Xero Competitors: Which Ones Offer the Best Value for Money?

Did you know that the global accounting software market is expected to reach $20.1 billion by 2026, growing at a CAGR of 8.5%? This rapid growth is driven by businesses of all sizes looking for efficient, scalable, and cost-effective solutions for their financial management needs.

Among the most popular options is Xero, a cloud-based accounting software that has gained significant traction with small businesses worldwide. However, many companies are now exploring Xero competitors as they seek better value for money, more relevant features, or lower operational costs.

In this article, we’ll review the best Xero alternatives, diving into the strengths and weaknesses of each competitor. We’ll particularly focus on tools that offer excellent value for money, ensuring that your investment works hard for your business. One of the standout options is Giddh, which combines affordability, ease of use, and scalability, making it a strong contender for SMEs looking for a streamlined accounting solution.

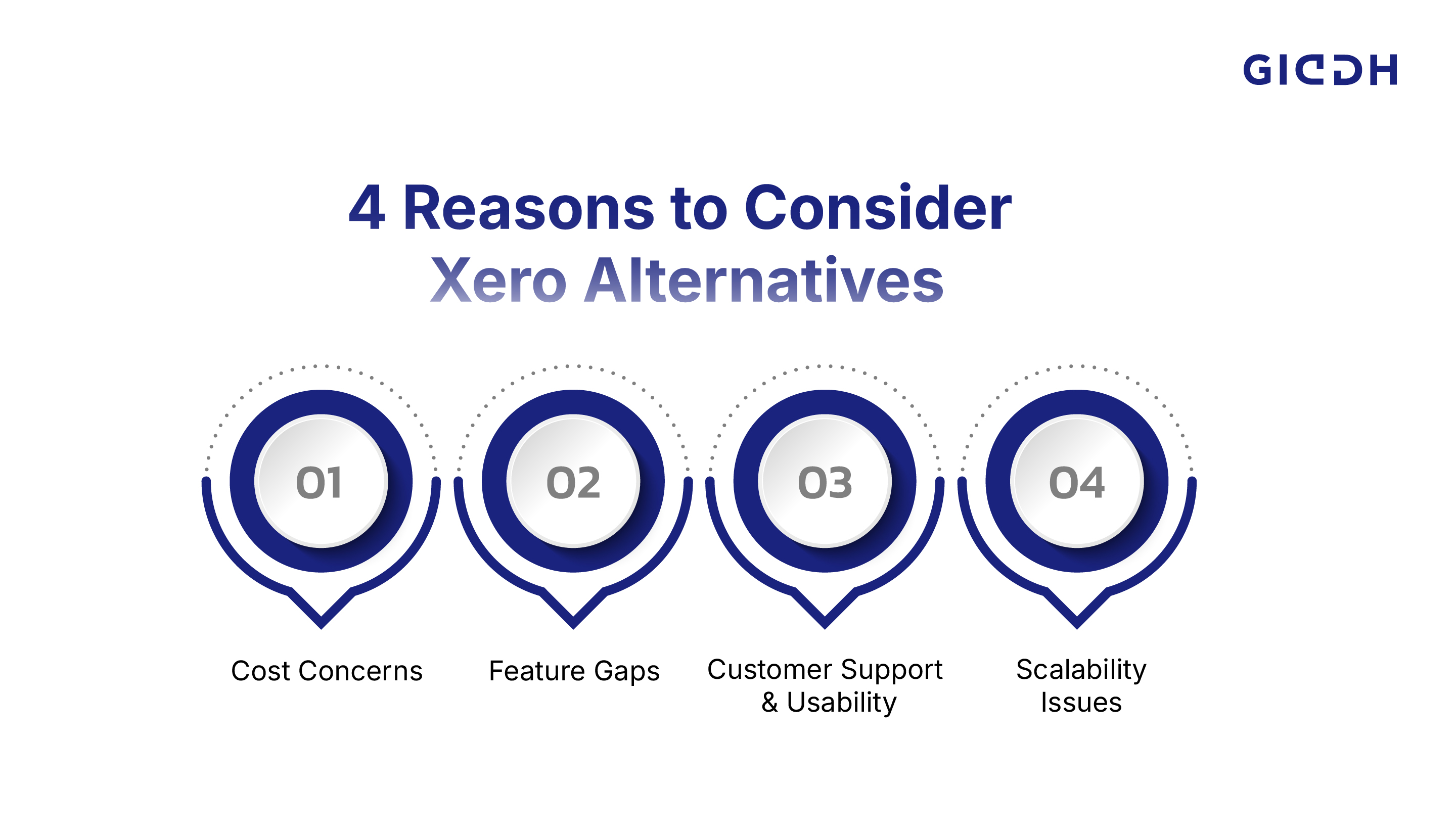

Why Are Businesses Looking for Xero Alternatives?

While Xero is a powerful and popular choice for many businesses, there are several reasons why it may not be the ideal fit for all organizations, especially small and medium-sized ones. Here are the main factors that drive businesses to seek Xero alternatives:

-

Cost Concerns

Xero’s pricing can be a bit steep for businesses with tight budgets. With plans starting at $12 per month and going up to $65 per month for more advanced features, some enterprises find that the cost outweighs the benefits. Smaller businesses or startups may not be able to justify these ongoing costs, especially if their accounting needs are minimal.

-

Feature Gaps

While Xero offers a wide range of features, it may not include everything certain businesses need. For example, if your business operates in a niche industry or requires particular features, Xero might not offer the right tools at the right price. Some competitors offer more specialized tools or features that are better suited to your needs.

-

Customer Support & Usability

Many users have expressed frustration with Xero’s customer support, noting long wait times and limited help options. The software’s interface may also be challenging for new users, especially those without prior accounting experience. Businesses are increasingly looking for alternatives that offer better support and a more intuitive user experience.

-

Scalability Issues

As your business grows, your accounting needs may become more complex. Some Xero users have reported that scaling the platform to meet these new demands can be cumbersome, leading them to seek more scalable Xero alternatives that can grow with their business without causing budgetary concerns.

Top Xero Competitors: A Quick Overview

To help you make an informed decision, here’s a quick overview of some of the top Xero competitors based on factors like price, ease of use, scalability, and feature sets:

Competitor | Price | Key Features | Best for |

|---|---|---|---|

QuickBooks | Starts at $25/month | Strong invoicing, reporting, payroll features | Businesses needing comprehensive features |

FreshBooks | Starts at $15/month | User-friendly, excellent customer support | Small businesses with simple needs |

Zoho Books | Starts at $9/month | Affordable, customizable, good integrations | Small to medium-sized businesses |

Wave | Free (Basic version) | Basic accounting tools, invoicing, receipt scanning | Small businesses or startups |

Giddh | Starts at $6/month | Affordable, scalable, easy integration with business tools | Growing small to medium-sized businesses |

Among these, Giddh stands out for offering a comprehensive and affordable solution with an intuitive interface, making it an excellent alternative to Xero. But let’s dive deeper into each competitor.

The Best Xero Alternatives for Businesses: Detailed Comparison

When searching for alternatives to Xero, businesses need to carefully evaluate their options to ensure they’re getting the best value for their money.

Here’s a detailed comparison of some of the top Xero competitors, highlighting their benefits, key features, and when they’re the right choice. Giddh, however, stands out as a particularly strong choice for small and medium-sized business accounting due to its affordability, powerful features, and seamless integration capabilities.

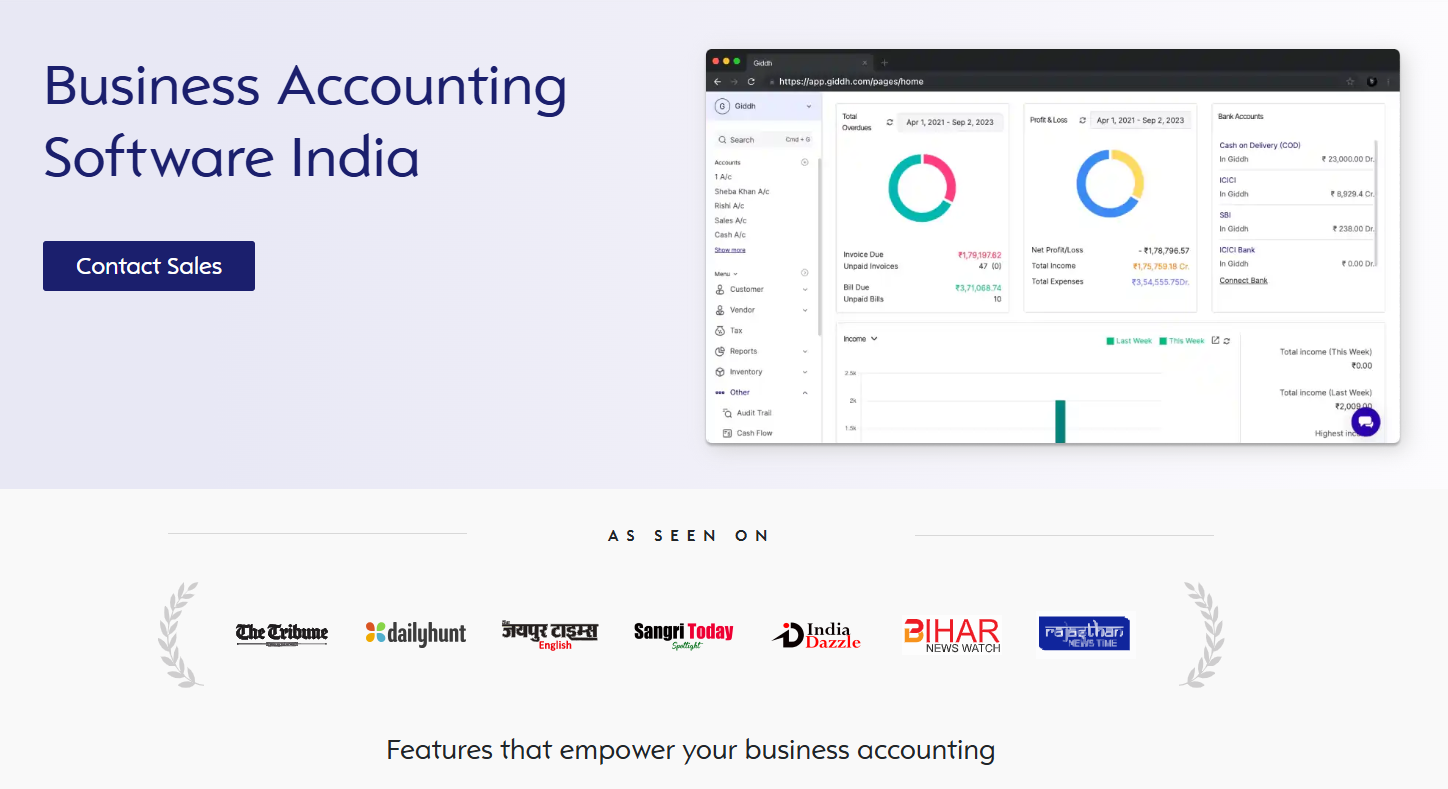

Giddh

Giddh offers a combination of affordability, powerful features, and seamless integration, making it an excellent alternative to Xero. Whether you’re managing finances for a small startup or a growing medium-sized business, Giddh provides a scalable, user-friendly solution that adapts as your business evolves.

Key Features:

-

Affordable Pricing: Starting at just $6/month, Giddh offers highly competitive pricing, making it one of the most cost-effective accounting solutions on the market.

-

Multi-Currency Support: Ideal for businesses that operate in multiple regions or deal with clients in different currencies.

-

Comprehensive Reporting: Giddh offers easy-to-use yet powerful reporting tools, providing a clear overview of your financial health.

-

Seamless Integration: Giddh integrates with numerous third-party applications, including CRM tools, payment processors, and inventory management systems, ensuring smooth data flow.

-

Automation Features: Automate routine tasks like invoicing, payment reminders, and expense categorization, saving you time and reducing errors.

-

User-Friendly Interface: Giddh’s simple and intuitive interface means that even users with no accounting experience can quickly learn and start using the software.

-

Scalable Solutions: As your business grows, Giddh scales with you, offering flexible features that adapt to your evolving needs.

When is it a good choice?

Giddh is perfect for small and medium-sized businesses that need a cost-effective, scalable, and user-friendly solution for managing their finances. It’s also ideal for businesses that want to save time with automation and need a software that can integrate with other essential business tools.

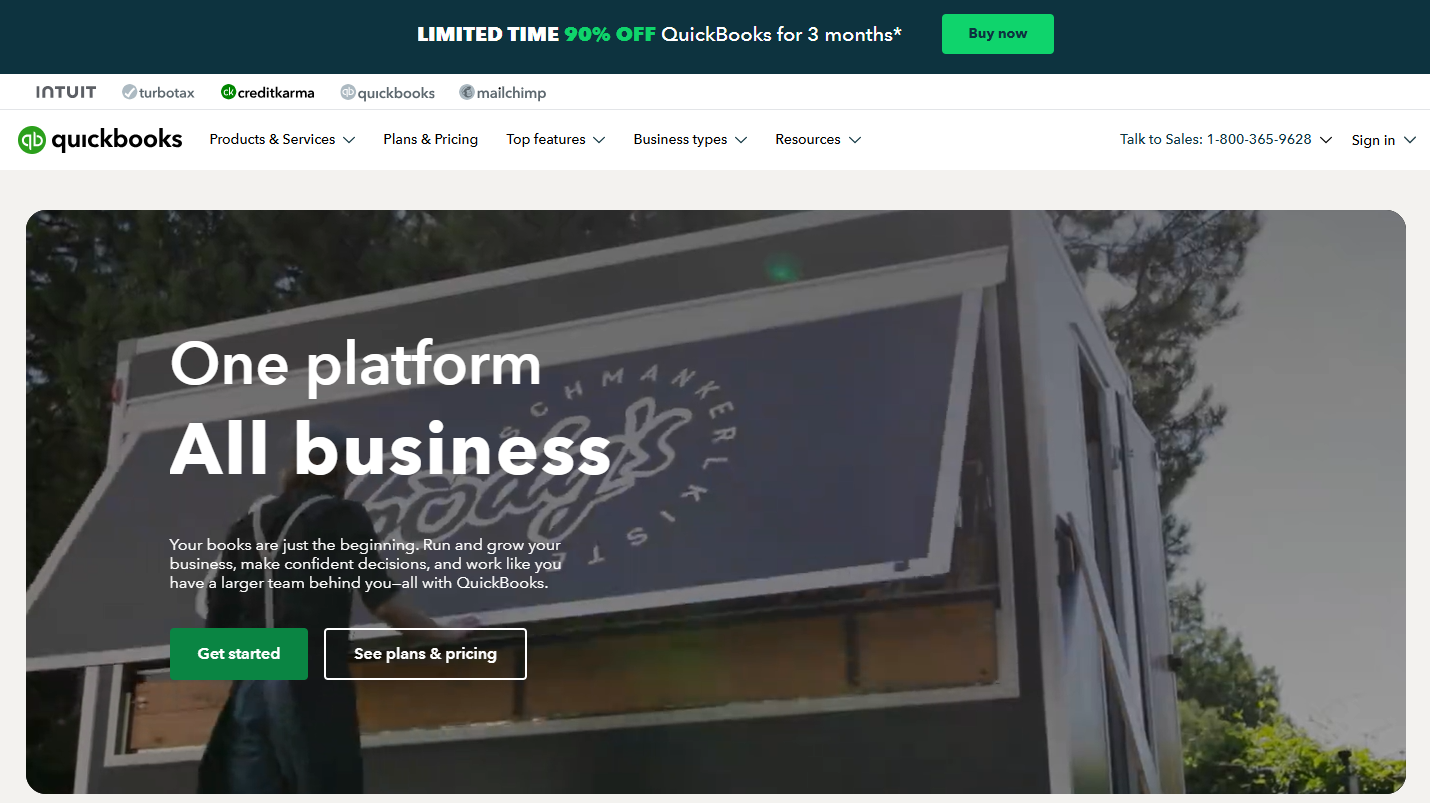

QuickBooks

QuickBooks is one of the most well-known accounting software solutions and is used by businesses of all sizes. It offers a robust set of features designed to handle various accounting tasks from invoicing to payroll, and it integrates well with other financial tools.

Key Features:

-

Invoicing and Payments: Allows users to create and send invoices easily and track payments in real-time.

-

Payroll Management: Includes integrated payroll functionality to manage employee payments and tax calculations.

-

Advanced Reporting: Offers detailed reports and insights into financial data, which is great for businesses needing in-depth analysis.

When is it a good choice?

QuickBooks is ideal for businesses needing comprehensive features and are willing to pay a premium for advanced functionality. It’s especially suited for larger businesses or businesses with complex financial needs that require robust reporting and payroll management features.

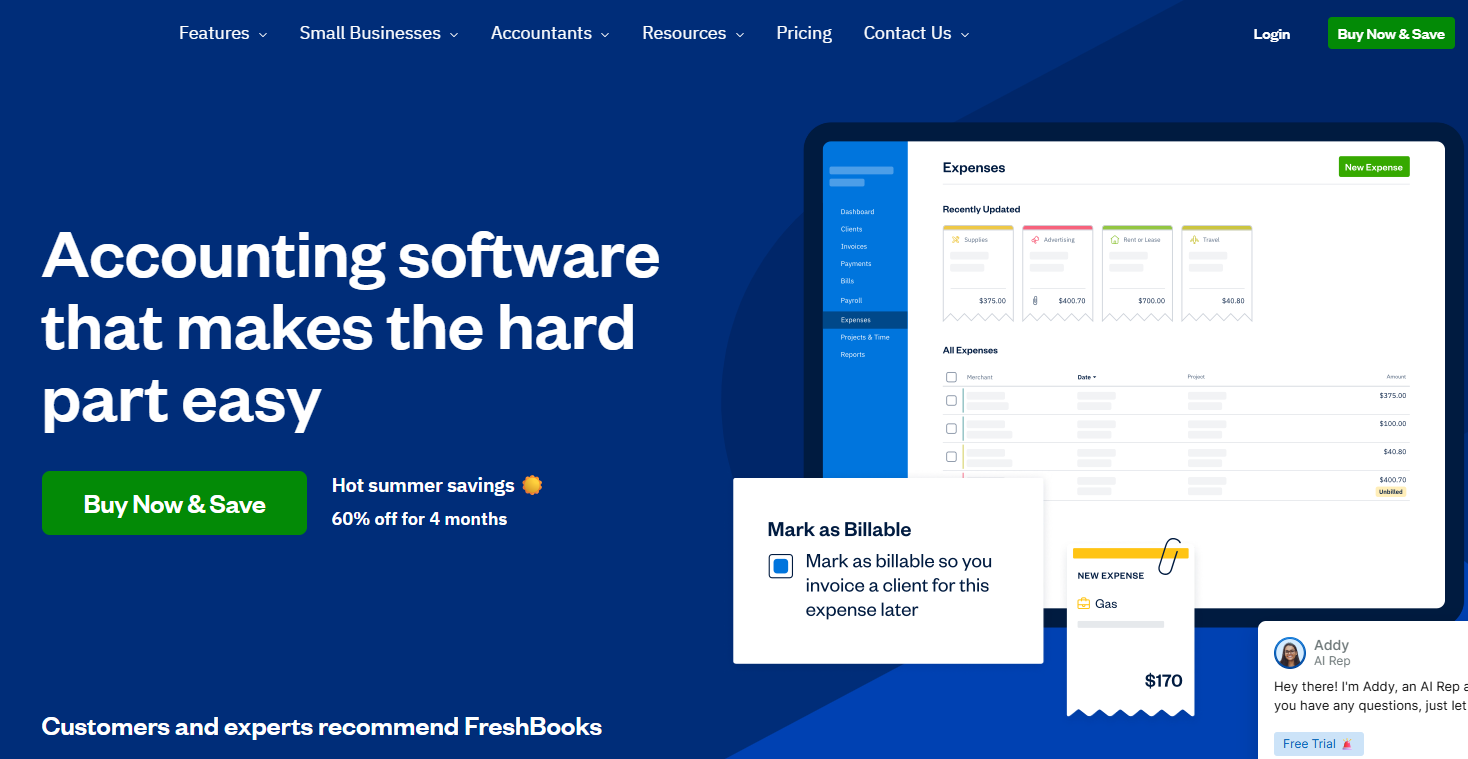

FreshBooks

FreshBooks is a user-friendly accounting software solution that’s especially popular with freelancers and small businesses. It provides solid customer support and essential accounting features with an intuitive interface.

Key Features:

-

Time Tracking: Enables users to track billable hours and automatically generate invoices based on time worked.

-

Client Management: Helps businesses maintain and track client information and interactions, improving customer relationship management.

-

Expense Tracking: Easily categorize and track business expenses, ensuring that deductions are accurately recorded for tax purposes.

When is it a good choice?

FreshBooks is an excellent choice for freelancers and small businesses that need simple accounting functionalities, invoicing tools, and excellent customer support. It’s perfect for those who don’t need a complex financial system and want something quick and easy to set up.

Zoho Books

Zoho Books provides a comprehensive set of features at an affordable price, making it a strong option for small to medium-sized businesses. It offers various integrations with other Zoho apps and third-party tools, allowing businesses to expand their functionality.

Key Features:

-

Automated Workflows: Automate repetitive tasks like invoicing, payment reminders, and recurring billing.

-

Inventory Management: Track your inventory and manage orders seamlessly, making it a great choice for retail and e-commerce businesses.

-

Tax Compliance: Zoho Books offers tax management features that help businesses stay compliant with local tax regulations.

When is it a good choice?

Zoho Books is an excellent choice for small to medium-sized businesses looking for an affordable, comprehensive solution that offers good integration capabilities and automation. It’s particularly useful for businesses with inventory needs or those already using other Zoho applications.

Wave

Wave is a popular free accounting software, which makes it a go-to solution for startups and small businesses with minimal accounting needs. Despite being free, it still offers a range of useful features, particularly for businesses that need basic financial tools.

Key Features:

-

Free Invoicing and Accounting: Basic accounting and invoicing features are entirely free, making Wave a cost-effective solution.

-

Receipt Scanning: Scan and upload receipts directly to your account, making expense tracking easier.

-

Basic Reporting: Includes financial reports like profit and loss statements and balance sheets, useful for basic financial tracking.

When is it a good choice?

Wave is best for startups or small businesses on a tight budget that need basic accounting tools. It’s particularly well-suited for businesses that don’t require advanced features like payroll management or inventory control.

Understanding Different Types of Accounting Software

When choosing an accounting solution, it’s essential to understand the different types of software available. Here are five main types of accounting software that businesses may consider:

-

Cloud-based Solutions: These tools, such as QuickBooks and Giddh, are hosted in the cloud, allowing businesses to access their accounting information remotely from any device.

-

Desktop-based Solutions: Traditional accounting software installed on your computer. These require manual backups and updates.

-

Open-source Software: Open-source tools like Giddh offer customization, allowing businesses to tailor the software to their needs.

-

Industry-Specific Software: Tailored accounting tools designed for specific industries, such as retail, manufacturing, or nonprofit.

-

ERP Software: Large-scale software used by enterprises that includes accounting modules alongside other business functions.

How to Choose the Best Accounting Software for Your Business

When deciding on the best accounting software for your business, consider the following factors:

-

Budget: Choose software that fits within your budget. Options range from freemium models to subscription-based pricing.

-

Core Features: Ensure the software includes invoicing, expense tracking, and reporting, which are essential for most businesses.

-

Scalability: Ensure the software can grow with your business. If you plan to scale, you’ll need a solution that can handle increasing complexity.

-

Customer Support: Good customer support is crucial for a smooth user experience. Look for software with easily accessible help resources.

-

Integrations: Choose software that integrates well with other business tools you use, such as CRMs and payment systems.

Conclusion

Choosing the right accounting software for your business is a critical decision that affects your bottom line. While Xero is a popular choice, several competitors offer better value for money. Among these, Giddh stands out as an excellent option, offering affordable pricing, an easy-to-use interface, and strong scalability.

If you’re ready to explore the best alternatives to Xero and find the perfect accounting solution for your business, get started here and dive deeper into our in-depth comparison of top Xero competitors.

FAQ

Q1: Which is better, Xero or QuickBooks?

A1: QuickBooks is better for businesses that need a more comprehensive set of features, while Xero is more suitable for small businesses with simpler needs. The right choice depends on your specific business requirements.

Q2: What is the best accounting software for small businesses in India?

A2: Giddh is one of the best accounting software options for small businesses in India due to its affordability, ease of use, and scalability.

Q3: Is Giddh better than Xero?

A3: For many small and medium-sized businesses, Giddh is a better choice due to its affordable pricing, simple interface, and seamless integrations with other business tools.