloud accounting offers unparalleled advantages.

Now that you have a clear breakdown of cloud accounting software pricing and ROI expectations, it’s time to make an informed decision.

Explore our guide to find the right software for your business and start optimizing your financial processes today!

FAQ

1. What is the best cloud accounting software for small businesses?

The best cloud accounting software for small businesses includes QuickBooks, Xero, and Giddh, depending on your scalability and feature needs.

2. How much does cloud accounting software cost?

Pricing ranges from $12/month for basic plans to $100+ per month for advanced enterprise solutions. Costs can also vary based on the number of users and required features.

3. Is cloud accounting software safe?

Yes, most cloud accounting software platforms use high-level encryption, regular backups, and secure login protocols to protect your data.

4. What is the ROI of cloud accounting software?

The ROI of cloud accounting software is often seen in time savings, improved accuracy, and operational efficiency, with businesses reporting significant cost reductions over time.