Why Businesses Are Switching to E-Invoicing Software India for GST Compliance

As of 2024, over 1.2 million businesses in India have already switched to e-invoicing, signaling a significant shift in how companies manage their GST compliance. But why are more businesses adopting e-invoicing solutions? The answer lies in the growing complexities of the Goods and Services Tax (GST) system and the need for businesses to avoid costly mistakes related to manual invoicing.

With the government pushing for increased digitalization in GST reporting, companies are compelled to adopt e-invoicing solutions to stay compliant and competitive.

This blog will dive into why businesses are increasingly adopting e-invoicing software, the key benefits, and how tools like Giddh’s e-invoicing software can help enterprises to streamline GST compliance processes and boost efficiency.

The Need for E-Invoicing in India: The GST Compliance Challenge

GST Compliance Landscape

In India, businesses face the constant challenge of ensuring compliance with the dynamic and often complex GST system. GST, while a significant step towards simplifying the country’s tax structure, comes with its own set of challenges.

The need for accurate invoicing, timely filing, and accurate tax computations is paramount. Manual invoicing systems are prone to errors, often leading to discrepancies in GST filings and creating room for costly penalties.

Challenges with Manual Invoicing

-

Errors and Mistakes: Manual invoicing increases the risk of mistakes, including incorrect tax calculations, missing entries, and inaccurate GST rates.

-

Delayed Filings: Businesses often struggle to file GST returns on time due to cumbersome manual processes.

-

Non-Compliance Risks: Mistakes in tax calculations or delayed filings may result in penalties, audits, or even blacklisting by tax authorities.

Government’s Shift Toward Real-Time Reporting

In response to these challenges, the Indian government has made significant strides in pushing businesses towards e-invoicing systems, requiring businesses with annual turnover above a certain threshold to implement this solution. The shift towards real-time reporting aims to reduce tax evasion, improve transparency, and streamline GST compliance.

Regulatory Mandates and Penalties

The GST Council’s e-invoicing mandate requires businesses with a turnover of over ₹10 crore to generate e-invoices. Non-compliance with e-invoicing rules could result in heavy penalties, making it crucial for businesses to adopt this digital solution.

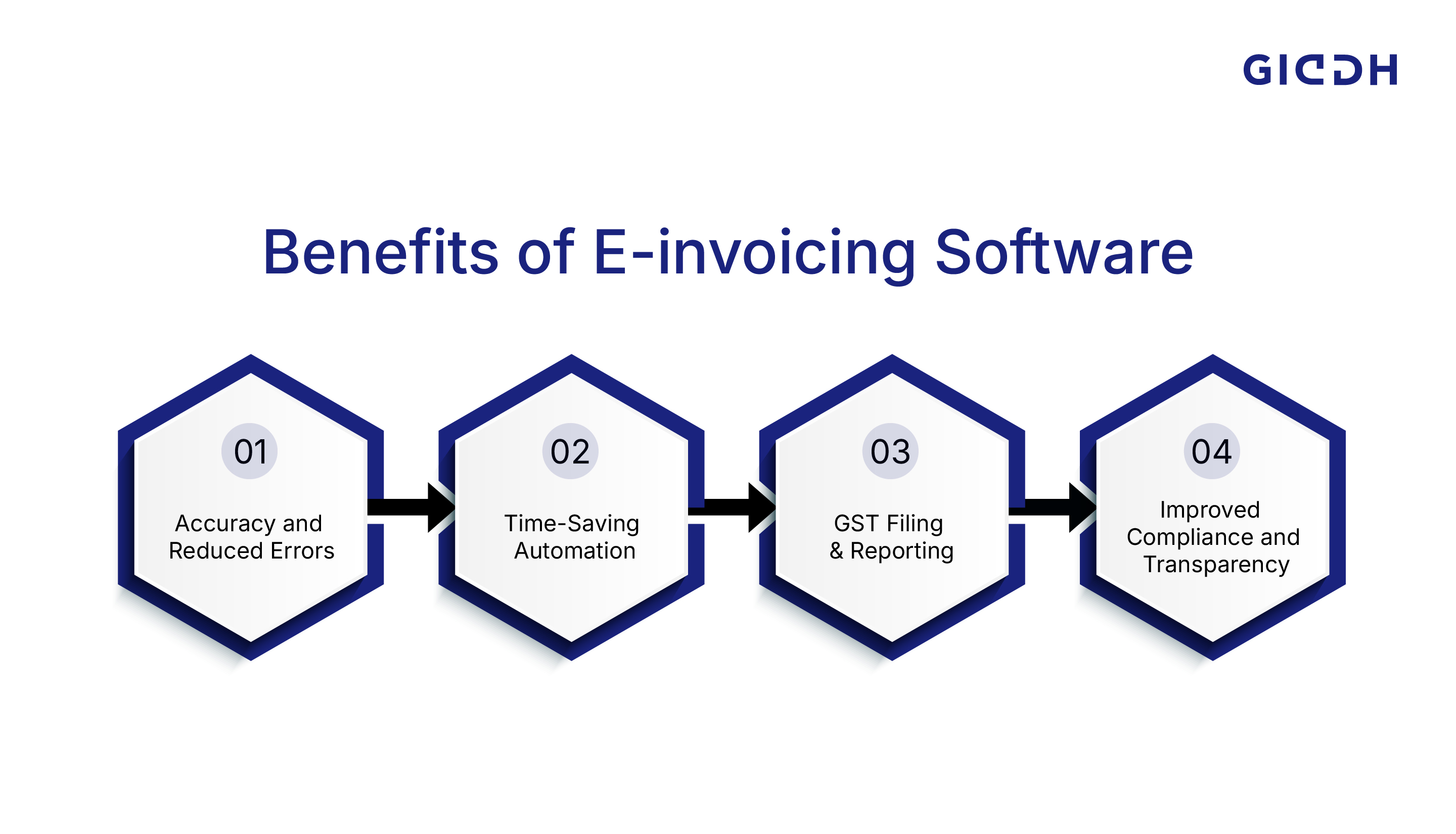

Key Benefits of Switching to E-Invoicing Software

Accuracy and Reduced Errors

E-invoicing eliminates many common accounting mistakes associated with manual invoicing systems. By automating tax calculations and invoice generation, the chances of errors are significantly reduced. Businesses can ensure that their tax filings are correct, avoiding penalties for underreporting or incorrect calculations.

Key Benefits:

-

Automated Tax Calculation: Accurate GST calculations every time.

-

Reduced Human Error: Minimized chances of invoice errors.

Time-Saving Automation

Manual invoicing can be time-consuming, especially for businesses with a high volume of transactions. The best E-invoicing software automates the process, saving valuable time that can be directed towards core business activities.

Key Benefits:

-

Automated Invoice Generation: Fast and efficient invoice creation.

-

Streamlined Workflow: Reduced administrative burden on finance teams.

Real-Time GST Filing & Reporting

E-invoicing software integration with the GST portal enables businesses to file their returns instantly. This reduces delays and ensures timely compliance with tax regulations.

Key Benefits:

-

Instant Filing: Submit GST returns in real time to reduce the risk of late filings.

-

Seamless Integration: E-invoices are automatically verified with the GST system, ensuring compliance.

Improved Compliance and Transparency

With e-invoicing, businesses can maintain accurate and transparent records, helping reduce the risk of audits or penalties. Automated compliance tracking ensures that all GST requirements are met without fail.

Key Benefits:

-

Reduced Audit Risks: Better records and streamlined processes reduce audit risks.

-

Real-Time Monitoring: Businesses can track their compliance status effortlessly.

Why Businesses in India Are Choosing E-Invoicing Software

Efficiency in Managing Multiple Transactions

Businesses, especially in industries like retail, manufacturing, and services, manage thousands of invoices each month. E-invoicing software simplifies this process by handling bulk invoicing, ensuring consistency, accuracy, and speed.

Industry-Specific Benefits:

-

Retail: Fast-paced invoicing for high-volume transactions.

-

Manufacturing: Bulk invoicing with customized tax fields.

-

Services: Invoice generation with service-specific GST parameters.

Cost-Effective Solutions for Businesses of All Sizes

One of the key concerns businesses have when switching to new software is the cost. However, e-invoicing software offers a cost-effective solution by eliminating paper-based invoicing, reducing administrative labor costs, and preventing costly errors.

Cost-Effective Benefits:

-

Scalable Pricing: Plans designed for businesses of all sizes.

-

ROI-Driven: Savings from time and error reductions outweigh initial investment.

Industry-Specific Customization

E-invoicing solutions like Giddh offer tailored features to meet the unique needs of various industries. Whether it's bulk invoicing for manufacturers or customized fields for service businesses, these tools provide flexibility that ensures better compliance and efficiency.

Custom Features:

-

Manufacturing: Support for bulk invoicing.

-

Services: Service-based tax calculations and reports.

User-Friendly Interfaces

Modern e-invoicing platforms like Giddh come with intuitive dashboards and interfaces, making the transition from manual to automated invoicing solution and user-friendly for all business stakeholders.

Giddh’s E-Invoicing Software in GST Compliance

Giddh’s e-invoicing software stands out by offering businesses an easy-to-use, reliable, and fully GST-compliant solution. With a user-friendly interface and seamless integration with the GST portal, Giddh helps businesses automate invoicing, reduce errors, and stay compliant with tax regulations. It ensures accuracy, reduces manual effort, and keeps businesses aligned with evolving GST regulations.

Key Features:

-

GST Compliance: Built to meet all GST regulations.

-

Real-Time Invoice Validation: Ensures every invoice is compliant before submission.

-

Automated Filing: Direct submission to the GST portal.

-

ERP E-Invoice Integration

Giddh integrates directly with your ERP system, enabling smooth data flow between accounting and GST e-invoice generation without duplicate entries. -

Auto-Push of E-Invoices to IRP

Invoices are automatically pushed to the Invoice Registration Portal (IRP), eliminating manual uploads and reducing the risk of compliance delays. -

Real-Time E-Invoice Status Tracking

Businesses can track the status of each e-invoice—generated, validated, or rejected—directly from the dashboard, ensuring full visibility and control. -

Auto-Populated GST E-Invoice Data

Invoice data is auto-populated from existing records, minimizing human errors and ensuring consistency across GST filings. -

IRN & QR Code for B2B Compliance

Each B2B e-invoice is generated with a unique Invoice Reference Number (IRN) and QR code, ensuring authenticity, traceability, and full GST compliance.

How Giddh Helps Businesses

Giddh’s software allows businesses to streamline their invoicing process, whether they handle thousands of transactions or require more tailored tax fields across different industries.

Example Success Stories:

-

Retail: Reduced errors in invoicing and fast-tracked the filing process.

-

Manufacturing: Bulk invoicing with customized tax fields.

Common Questions About E-Invoicing Software in India

1. How Much Does E-Invoicing Software Cost?

Pricing varies based on business size and features required. Giddh offers flexible pricing plans that cater to businesses of all sizes, ensuring affordability while providing top-tier features.

2. Is E-Invoicing Software Only for Large Businesses?

No, e-invoicing is beneficial for businesses of all sizes, including small and medium enterprises. Giddh’s scalable solutions make it easy for smaller firms to adopt e-invoicing without breaking the bank.

3. Can E-Invoicing Software Integrate with Existing Accounting Systems?

Yes, Giddh’s e-invoicing software can integrate seamlessly with most existing accounting systems, providing a smooth transition from manual processes to automated solutions.

Conclusion

Adopting e-invoicing software in India is more than just a regulatory requirement—it’s a strategic move to reduce manual errors, save time, and ensure smooth GST compliance. With tools like Giddh’s e-invoicing software, businesses can streamline their invoicing process and stay ahead of evolving tax regulations.

Ready to make your business more efficient? Discover how Giddh’s e-invoicing software can simplify your GST compliance process—get a free demo today!

FAQs

What is E-Invoicing Software?

E-invoicing software automates invoice creation and submission, ensuring real-time compliance with GST regulations.

How Does E-Invoicing Software Help with GST Compliance?

It automates invoicing and integrates directly with the GST portal, ensuring timely and accurate filings and reducing the risk of penalties.