Most Popular Accounting Software for GST, VAT & Global Tax Compliance

In 2024, over 80% of small and medium-sized businesses (SMBs) report difficulty in managing tax compliance due to the complexity of GST, VAT, and international tax regulations.

Navigating the tax requirements of various regions can be an overwhelming task, but businesses must remain compliant to avoid costly penalties and audits. As the tax landscape becomes more complex, relying on outdated systems or manual processes is no longer an option for business owners and accountants.

With the right accounting software, SMBs can automate tax calculations, stay updated on changing tax laws, and ensure compliance with ease. The focus of this article is on the most popular accounting software solutions that provide seamless integration with global tax systems such as GST and VAT. By understanding these options, businesses can choose the best tools to streamline tax management and ensure timely filings.

Why Tax Compliance is Crucial for Small Businesses

Managing tax compliance can seem like a daunting task for small businesses, especially with the need to keep up with ever-changing regulations. Here are some of the most common challenges SMBs face in this area:

-

Complex Tax Calculations: Different regions have their own unique tax systems. For example, GST in India differs significantly from VAT in the European Union. SMBs often struggle with calculating taxes correctly, leading to potential errors and penalties.

-

Frequent Changes in Tax Laws: Tax laws are dynamic. Whether it’s a minor change in the VAT rate or a complete overhaul of GST regulations, staying updated is critical.

-

Risk of Costly Errors: Manual tax calculations and outdated systems increase the risk of human error, leading to costly mistakes.

How Can Automated Accounting Software Help?

Using accounting software designed for tax compliance can help automate calculations, ensuring accuracy and reducing the burden of manual work. With up-to-date information on changing regulations, automated software allows SMBs to stay compliant without the need for constant monitoring.

What Makes Accounting Software for Tax Compliance Effective?

When selecting accounting software, businesses must prioritize specific features to ensure they can effectively handle GST, VAT, and global tax regulations. Here are the most critical considerations:

-

Automation of Tax Calculations: The Best accounting software automatically calculates GST, VAT, and other taxes based on up-to-date regulations, ensuring accuracy and saving valuable time.

-

Integration with Global Tax Systems: The software should support multiple tax systems (GST, VAT, international taxes) to allow businesses to manage tax compliance seamlessly across borders.

-

User-Friendly Interface: For many SMBs, the primary users of collaborative accounting software are not tech experts. The software must have an intuitive interface and be easy to navigate for accountants and business owners alike.

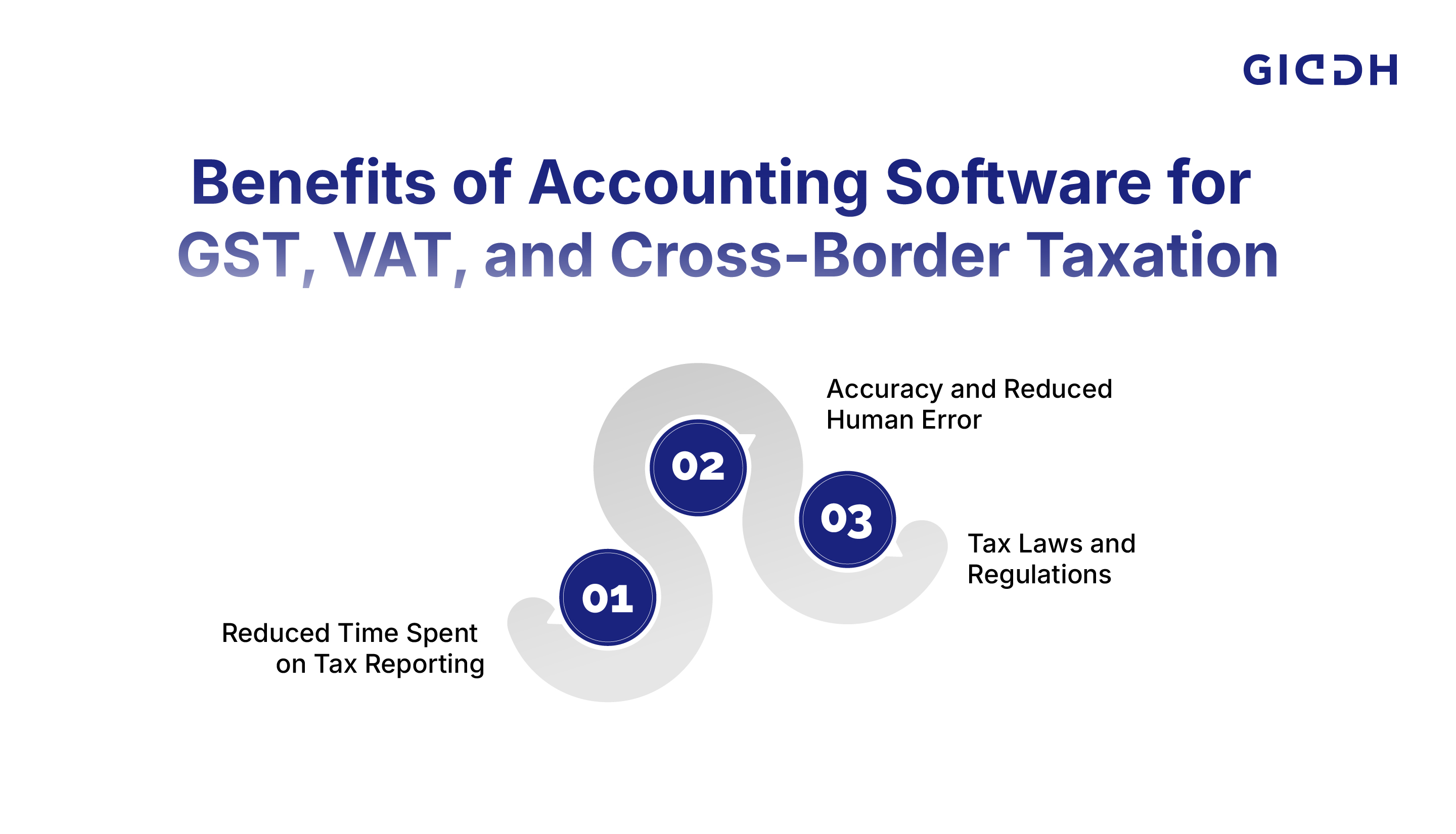

Key Benefits of Accounting Software for GST and VAT

Using modern accounting software for GST, VAT, and global tax compliance delivers measurable advantages for businesses handling multi-region taxation. These benefits directly impact efficiency, accuracy, and regulatory confidence.

Reduced Time Spent on Tax Reporting

-

Automates repetitive tasks such as tax calculations, invoice-level tax application, and return preparation.

-

Eliminates manual data entry by syncing transactions, invoices, and ledgers in real time.

-

Speeds up monthly, quarterly, and annual tax filings with pre-formatted compliance reports.

-

Frees up finance teams to focus on analysis, forecasting, and business decisions instead of paperwork.

Increased Accuracy and Reduced Human Error

-

Applies correct GST, VAT, and international tax rates automatically based on location and transaction type.

-

Minimizes calculation mistakes caused by spreadsheets, manual formulas, or outdated tax rules.

-

Maintains consistent tax treatment across invoices, expenses, and reports.

-

Reduces the risk of penalties, audit issues, and incorrect tax filings.

Real-Time Updates on Tax Laws and Regulations

-

Updates tax rules automatically when GST slabs, VAT rates, or compliance formats change.

-

Ensures reports and returns remain aligned with the latest regulatory requirements.

-

Removes the need for constant manual tracking of tax law changes across regions.

-

Helps businesses stay compliant without relying on external alerts or manual revisions.

Top Accounting Software Solutions for GST, VAT, and Global Tax Compliance

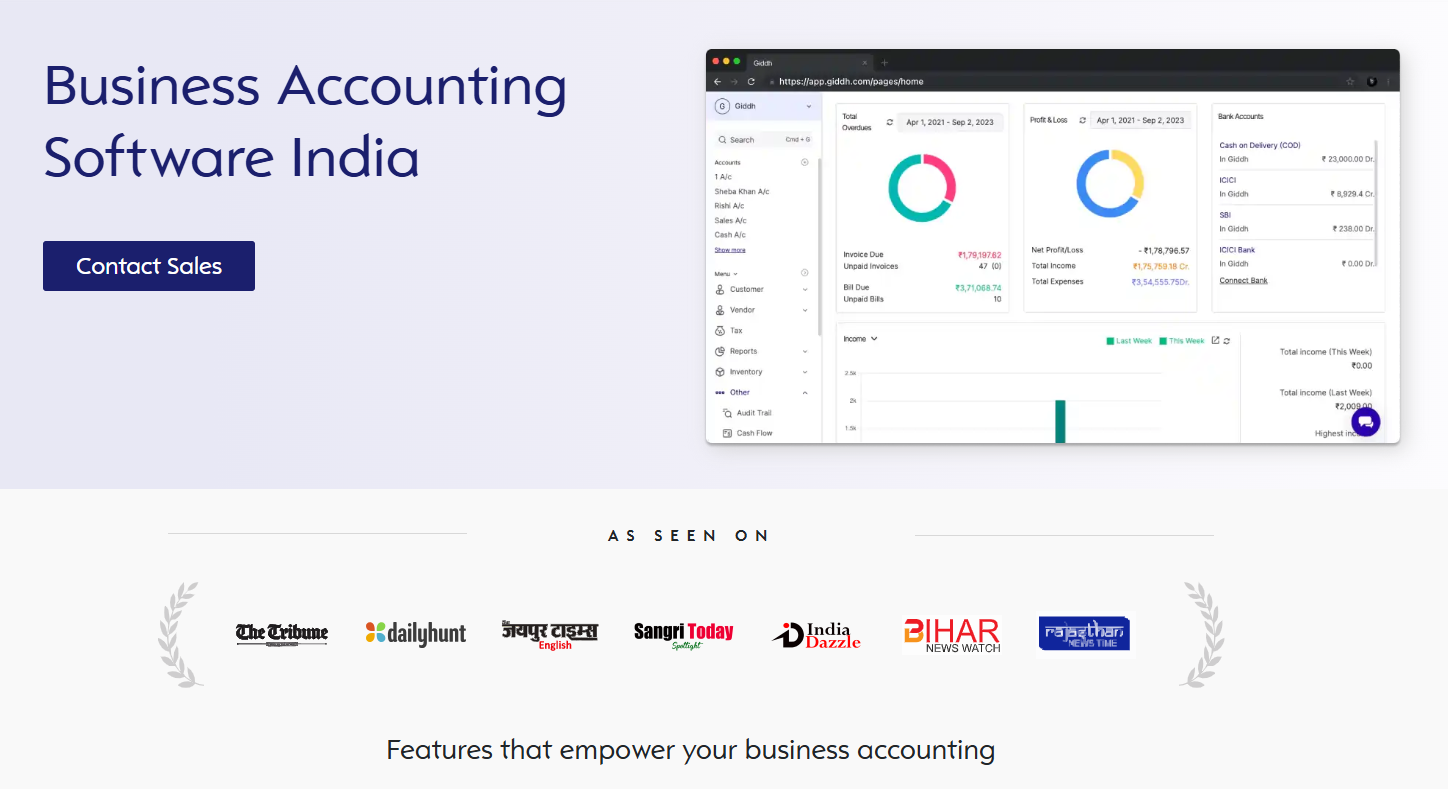

Giddh

Giddh is a cloud-based accounting software tailored for businesses that need seamless tax compliance across multiple jurisdictions. It is explicitly designed to handle GST, VAT, and international tax regulations, making it an ideal choice for SMBs dealing with complex tax systems.

Giddh excels in helping businesses remain compliant with GST, VAT, and international tax regulations, offering features explicitly tailored for seamless tax filing and reporting.

Strengths:

-

GST Compliance: Giddh simplifies GST filing and integrates with the GSTN (Goods and Services Tax Network) for hassle-free returns.

-

Real-Time Updates: Giddh ensures real-time updates for global tax regulations, including VAT, GST, and other international tax systems.

-

Ease of Use: Designed with non-experts in mind, Giddh is user-friendly and simplifies tax reporting.

More Key Features of Giddh:

-

Asset Management: Giddh helps track assets and their depreciation, making it easier to manage capital expenditure.

-

Inventory Management: The software provides efficient management of stock levels and invoicing.

-

Bank Reconciliation: Giddh automates reconciling bank statements with your accounting data.

-

Invoice Management: Create and send invoices directly from the platform to ensure they comply with tax regulations.

-

Multi-Currency Support: Giddh supports multiple currencies for accounting, making it a strong choice for businesses with a global reach.

-

Ledger-Based Accounting: Manage all your accounts through a ledger system to gain a clear overview of your financials.

-

White-Label Option: For accountants and service providers, Giddh offers a white-label solution that allows businesses to brand the software as their own.

QuickBooks

QuickBooks is one of the most widely used accounting software solutions for small and medium-sized businesses globally. It offers robust GST and VAT support, making it ideal for companies operating in regions with complex tax regulations.

Strengths:

-

User-Friendly: QuickBooks provides an intuitive interface, making it easy for both novice and experienced users to navigate.

-

Comprehensive Tax Compliance: Offers automatic updates for tax rates and compliance changes globally.

-

Scalable: QuickBooks offers a range of plans for businesses of all sizes, from freelancers to larger enterprises.

Key Features:

-

GST and VAT Support: QuickBooks automates GST and VAT calculations, simplifying tax filing.

-

Expense Tracking: Automatically tracks expenses, providing you with an overview of your cash flow.

-

Reports and Insights: QuickBooks generates detailed financial reports to help with tax planning and business strategy.

-

Multi-Currency Management: Handles transactions in multiple currencies, making it an ideal solution for global businesses.

Xero

Xero is a cloud-based accounting solution popular for its simplicity and flexibility. With robust tools for managing GST, VAT, and international taxes, Xero helps businesses streamline financial management across multiple regions.

Xero is a cloud-based accounting solution popular for its simplicity and flexibility. With robust tools for managing GST, VAT, and international taxes, Xero helps businesses streamline financial management across multiple regions.

Strengths:

-

Cloud-Based: Accessible from anywhere, making it ideal for businesses with remote teams or multiple offices.

-

Integration: Xero integrates easily with other third-party apps, including payment processors and banks.

-

Multi-Country Support: Xero is well-suited for international businesses, offering comprehensive tax features across multiple countries.

Key Features:

-

Automated Tax Calculations: Xero automatically calculates taxes like GST, VAT, and others, helping businesses remain compliant.

-

Inventory Management: Track your inventory seamlessly, syncing data with your accounting system.

-

Bank Reconciliation: Xero automatically reconciles bank transactions, saving time on manual matching.

-

Customizable Invoices: Customize your invoices with your business branding for a more professional look.

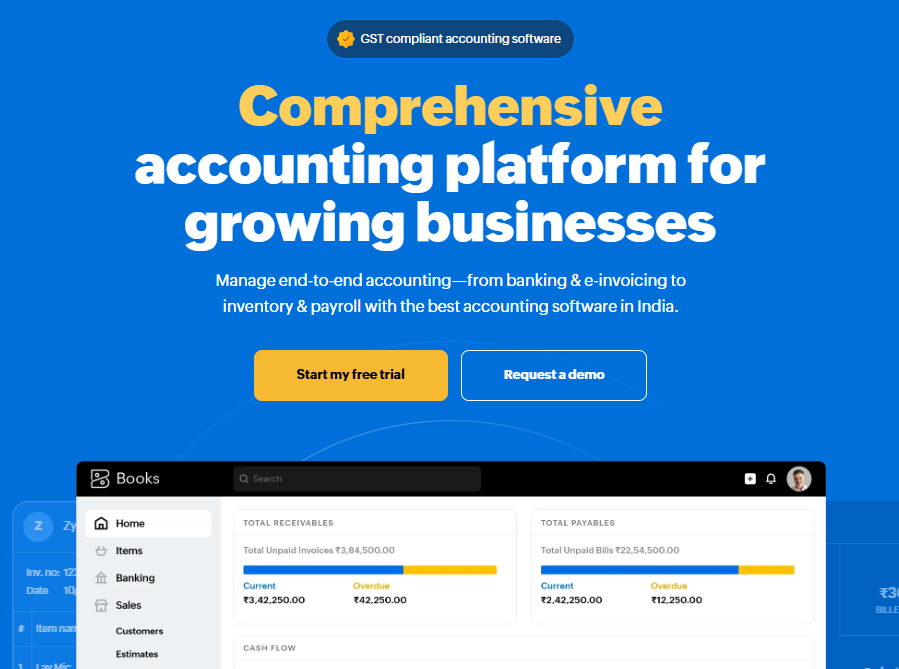

Zoho Books

Zoho Books is an affordable accounting solution aimed at small businesses, especially those in India. Its features are tailored to help SMBs stay compliant with GST and other local tax regulations. Zoho Books provides a simple yet powerful suite of tools to manage finances, taxes, and reporting.

Zoho Books is an affordable accounting solution aimed at small businesses, especially those in India. Its features are tailored to help SMBs stay compliant with GST and other local tax regulations. Zoho Books provides a simple yet powerful suite of tools to manage finances, taxes, and reporting.

Strengths:

-

GST-Compliant: Zoho Books is GST-compliant and helps businesses automatically generate GST returns.

-

Customizable: The platform allows businesses to customize invoices, reports, and workflows, offering a flexible solution.

-

Affordable: Zoho Books offers competitive pricing for small businesses, making it an attractive option for startups and SMBs.

Key Features:

-

GST Filing: Zoho Books automatically generates GST-compliant invoices and returns.

-

Expense Management: Track business expenses and categorize them for better financial reporting.

-

Time Tracking: Track time spent on projects and generate invoices based on hours worked.

-

Bank Integration: Sync with your bank accounts for automatic reconciliation of your transactions.

Wave

Wave is a free accounting software solution designed for small businesses. It offers features such as invoicing, accounting, and receipt scanning. Though primarily aimed at small businesses with basic needs, Wave has recently expanded its capabilities to include tax compliance for specific regions.

Wave is a free accounting software solution designed for small businesses. It offers features such as invoicing, accounting, and receipt scanning. Though primarily aimed at small businesses with basic needs, Wave has recently expanded its capabilities to include tax compliance for specific regions.

Strengths:

-

Free: Wave offers a free version with core accounting features, making it highly attractive for small businesses and startups.

-

Intuitive Interface: Its simple, user-friendly interface makes it easy to set up and use, even for non-accountants.

-

Basic Tax Compliance: Wave handles tax calculations and basic reporting for smaller businesses.

Key Features:

-

Invoice Creation: Quickly create and send invoices with automatic tax calculations.

-

Expense Tracking: Track and categorize business expenses to maintain proper records for tax purposes.

-

Receipt Scanning: Scan and upload receipts, which are automatically matched with expenses.

-

Accounting Reports: Generate basic accounting reports for tax and financial purposes.

Conclusion

Navigating the complexities of GST, VAT, and global tax compliance can be challenging for small businesses. However, the right accounting software can make all the difference. By automating tax calculations and staying updated on changing tax laws, businesses can ensure timely and accurate reporting. Tools like Giddh, QuickBooks, and Xero provide powerful solutions for SMBs to manage their tax obligations with ease. Don’t wait—take control of your tax compliance today with Giddh.

Don’t wait—take control of your tax compliance today with Giddh. Start your free trial now!

FAQ

1. What is the most popular accounting software for GST?

The most popular accounting software for GST is Giddh, as it offers comprehensive features for GST calculation and filing. Zoho also provides seamless GST compliance features for Indian businesses.

2. How can accounting software help with global tax compliance?

Accounting software automates tax calculations and ensures compliance with various global tax regulations such as GST, VAT, and international tax systems, reducing errors and saving time.

3. Is Giddh the best accounting software for small businesses in India?

Giddh is a top choice for small businesses in India, particularly for businesses needing seamless GST compliance and real-time tax updates.

4. What are the benefits of using automated accounting software?

Automated accounting software saves time, reduces human error, and ensures accurate tax reporting, allowing businesses to focus on growth rather than manual processes.

5. How do I choose the best accounting software for my business?

Look for software that fits your budget, can scale with your business, integrates with your existing systems, and supports the tax systems you operate under.