Bookkeeping vs Accounting: How to Pick the Best Software in India

In India, small and medium-sized businesses are rapidly adopting bookkeeping and accounting software to improve financial management and compliance. As per a recent study, over 60% of Indian SMBs use software solutions to handle their accounting needs, largely due to the growing complexity of financial tasks and the need for accurate GST compliance.

With over 1.3k searches monthly for best accounting software for India and similar queries, it’s clear that business owners are looking for solutions that not only help them stay organized but also meet the ever-evolving tax regulations.

If you're a business owner or accountant in India, are you using the right tool to keep up with changing GST rates and ensure financial accuracy? Selecting the best bookkeeping software in India can help you avoid errors and penalties, saving you time and money.

Bookkeeping vs Accounting: What’s the Difference?

Understanding the difference between bookkeeping and accounting is the first step in selecting the right software for your needs.

-

Bookkeeping is the process of recording daily transactions like sales, purchases, payments, and receipts. It’s foundational to managing cash flow and monitoring your business's financial health.

-

Accounting, on the other hand, involves analyzing, interpreting, and summarizing the financial data recorded in bookkeeping. It covers a broader spectrum, including preparing financial statements, conducting audits, and providing insights into tax liabilities.

Key Differences:

-

Bookkeeping focuses on organizing records, while accounting is about understanding and analyzing those records.

-

Accounting software often includes features for bookkeeping but goes a step further by offering reports, tax calculations, and more.

When choosing software, it’s essential to determine whether you need just a bookkeeping tool, such as the best bookkeeping software, or an all-encompassing accounting solution.

Key Features to Look for in Bookkeeping and Accounting Software

Choosing the right software is a critical decision for any business, especially for small to medium-sized enterprises (SMBs) that need to stay organized, compliant, and efficient. The right software helps automate essential financial tasks, reduce human error, and provide real-time insights into your business’s financial health.

Here’s a more detailed breakdown of what to look for in bookkeeping vs accounting software:

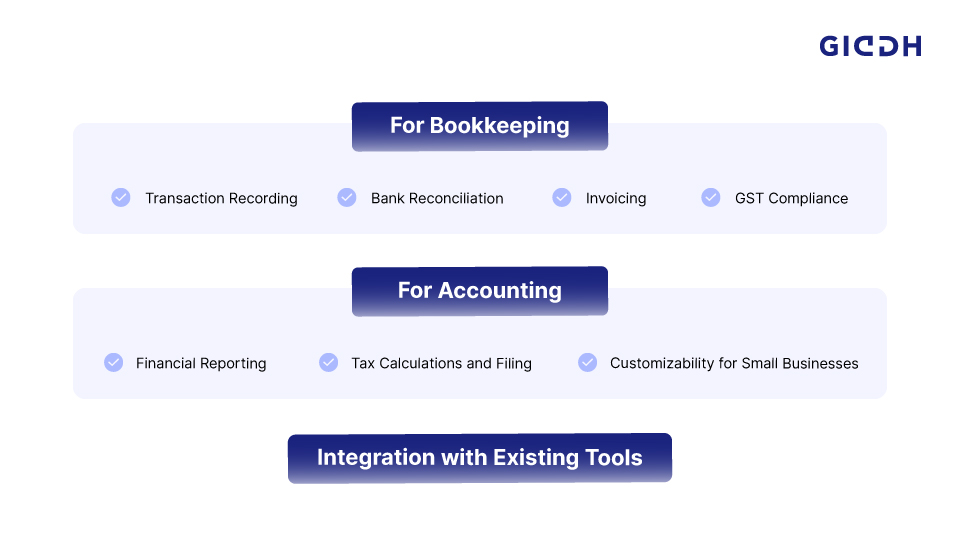

For Bookkeeping:

Transaction Recording:

Bookkeeping software should allow you to easily track all financial transactions, such as sales, purchases, receipts, and expenses. This includes recording your daily business activities, keeping accurate records of payments, and maintaining logs for auditing purposes. Automated transaction recording minimizes errors and saves time.

Key Benefits:

-

Accuracy and consistency in tracking all financial transactions.

- Easy access to transaction history for reporting and audits.

Bank Reconciliation:

One of the most time-consuming yet essential tasks in bookkeeping is reconciling bank statements with your business records. Good bookkeeping software automates bank reconciliation, matching your recorded transactions with your actual bank statements. This ensures that your accounts reflect the correct balances and eliminates discrepancies caused by manual errors.

Key Benefits:

-

Real-time matching of bank transactions to prevent errors.

- Quick identification of discrepancies reduces the time spent fixing issues.

Invoicing:

Generating invoices can be a hassle, but bookkeeping software should offer an easy-to-use invoicing platform feature. You should be able to create, send, and track invoices seamlessly. This includes integrating payment tracking, recurring billing options, and automated reminders for overdue payments. The software should also allow you to customize invoices to reflect your brand.

Key Benefits:

-

Professional-looking invoices that boost credibility.

- Better cash flow management through automated invoicing and payment reminders.

GST Compliance:

For Indian businesses, GST compliance is essential. The software should automate GST calculations based on the latest tax rates, ensuring all transactions are correctly categorized. It should also offer GST filing features, allowing businesses to e-file returns directly from the software. Being compliant with Indian tax laws helps companies to avoid penalties and fines.

Key Benefits:

-

Accurate GST calculations to reduce the risk of errors and audits.

- Easy e-filing integration to meet deadlines and ensure compliance.

For Accounting:

Financial Reporting:

Accounting software must go beyond bookkeeping to offer financial reporting capabilities such as profit and loss (P&L) statements, balance sheets, cash flow statements, and trial balances. These reports provide valuable insights into your business's financial health, helping you make informed decisions. Being able to track revenues, expenses, and net income helps business owners understand the overall performance.

Key Benefits:

-

In-depth financial analysis to make data-driven business decisions.

- Compliance-ready reports for audits and tax filing.

Tax Calculations and Filing:

For businesses in India, accurate tax calculations are crucial. Accounting software should automate tax computations, including GST and Income Tax, based on your income and expenses. Additionally, it should allow for e-filing of tax returns directly from the software, saving time and reducing the chances of human error. This feature is essential for business owners looking to stay compliant with the constantly changing tax landscape.

Key Benefits:

-

Automated and accurate tax calculations based on real-time data.

- Direct e-filing of returns to simplify the filing process.

Customizability for Small Businesses:

While most accounting software offers robust features, SMBs need software that’s flexible and can grow with their business. The best accounting software should be customizable to fit your unique needs, including creating custom financial reports, managing multiple branches or departments, and adapting to industry-specific requirements. It should scale as your business grows, offering advanced features when needed.

Key Benefits:

-

Scalability ensures that the software adapts to your growing business needs.

- Custom reports and tools tailored to your industry and business size.

Integration with Existing Tools

Both bookkeeping and accounting software should be compatible with other tools you may already be using. Whether you have an e-commerce platform, a customer relationship management (CRM) system, or a payroll software, integration ensures a smooth flow of data across systems, reducing the need for manual data entry. For example, Giddh integrates with major e-commerce platforms and banking systems to give you a unified view of your finances.

Key Benefits of Integration:

-

Increased efficiency: Seamless data transfer between systems reduces duplication of effort.

-

Centralized data: One platform to track all financial activities, including sales, expenses, taxes, and invoices.

By focusing on these essential features, businesses can ensure they select the software that will make financial management easier, more accurate, and compliant with Indian laws. The right software will empower you to manage your finances with confidence, automate manual tasks, and gain valuable insights into your business operations.

The Top Bookkeeping and Accounting Software in India

Now, let’s dive into some of the leading software options available for Indian businesses. Here’s a breakdown of popular tools based on features, user-friendliness, and pricing:

| Software | Key Features | Pricing | Best For | | :---: | :---: | :---: | :---: | | Giddh | GST Compliance, e-filing, Financial Reports | Starts at ₹499/month | Small and medium businesses | | Tally ERP 9 | Accounting, Inventory Management | Starts at ₹18,000/year | Growing businesses | | QuickBooks | Bookkeeping, Invoicing, Tax Filing | ₹1,000/month | Small businesses, freelancers | | Zoho Books | GST Support, Customization Options | ₹1,200/month | SMEs and start-ups |

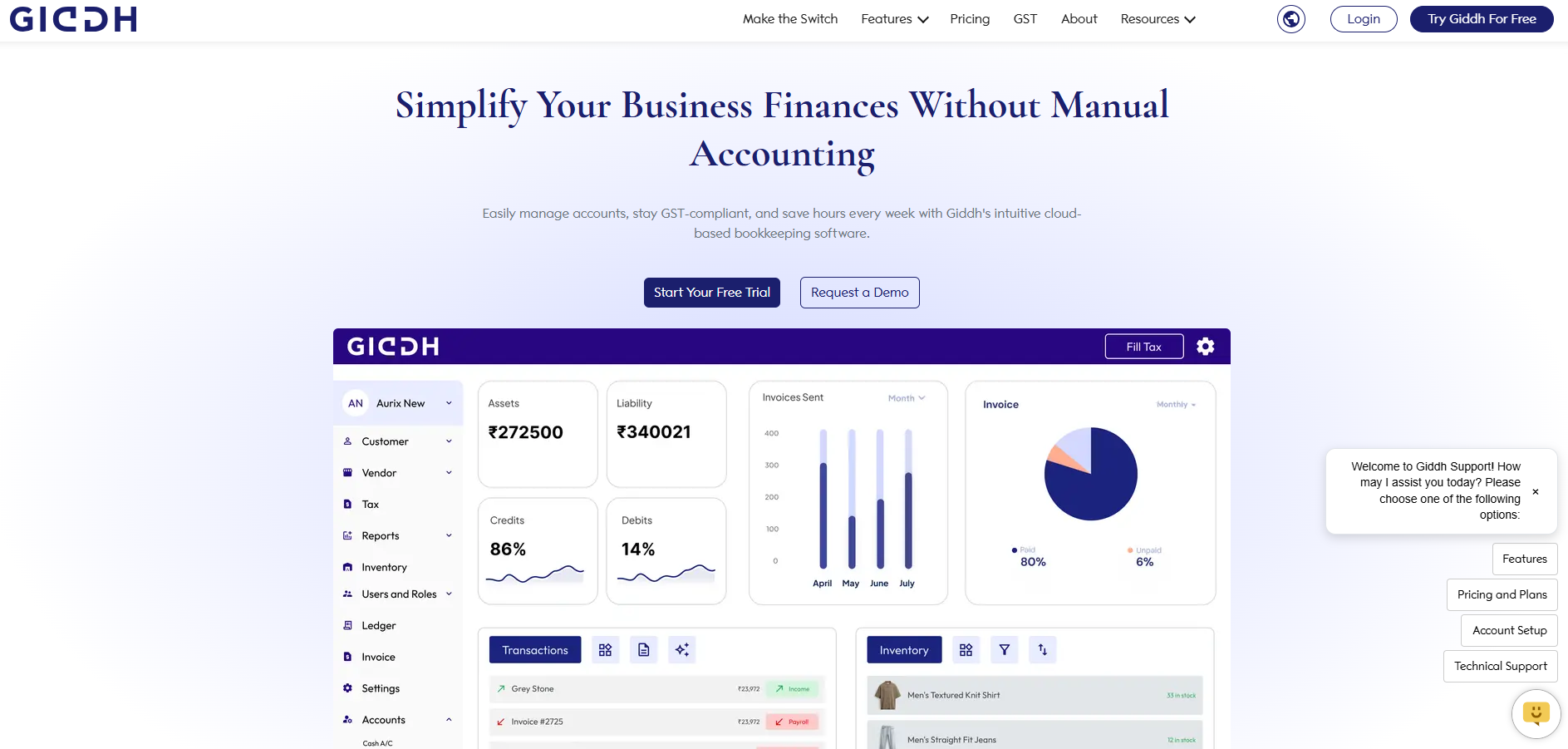

Giddh, designed explicitly for Indian companies, is an all-in-one solution. It seamlessly integrates GST calculations, financial reporting, and e-filing, making it ideal for companies that need to stay compliant with India's ever-evolving tax laws.

Giddh: The Ultimate Solution for Bookkeeping and Accounting in India

In choosing the best bookkeeping software in India, Giddh stands out for providing both bookkeeping and accounting services on a single powerful platform.

Whether you’re a small business owner or managing a growing enterprise, having the right software is crucial to maintaining financial accuracy, ensuring compliance with GST, and ultimately driving business growth.

Giddh is designed to handle both day-to-day bookkeeping tasks and more complex accounting needs, making it a comprehensive solution for businesses across India.

Here’s how Giddh addresses your bookkeeping and accounting needs, and how it empowers businesses to generate more revenue with greater accuracy:

Bookkeeping Made Easy with Giddh

For businesses, bookkeeping is the foundation of good financial management. It involves recording daily transactions, tracking expenses, and managing cash flow. With Giddh’s seamless bookkeeping tools, businesses can ensure they stay on top of their finances while minimizing errors and inefficiencies.

Key Bookkeeping Features of Giddh:

-

Automated Transaction Recording: Giddh automatically records daily transactions like sales, purchases, payments, and receipts. This eliminates the need for manual entry, reducing errors and saving time.

-

GST Compliance: Giddh ensures that all transactions are in line with India’s GST regulations. With real-time tax calculations, businesses are always up-to-date with the latest tax rates.

-

Bank Reconciliation: Giddh integrates directly with your bank accounts, automatically reconciling your transactions, and highlighting any discrepancies, making financial tracking accurate and effortless.

-

Invoicing and Payment Tracking: Easily generate professional invoices and track outstanding payments, ensuring faster cash flow and accurate financial records.

How Giddh Helps Businesses:

-

Automates manual bookkeeping tasks, increasing productivity.

-

Prevents accounting errors, ensuring financial data is accurate and reliable.

-

Saves time on reconciliation, leaving more time for business development.

Accounting Made Simple with Giddh

While bookkeeping handles the transactional aspects of your business, accounting gives you a more comprehensive view of your company’s financial health. Giddh takes your bookkeeping data and transforms it into insightful financial reports that help you understand the performance of your business. From balance sheets to profit & loss statements, Giddh provides robust accounting services to make decision-making easier.

Key Accounting Features of Giddh:

-

Real-Time Financial Reports: Giddh generates detailed Profit & Loss, Balance Sheets, Cash Flow, and Trial Balance reports, giving you real-time insights into your business’s financial standing.

-

Tax Filing and Calculation: The software automatically calculates GST, TDS, and other taxes, ensuring you never miss a tax filing deadline. It also integrates with the government’s e-filing system for hassle-free tax submissions.

-

Custom Financial Reports: Need specific insights? Giddh lets you customize reports to match your business needs, such as tracking departmental budgets, revenue streams, and expenses.

How Giddh Helps Businesses:

-

Provides financial clarity with real-time reports, helping businesses stay on track and plan for the future.

-

Automates tax filing, reducing the risk of compliance issues and penalties.

-

Offers detailed insights to optimize spending, revenue generation, and profitability.

Powerful Features for Business Growth

In addition to basic bookkeeping and accounting, Giddh offers several powerful features that help businesses scale and optimize revenue generation. The platform’s advanced tools enable businesses to stay competitive, reduce operational costs, and improve their overall financial strategy.

Additional Powerful Features of Giddh:

-

E-commerce Integration: Giddh seamlessly integrates with popular e-commerce platforms like Shopify, Amazon, and Flipkart, allowing businesses to sync their sales, inventory, and expenses automatically. This ensures better accuracy in tracking online transactions.

-

Multi-User Access: Giddh allows multiple users to access the platform, so your team can collaborate in real time. This feature is especially beneficial for businesses with multiple departments or remote teams.

-

Scalability: As your business grows, Giddh grows with you. Whether you need advanced features like payroll management or multi-branch accounting, Giddh can scale to fit your evolving needs.

How Giddh Helps Businesses Drive Revenue and Accuracy:

-

Increased Revenue: By streamlining financial operations and automating critical tasks like invoicing and tax filing, Giddh reduces the time spent on manual processes, freeing up time for business growth strategies.

-

Enhanced Accuracy: With automated transaction recording, real-time GST calculations, and bank reconciliations, businesses can reduce errors in their financial data, leading to more accurate reports and better decision-making.

-

Improved Decision-Making: With real-time, custom reports and financial insights, business owners can make informed decisions to optimize spending, improve profitability, and identify new growth opportunities.

Giddh for Businesses of All Sizes

Giddh is not only an ideal tool for small businesses but is also scalable for larger enterprises. Whether you’re just starting or are managing a growing business, Giddh provides the flexibility and features you need to maintain financial accuracy and ensure compliance with Indian laws.

Why Giddh is Perfect for SMBs in India:

-

Affordability: Giddh offers pricing plans that cater to businesses at different stages of growth, making it a cost-effective choice for SMBs.

-

User-Friendly: Giddh is designed to be intuitive and easy to use, even for non-accountants. With simple navigation and clear instructions, business owners can manage their finances with minimal training.

-

Comprehensive Support: Giddh provides dedicated customer support to help businesses with any technical or financial inquiries, ensuring that you have the resources to succeed.

Conclusion:

In conclusion, selecting the proper bookkeeping or accounting software is essential to ensure your business runs smoothly and remains compliant with India’s tax regulations. As companies face increasing complexity in managing finances and meeting compliance standards, using the best bookkeeping software in India can make a world of difference.

Try Giddh to stay compliant and efficient with the best bookkeeping and accounting tools for your needs!

FAQ

Q1: What is the difference between bookkeeping and accounting software?

Answer: Bookkeeping software helps you track daily transactions, whereas accounting software includes additional features like generating financial reports and handling taxes.

Q2: Can I find the best bookkeeping software for free?

Answer: Yes, several options, such as Wave and Zoho Books, offer free versions, but they might lack the advanced features required by larger businesses.

Q3: Which software is best for GST compliance in India?

Answer: Giddh and Tally ERP 9 are excellent choices for GST compliance, providing up-to-date tax filing and GST reporting.

Q4: Is Giddh suitable for e-commerce businesses?

Answer: Yes, Giddh integrates with popular e-commerce platforms and provides GST-compliant invoicing and financial reporting tools.